Budget 2017: The numbers are deceiving, they hide more than they reveal

At first glance, the budget numbers look reassuring but a closer examination of the numbers tells another story,

At first glance, the budget numbers look reassuring. Tax revenues are expected to grow 12%, mostly on the back of a sharper rise in personal income tax collections. Allocations under large expenditure heads such as defence, subsidy, salaries and pension conform to the trend in recent years.

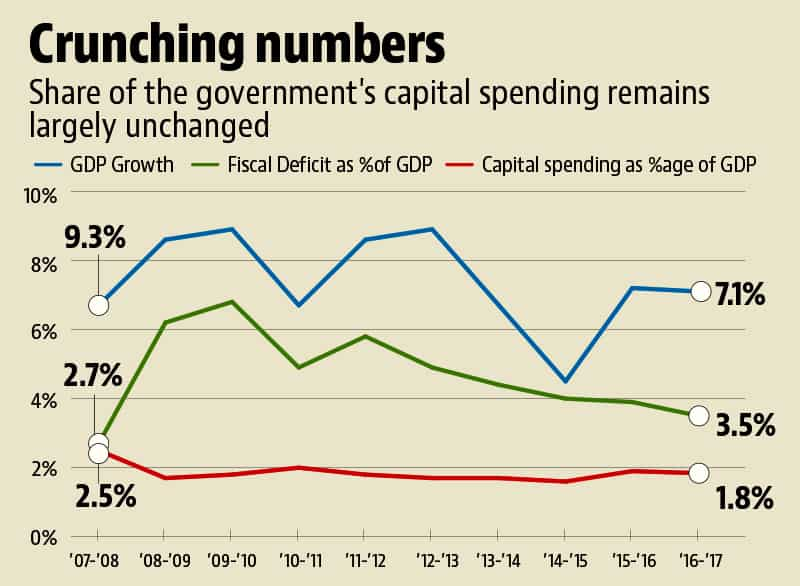

Some scheduled cuts such as those in recapitalisation of state-run banks and spending on a few plan projects are expected to free up the money that finance minister Arun Jaitley intends to spend on additional rural and infrastructure projects. As a result, total expenditure is projected to grow moderately at 8.5% and fiscal deficit, the gap between what the government earns and spends, is expected to be under 3.2% of GDP in 2017-18.

As the minister told parliament, his “approach in preparing this budget is to spend more on rural areas, infrastructure and poverty alleviation with fiscal prudence.”

Although the fiscal deficit number is a bit higher than the target of 3% Jaitley had set earlier, it still doesn’t amount to higher borrowing from the market, which is projected to stay at the same level as in 2016-17.

That said, a closer examination of the numbers tells another story. To begin with, the finance minister expects corporate tax collections to grow just 9%, while the nominal GDP growth is estimated at 12%. His decision to cut the tax rate for enterprises with an annual turnover of less than Rs 50 crore will result in a loss of Rs 7,000 crore.

Even after this is factored in, the conservative estimates on corporate tax collections suggest Jaitley isn’t expecting companies to stage a smart recovery from the current economic slump, aggravated by demonetisation. Excise and customs collections are also projected to grow at a sluggish pace, which means the government is acknowledging that the impact of demonetisation on consumer spending will last longer than expected.

The government’s efforts to raise revenue in the next financial year rides mostly on the hope that it will be able to leverage the data on potential tax evaders it managed to scrape in the aftermath of demonetisation. Jaitley hopes his team will expand the tax net and help raise 25% more in personal income tax collections. That too is not an ambitious number, given that two more instalments of tax payment under the Income Disclosure Scheme are due in 2017-18.

Read | Budget 2017: Arun Jaitley attempts the tightrope walk to revive economy

On the expenditure side, despite Jaitley’s claims of setting aside much bigger allocations for rural and infrastructure development, the share of the government’s capital spending in GDP in 2017-18 will actually be flat compared to the current fiscal. Sectors such as roads, irrigation, health and projects meant for women and child welfare may have got a boost but it falls short of the stimulus the economy needs.