Three bankers are sacked every two days: Central Vigilance Commission report

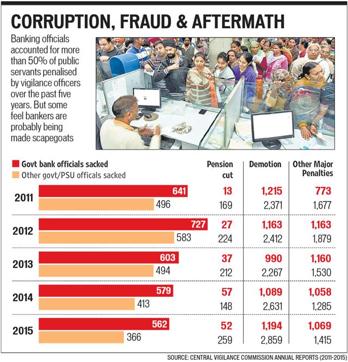

Banking officials, many of whom are under the scanner for possible fraud involving new currency notes, accounted for more than 50% of public servants penalised by vigilance officers over the past five years.

Banking officials, many of whom are under the scanner for possible fraud involving new currency notes, accounted for more than 50% of public servants penalised by vigilance officers over the past five years.

In all, 3,100 of them were sacked and 5,600 demoted between 2011 and 2015. This means three public sector bank officials were sacked and six more demoted every two days.

“We are ashamed of this,” said CH Venkatachalam, general secretary of the All India Bank Employees’ Association. “But the percentage of the number of employees sacked is a miniscule percentage of the total bank employees... There is, however, no justification for corruption and a corrupt officer should be taken to task,” he added. Public sector banks have about eight lakh staffers on their rolls.

Bankers are at the heart of implementing the government’s November 8 decision to scrub the economy clean of black money when it demonetised Rs 500 and Rs 1,000 currency notes. Bank notes in these two denominations made up for 86% of the Indian currency.

Bank officials had to exchange and receive deposits in old bank notes and ration the new currency notes. But seizures of new currency notes that started soon suggested that some bankers were letting down the government.

Read | RBI official arrested in Bengaluru for alleged role in banned notes exchange

As first reported by HT, finance minister Arun Jaitley acknowledged that the facility to exchange the old notes was withdrawn due to abuse of the relaxation. A probe into some of these cases later indicated bank officials were involved in quite a few instances. At the HT Leadership Summit on December 3, power minister Piyush Goyal too conceded the government had received reports of “a nexus of certain professionals, certain bankers and possibly certain officials” operating in parts of the country.

Venkatachalam said bankers may end up having to bear the brunt of everything that was going wrong in the system today. But if people are getting large amount of new currency notes, the onus should not be on the bankers alone. “They probably are being used as scapegoats and someone such as the CBI needs to probe deeper,” he said.