Number Theory: US dollar holds sway, but it is losing its share

When it comes to the US dollar, the world’s leading currency, India is taking small steps to look beyond.

When it comes to the US dollar, the world’s leading currency, India is taking small steps to look beyond. Some steps are shaped by opportunity. For example, to enable India to buy discounted Russian crude oil in roubles amid Western sanctions on Moscow, a Russian commercial bank opened an account in India’s Yes Bank in September. Discussions between India and Saudi Arabia to promote rupee-riyal trade are ongoing. Other steps are driven by necessity. Recently, State Bank of India urged Indian exporters to avoid trade in US dollars with Bangladesh, given the pressure on the latter’s dollar reserves.

Each of these steps reduces India’s reliance on the dollar by developing an alternate currency payment method for trade settlement. At a time of sharpening geopolitical positions and exchange rate volatility, many nations are looking at alternate payment mechanisms to sustain uninterrupted trade with their trading partners. However, it’s a long road to crafting alternatives to the US dollar, which continues to have a dominant position in international trade and reserves.

Currencies of reserve

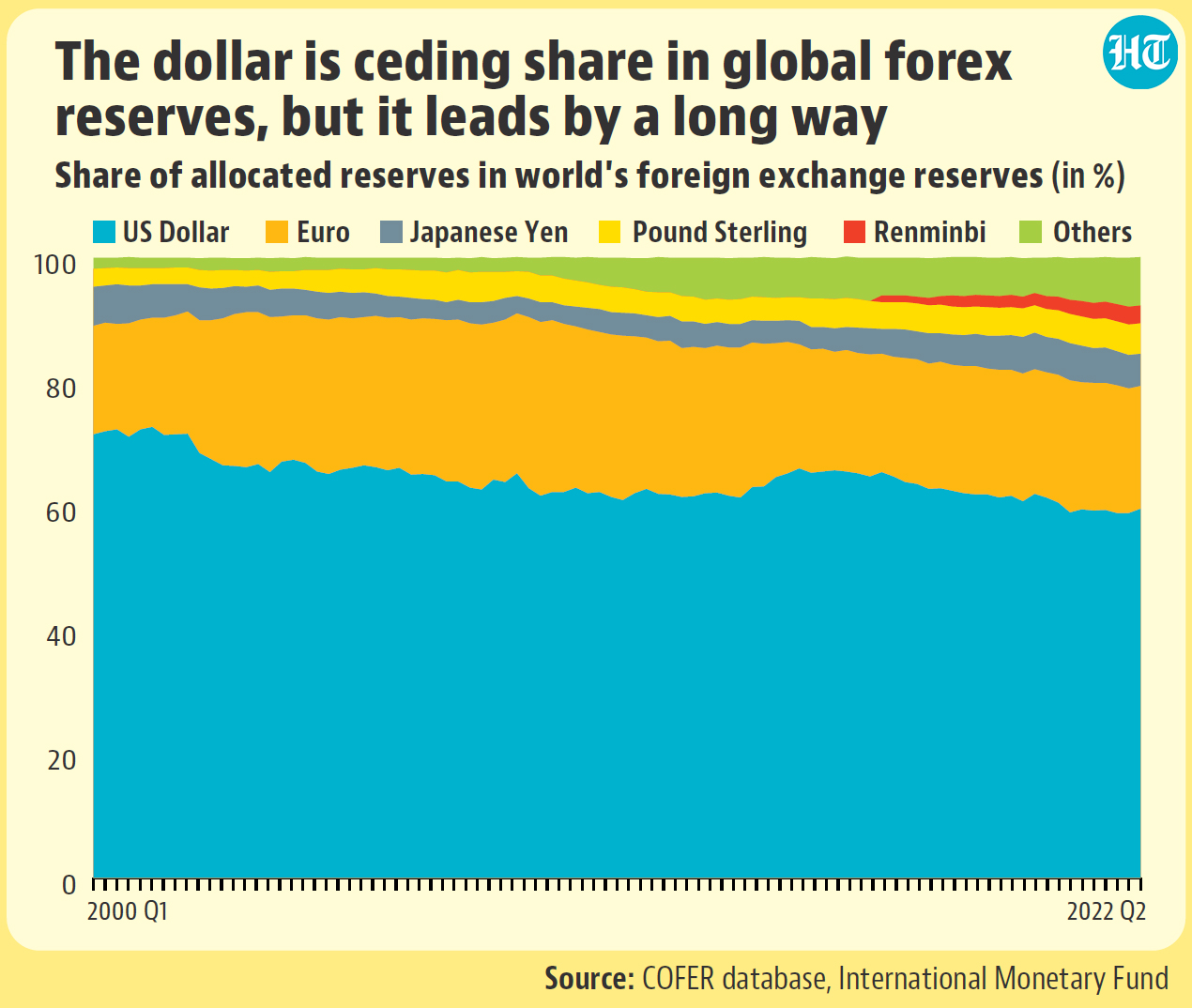

The International Monetary Fund (IMF) publishes data on the currency composition of foreign exchange reserves. These are assets held by central banks, such as India’s Reserve Bank of India, in foreign currencies to support foreign trade and influence monetary policy. However, IMF releases this data for the world as a whole, and not for individual countries. This data shows the US dollar, by virtue of being widely used in trade and financial transactions, remains the first choice of reserve currency. But it is losing share in global foreign exchange reserves, from about 72% in 2000 to about 60% in 2022.

Major currencies that have gained share are the euro, pound and the Chinese renmnibi. Further, the big basket of currencies beyond these major currencies have steadily increased their share from 1.8% to 7.8% during this period. At a recent event organised by Indian Express, India’s chief economic advisor V Anantha Nageswaran said that “while weaponisation of currencies or foreign exchange reserves” was the current trigger for countries to explore alternate arrangements, internationalizing the rupee was a “logical evolution” for India.

