Govt unlikely to come up with new 1,000-rupee notes soon

For now you will have to be content with 500 and 2,000-rupee notes -- 1,000-rupee banknotes are unlikely to see the light of the day, anytime soon.

For now you will have to be content with 500 and 2,000-rupee notes -- 1,000-rupee banknotes are unlikely to see the light of the day, anytime soon.

The government had, on November 10, announced that new currency notes of Rs 1,000 will be back in circulation once the situation stabilises, but the idea is all set to get a quiet burial.

The introduction of new notes of Rs 1,000 with added security features and design would mean that the country’s 2.20 lakh ATMs will once again not be in operation for weeks since they have to be tuned or recalibrated all over again. This would mean disrupting the current system, something the government is unlikely to do.

“That idea may not be implemented. There is no talk of that (printing R1,000 notes at a later date)... 1,000-rupee notes is not going to get introduced. And even if it done at some point, the size of the currency notes will have to be kept the same to reduce any disruption,” an official source told HT on the condition of anonymity.

Read more: Govt asks tax cheats to come clean by March, releases mail id for black money tip-offs

Once the remonetisation exercise is over, it needs to be first seen how the system is adapting to the new R500 and R2,000 currency notes, the source added.

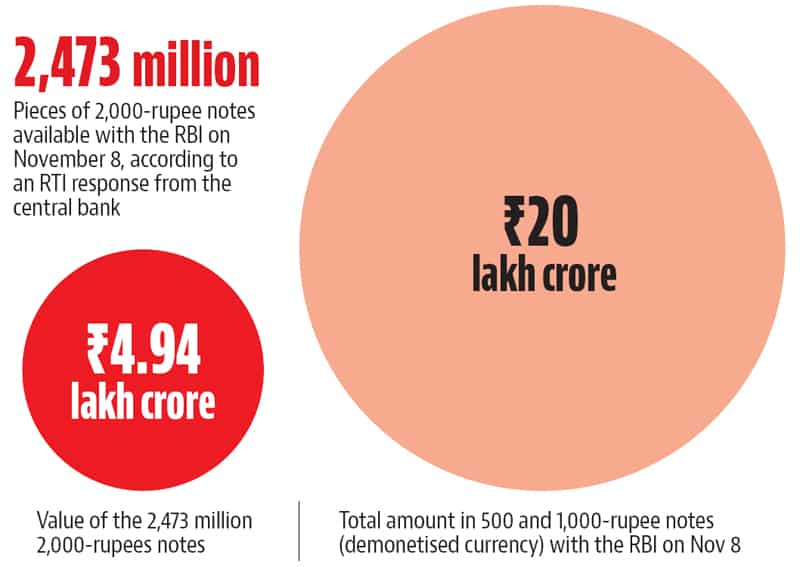

The government’s move to stop the circulation of high-value banknotes November 8 had led to an acute shortage of cash. Initially, none of the ATMs could dispense the new R2,000 notes since they needed to be re-tuned with separate features.

Read more: Note ban: Ineffective safeguards? Many banks did not get indelible ink

According to Soumya Kanti Ghosh, chief economic adviser, State Bank of India, once the 1,000-rupee notes are reintroduced, in value terms, the ratio between R1,000 and R2,000 banknotes must be on a 50:50 basis to ensure correct circulation.

Meanwhile, sources also said that on an average, ATMs are being injected with cash worth R2,000 crore daily, compared to R10,000 before the announcement of the demonetisation drive. Not just that. Per day, on an average only 30-40,000 ATMs are being loaded with cash.

“The situation will still take time to normalise,” a public sector bank official said.

Economic affairs secretary Shaktikanta Das had said last week that the focus now was on printing currency notes of R500.