Articles by Mahua Venkatesh

BJP-Trinamool Congress tussle dims GST rollout hopes

The government’s push to roll out the goods and services tax (GST) for a uniform, nationwide market from April received another jolt on Wednesday as a meeting with the states failed to resolve differences.

Updated on Jan 05, 2017 12:45 AM IST

New Delhi | Saubhadra Chatterji and Mahua Venkatesh, New Delhi

Bank staff want cash, not praise from the PM

Prime Minister Narendra Modi’s words of appreciation for bank employees in his televised speech on Saturday has brought little cheer to bank staff.

Updated on Jan 04, 2017 04:15 PM IST

Hindustan Times | Mahua Venkatesh, New Delhi

Banks face interest outgo mountain on old note deposits

Flush with idle deposits that poured in from Novmber 9 to December 30 in the wake of the note ban, India’s banks may end up having to make high interest payouts.

Updated on Jan 04, 2017 11:15 AM IST

Mahua Venkatesh, New Delhi

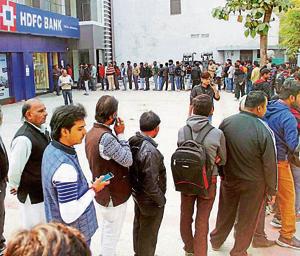

New cash norms fail to bring respite as half the ATMs still run dry

The Reserve Bank of India may have increased the ATM withdrawal limit to Rs 4,500 but almost half of the machines are still running dry as cash is in short supply, bank officials and unions have said.

Updated on Jan 02, 2017 11:55 PM IST

Hindustan Times, New Delhi | Mahua Venkatesh, New Delhi

Not satisfied with restaurant experience? Govt says you can refuse to pay service charge

You can refuse to pay the service charge on your restaurant or café bill if unhappy with the food or experience, the government said on Monday, clearing a debate on the compulsory tipping imposed on customers.

Updated on Jan 03, 2017 07:34 PM IST

New Delhi, Hindustan Times | Mahua Venkatesh

What happened on Nov 8, before Modi announced note ban

As RBI Governor Urjit Patel landed in New Delhi and headed to north block, he was perhaps thinking about the RBI board meeting that would be convened that evening and the reactions it would evoke.

Updated on Jan 02, 2017 10:46 AM IST

Hindustan Times | Suchetana Ray and Mahua Venkatesh, New Delhi

‘Banking system must be brought back to normal’: Modi in New Year’s eve address

He also urged banks to come out with schemes for the poor and disadvantaged.

Updated on Jan 01, 2017 10:03 AM IST

Hindustan Times, New Delhi | Mahua Venkatesh

Rewind 2016: India fastest growing economy, but will be remembered for note ban

India’s economy was one of the fastest growing economies in the world in the first half of the financial year. With favourable macro-economic indicators, the country’s economic growth stood at 7.2%.

Updated on Dec 31, 2016 08:59 AM IST

Hindustan Times | Mahua Venkatesh and Suchetana Ray

1000 raids in 50 days: Taxman monitoring deposits of Rs 2 lakh and above

The Income Tax (IT) department has set its sights on all deposits of Rs 2 lakh and above that have come into the bank accounts in the wake of the demonetization exercise announced on November 8. Besides, smaller deposits in dormant and Jan Dhan accounts are also under scrutiny. Earlier, the IT department had said that deposits of up to Rs 2.5 lakh would not attract any scrutiny.

Updated on Dec 30, 2016 10:19 PM IST

Hindustan Times | Mahua Venkatesh and Suchetana Ray, New Delhi

As note deposit deadline ends, here’s how rules changed over 50 days

Ever since the government announced the scrapping of Rs 1000 and Rs 500 in a surprise move on November 8, the rules on movement of the new currency and the exchange of old currency has changed at least 60 times.

Updated on Dec 30, 2016 02:21 PM IST

Hindustan Times | Suchetana Ray and Mahua Venkatesh, New Delhi

Tackling money laundering: Banks set to put in place KYE norms soon

The banking sector is gearing up to put in place know-your-employee (KYE) guidelines as reports of bank staff helping people launder money following the November 8 demonetisation announcement continue to come in .

Published on Dec 30, 2016 10:53 AM IST

Hindustan Times | Mahua Venkatesh, New Delhi

After note ban, KYC-like norms likely for banking staff to curb malpractices

The banking sector is gearing up to put in place know-your-employee (KYE) guidelines as reports of bank staff helping people launder money following the November 8 demonetisation announcement continue to come in. To improve compliance, a policy to protect whistleblowers was also in the works, sources said.

Updated on Dec 29, 2016 07:57 PM IST

New Delhi, Hindustan Times | Mahua Venkatesh

Budget likely to focus on growth

Finance minister Arun Jaitley is looking to present a growth-oriented Budget on February 1.

Updated on Jan 02, 2017 02:33 PM IST

Hindustan Times | Mahua Venkatesh, New Delhi

50 days of demonetisation: ATM queues shorter but ripples to remain in January

Queues at banks and ATM kiosks are shrinking and digital payment modes are spreading, but the 50 days of pain from the shock recall of two high-value banknotes is set to linger into the new year, experts warned on Wednesday.

Updated on Dec 29, 2016 10:30 AM IST

Hindustan Times, New Delhi | Mahua Venkatesh and Suchetana Ray, New Delhi

Govt to move fast on ‘grey’ desposits

With the December 30 deadline for depositing old currency notes approaching fast, the government is looking to put in place a mechanism for fast resolution of all disputes arising from suspicious transactions.