Rupee-rouble trade

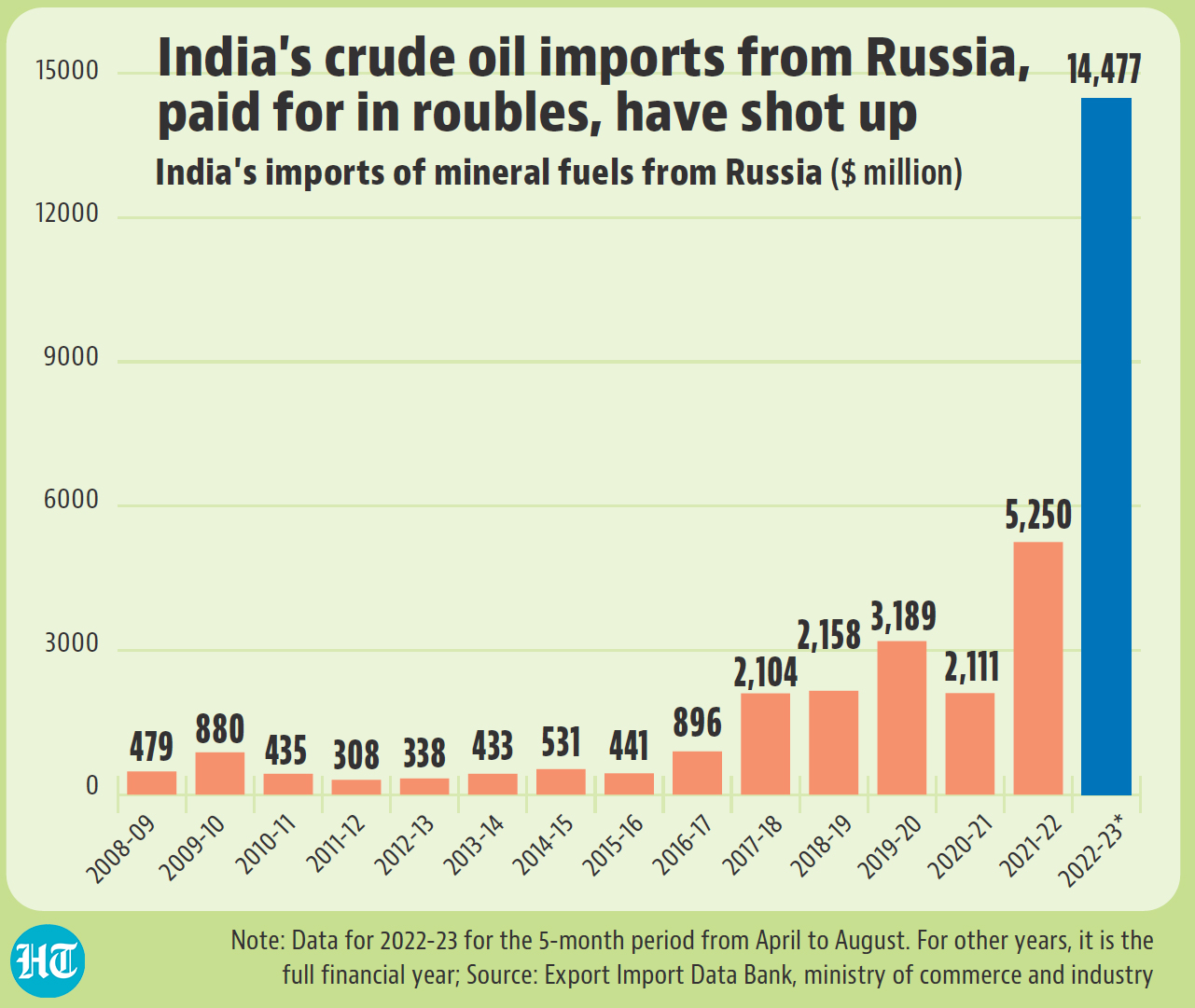

Today, an active expression of the alternate route is India’s purchase of crude oil from Russia, much to the chagrin of western countries, and paying for it in roubles. India has been snapping up crude oil from Russia, which offered discounts and bore the cost of transportation and insurance.

Data from India’s ministry of commerce and industry shows that India imported about $5.3 billion worth of mineral fuel from Russia in all of 2021-22. In just the first five months of 2022-23, this rose to $14.5 billion. As a result, Russia’s share in total Indian imports of mineral fuels has shot up from 2.7% in 2021-22 to 11.4% in 2022-23. According to think-tank Observer Research Foundation, before 2019, more than 50% of Indian payments for Russian