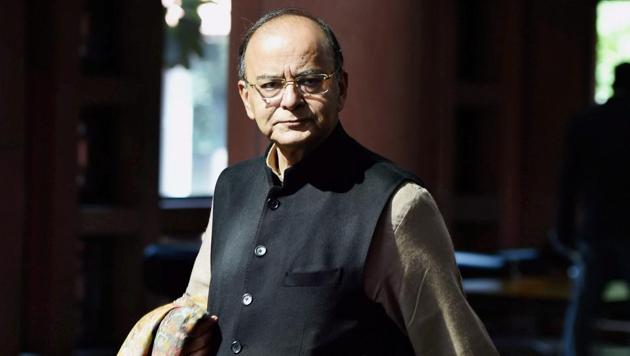

Budget 2017: Arun Jaitley attempts the tightrope walk to revive economy

Finance minister Arun Jaitley had to do an unenviable tightrope walk. He had to revive an economy reeling under the impact of demonetisation and also soften the blow of currency ban with tax sops. At the same time also had to ensure that India’s fiscal deficit is under control.

The 2017-18 budget was one of the most anticipated annual financial statements of the government in recent times, especially on account of the economic disruption caused by demonetisation of high-value currency in November last year. Finance minister Arun Jaitley had to do an unenviable tightrope walk. He had to revive an economy reeling under the impact of demonetisation and also soften the blow of currency ban with tax sops. At the same time also had to ensure that India’s fiscal deficit is under control.

Budget 2017 sought to address some of the key pain points in the economy without springing up any major negative surprises, which could have derailed the fragile growth momentum currently being witnessed in the Indian economy amid major global challenges.

The Economic Survey presented by the FM on Tuesday, pegged India’s economic growth at 6.5% for the current fiscal, down from 7.6% recorded in the last financial year. However, the survey expected a rebound in the range of 6.75 - 7.5 % in FY 2017-18. Against this backdrop, the FM was expected to come up with measures that would help revive investment, exports and consumption demand. Topping the list of expected sweeteners was the hike in income-tax exemption limit, schemes for boosting agriculture, domestic manufacturing and promoting start-ups. On the contrary, a rise in the rate of service tax and changes in tax regime on investments in equities were anticipated to remain within the fiscal consolidation roadmap. Challenges before Jaitley were also to create a non-adversarial tax regime and bring clarity on tax implications of recent legislative changes such as Ind AS accounting standards.

There is a general disappointment that the FM did not deliver on his promise to reduce tax rates for corporates, except in a limited manner for medium and small enterprises (with turnover of less than Rs 50 crores) with reduced tax rate of 25%.

Detailed clarifications have been provided on the tax treatment of changes in accounts due to implementation of Ind AS, the new accounting standards large companies have to follow. These need to be studied in detail to understand the impact on tax, in particular- MAT which is a tax on book profits.

In his speech, the FM mentioned that “we are largely a tax non-compliant society”. This signals a strong administrative regime in the future. In line with this, the FM has recommended aggressive scrutiny timelines of 18 months for assessment year 2018-19 and 12 months for assessment year 2019-20 onwards. Emphasis has been placed on maximising e-assessments in the near future.

In an ambitious move to clean the tax administration and provide friendly interface to assesses, the FM has envisioned “honouring the honest”. As with every change, the proof of the pudding will be in the eating!

Having said that, budget 2017 clearly seeks to put India on a path, which with persistence and commitment, can aid the country in shedding its non-salubrious taxation reputation and emerge as a mature and developed nation.

Neeru Ahuja is partner, Deloitte Haskins & Sells LLP