Updated on Dec 27, 2016 06:49 PM IST

Hindustan Times | Mahua Venkatesh, Delhi

‘Benami property’ law to be operationalised soon: PM Modi in Mann ki Baat

In his last “Mann ki Baat” address this year, PM Modi defended the frequent changes in the rules of demonetisation, saying these have been done to reduce the people’s problems and defeat such forces who are out to thwart his government’s fight against black money and corruption.

Updated on Dec 25, 2016 09:18 PM IST

Hindustan Times | Saubhadra Chatterji and Mahua Venkatesh, New Delhi

Budget 2017: Banks want more sops for digital push

With their core lending business hit due to demonetisation, public sector banks have sought higher capital support from the government. PSU bank heads met finance minister Arun Jaitley on Tuesday to present their suggestions for Budget 2017.

Updated on Jan 02, 2017 02:35 PM IST

Hindustan Times | Suchetana Ray and Mahua Venkatesh, New Delhi

Govt unlikely to come up with new 1,000-rupee notes soon

For now you will have to be content with 500 and 2,000-rupee notes -- 1,000-rupee banknotes are unlikely to see the light of the day, anytime soon.

Updated on Dec 20, 2016 03:20 PM IST

Hindustan Times | Mahua Venkatesh, New Delhi

Note ban: Ineffective safeguards? Many banks did not get indelible ink

It turns out that the indelible ink meant to identify people who exchanged cash at bank never reached most of the branches, after all.

Updated on Dec 17, 2016 07:13 PM IST

Hindustan Times, New Delhi | Mahua Venkatesh

Demonetisation: Opened a bank account in last one month? The govt is watching

Bank accounts and lockers, which have been opened in the last one month, will be monitored closely to check transaction patterns and rule out any discrepancy.

Updated on Dec 17, 2016 08:46 AM IST

Hindustan Times, New Delhi | Mahua Venkatesh

Govt asks tax cheats to come clean by March, releases mail id for black money tip-offs

The government on Friday said tax dodgers have time until 2017 March-end to come clean under a scheme unveiled by finance minister Arun Jaitley in November.

Updated on Dec 17, 2016 01:48 AM IST

New Delhi, Hindustan Times | Mahua Venkatesh

MSMEs want their own income disclosure scheme

Cash-starved micro small and medium enterprises (MSMEs) have sought a one- time “disclosure” scheme, which will allow them to declare their actual annual turnovers, with the promise that they will not be harassed for audit records of previous years.

Updated on Dec 15, 2016 10:09 AM IST

Hindustan Times | Mahua Venkatesh, New Delhi

Less policy sales offline, lesser commissions, LIC agents could face the heat of the note ban

For over 1 million agents engaged with Life Insurance Corp (LIC), the country’s largest life insurer, the government’s move to push digital transactions after demonetisation has come as a big shock.

Published on Dec 14, 2016 11:01 AM IST

Hindustan Times | Mahua Venkatesh, New Delhi

Three bankers are sacked every two days: Central Vigilance Commission report

Banking officials, many of whom are under the scanner for possible fraud involving new currency notes, accounted for more than 50% of public servants penalised by vigilance officers over the past five years.

Updated on Dec 14, 2016 08:45 AM IST

Hindustan Times, New Delhi | Aloke Tikku and Mahua Venkatesh

Govt may put GST empowerment issues to vote

With time running out for adopting the goods and services tax (GST), the thorny issue of dual control may end up being put to vote, even though finance minister Arun Jaitley has been citing ‘consensus’ as the way forward for all issues pertaining to the new tax structure.

Updated on Dec 10, 2016 12:24 PM IST

Hindustan Times | Mahua Venkatesh, New Delhi

Demonetisation takes the sheen off gold sales

Buyers are shying away from buying gold, the traditional favourite for parking money, thanks to the ongoing cash crunch and the fear of coming under the tax radar.

Updated on Dec 10, 2016 12:13 PM IST

Hindustan Times | Himani Chandna and Mahua Venkatesh, New Delhi

Rs 100 crore deposited in over 40 ‘fake accounts’ in Axis Bank branch: I-T dept

Income tax officials raided an Axis Bank branch in Chandni Chowk beginning Thursday evening and said on Friday the operation unearthed more than 40 fake accounts in which large sums were deposited in old notes after November 8.

Updated on Dec 10, 2016 01:22 AM IST

Hindustan Times | Abhinav Rajput and Mahua Venkatesh, New Delhi

Govt may get back entire ₹14 lakh crore

RBI says ₹11.55 lakh cr have already come into the system, but SBI raises questions of double counting

Updated on Dec 09, 2016 12:35 PM IST

Hindusstan Times | Mahua Venkatesh, New Delhi

Jaitley says rail tickets, petrol, insurance to cost less in big digital push

The government announced a raft of measures on Thursday to promote cashless transactions as part of a campaign to encourage people to go digital, a month after the shock culling of high-value bank bills triggered a severe cash crunch.

Updated on Dec 08, 2016 11:35 PM IST

Hindustan Times | Mahua Venkatesh, New Delhi

Banks to beef up internal monitoring mechanisms to evade frauds

The finance ministry, last week, said as many as 27 officials engaged with various public sector banks were suspended, and six were transferred to non-sensitive posts after reports of misconduct.

Updated on Dec 08, 2016 01:20 PM IST

Hindustan Times | Mahua Venkatesh, New Delhi