goods and services were in dollars, but this changed after India started paying Russia for the S-400 air defence systems. In 2021, 53.4% of all payments from India to Russia were in roubles and 38.3% in dollars. Rouble trade could increase further in 2022.

Dollar dominance

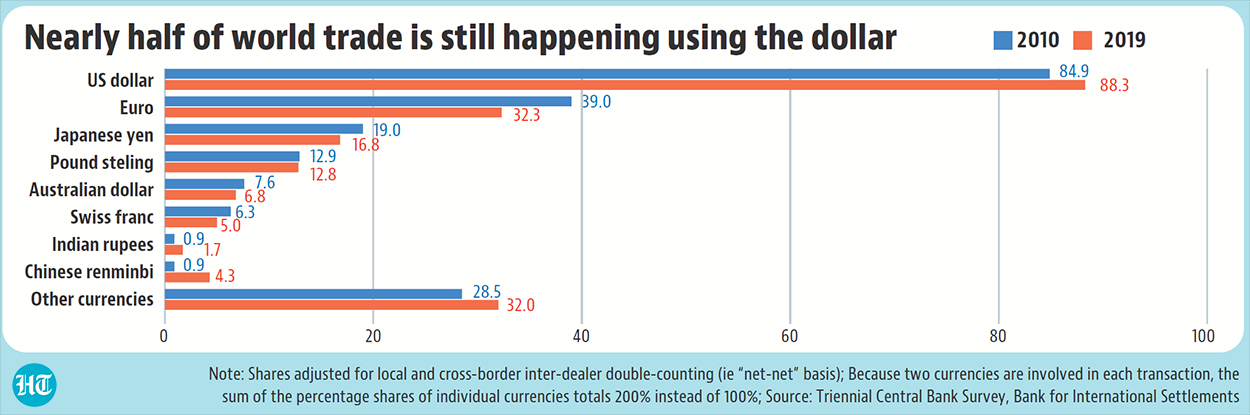

Yet, the US dollar still dominates world trade. Data from the Bank for International Settlements (BIS) shows that the share of dollar-denominated trade in 2019 was a market-leading 88.3% (out of 200%, as two currencies are involved in each trade transaction). This was 89.9% in 2001 and 84.9% in 2010. Between 2010 and 2019, the dollar recouped some of its lost share. Major currencies that have lost ground are the euro, Japanese yen, British pound, Australian dollar and the Swiss franc.

