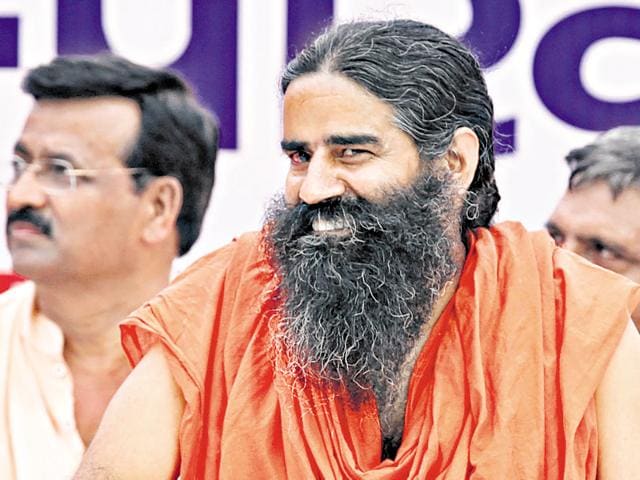

Baba brand set to shake up pooja materials market next

The ₹10,000-crore market for incense sticks and material for worship (pooja samagri) is set to get a branding shake-up soon. Baba Ramdev’s Patanjali Ayurved, after creating a flutter in the market for medicines and FMCG products, including biscuits and instant noodles, will now boost its Astha brand under the home worship category.

The ₹10,000-crore market for incense sticks and material for worship (pooja samagri) is set to get a branding shake-up soon.

Baba Ramdev’s Patanjali Ayurved, after creating a flutter in the market for medicines and FMCG products, including biscuits and instant noodles, will now boost its Astha brand under the home worship category.

According to market observers, the move will expand the organised market, but hurt small and unorganised players in a big way. “This (agarbatti, dhoop, pooja needs) is a very fragmented market. The entry of Patanjali will grow the organised market, and the overall market will also expand,” said Kaustubh Pawaskar, an FMCG analyst at brokerage Sharekhan.

The agarbatti (incense stick) market alone accounts for around ₹4,000 crore of the R10,000-crore pie, and at least half of this market is fragmented with many small players spread across various states.

Patanjali has been selling agarbattis for the past couple of years under the Madhuram brand, but is now set to launch a wider range of products used in poojas, such as lamps.

“Most Indians some way or the other do worship god. We are already selling agarbattis under our Madhuram brand, now we will grow the market further with Aastha,” Patanjali spokesperson SK Tijarawala said. “We will use natural ingredients unlike existing brands, which have chemicals and pollute the environment.

The company said it would create 50 million additional jobs by outsourcing the manufacturing of these products to cottage and small-scale firms.

It will sell the products through 300,000 outlets across the country, including its own stores, clinics, organised supermarket chains and the general trade, Tijarawala said.

Patanjali expects the market to grow from R10,000 crore to R50,000 crore in the next 10 years.

Mysore-based NR Group is currently the largest player in the agarbatti market, through its Cycle brand of products. The company sells about a billion incense sticks a year and claims a 25% share of the organised agarbatti market, based on Nielsen data.

However, the company, which also sells pooja material, said it was unperturbed by Patanjali’s plans.

“I think Patanjali’s overall pooja samagri foray will be interesting. This category is highly unorganised and unbranded. We have launched our pooja material under the ‘Om Shanthi’ brand with good success,” Arjun Ranga, MD of Cycle Pure Agarbathies, told HT.

Cycle, which has Amitabh Bachchan as the brand ambassador, is aggressively foraying into the north Indian market, and is doubling its distribution reach and introducing newer products, Ranga said.

Apart from Cycle, ITC is also a major player in the agarbatti market with its Mangaldeep brand, which is growing at a compounded annual rate of over 20% and is the fastest growing incense brand in the country, according to the company.

“The entry of any new player will make the category more dynamic and help grow the market in the short term. The category at the same time is highly fragmented and regionalised and will be challenging for any new player to find a foothold,” said VM Rajasekharan, chief executive, agarbatti and matches business, ITC.

ITC has made significant investments in improving product quality, supply chain responsiveness and in market availability, he added.

Over the last few years, Patanjali has aggressively expanded across FMCG and personal care categories riding on the ayurveda platform, forcing established players, including Hindustan Unilever, Colgate, Godrej and Dabur, among others, to strengthen their ‘natural’ products portfolio.

But companies, including ITC, are likely to take advantage of their wider reach to retail agarbatti and pooja samagri, analysts said. For example, ITC’s consumer goods, of which agarbattis are a part, are available across 4.5 million outlets in the country.

“You can get ITC products even at the neighbourhood paan shop. It has an advantage due to the huge distribution reach,” Pawaskar , FMCG analyst, Sharekhan. added