The Indian rupee and Chinese renminbi, though marginal currencies, gained share between 2010 and 2019. As did the basket of other currencies. According to a 2019 study by Priyadarshi Dash, the Chinese renminbi and the Indian rupee have the potential to be natural contenders for international currency status among emerging-market economies on account of their increasing economic competency and their ability to absorb shocks of the global financial crisis.

India patterns

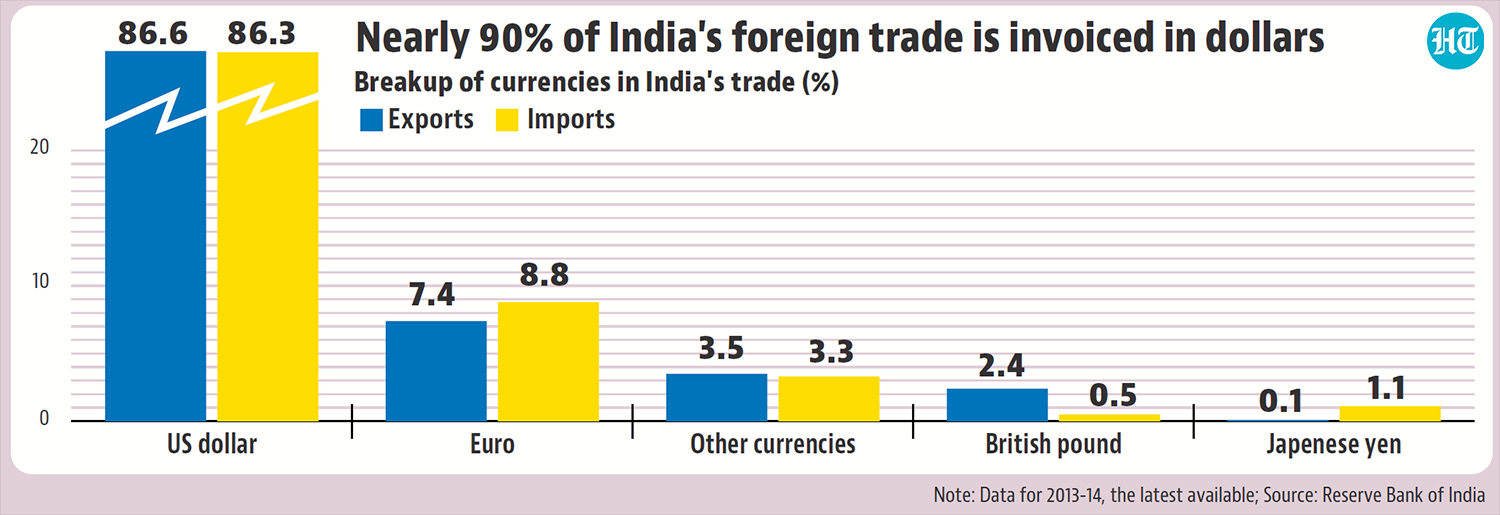

Trade data for India by currencies is available from the Reserve Bank of India, but the latest period is 2013-14. This shows that India was heavily dependent on the US dollar for its trade invoicing. The dollar had a share of about 87% in India’s exports and 86% in India’s imports. It was followed by the euro. The dollar dominance is despite the fact that the US had a share of only 12.4% in India’s exports and 5% in India’s imports.

It is interesting to note that the share of invoicing in other currencies has increased: in exports from 1.8% in 2008-09 to 3.5% to 2013-14, and in imports from 0.9% to 3.3%. Given recent realignments, this could increase further. But dislodging the US dollar from its pre-eminent position will take some doing.

Uma Gupta is a Hindustan Times-How India Lives data journalism fellow

All Access.

One Subscription.

Get 360° coverage—from daily headlines

to 100 year archives.

HT App & Website