Articles by Mahua Venkatesh

Govt relaxes cash withdrawal norms, move may help small businesses

Economic affairs secretary Shaktikanta Das said businesses with current accounts active for three months can withdraw Rs 50,000 every week.

Updated on Nov 14, 2016 08:06 PM IST

Hindustan Times | Suchetana Ray and Mahua Venkatesh, New Delhi

After widespread chaos, PMO seeks report on demonetisation situation

The Prime Minister’s Office (PMO) has sought reports on the demonetisation situation from banks and post office, amid reports of people having to wait long hours to withdraw or deposit cash.

Updated on Nov 13, 2016 06:00 PM IST

Hindustan Times | Mahua Venkatesh, New Delhi

Demonetisation blues continue, storing ‘dead cash’ now a major problem

Banks, post offices and cash logistics companies that manage ATMs are grappling to keep up with the unprecedented demand from customers even four days after Prime Minister Narendra Modi announced demonetisation of Rs 500 and Rs 1000 bank notes.

Updated on Nov 13, 2016 09:12 AM IST

Mahua Venkatesh, Hindustan Times, New Delhi

Weekend rush for cash jolts banks, ATMs; families out on streets together

Banks and ATMs witnessed added chaos and longer queues on Saturday as cash-starved people jostled to exchange and withdraw money over the weekend, with cash dispensing machines running dry within hours of being stocked.

Updated on Nov 12, 2016 02:52 PM IST

Hindustan Times | Snehal Tripathi, Abhinav Rajput, Mahua Venkatesh and Rahul Karmakar, New Delhi/guwahati

Non-compliant currency: ATMs may take 2-3 weeks to become fully functional

Three days on and long queues of agitated costumers continued to form on Saturday outside banks and ATMs, most of which have remained shut due to a severe currency crunch and because they are incompatible with the new currency notes.

Updated on Nov 13, 2016 03:22 PM IST

Hindustan Times | Mahua Venkatesh, New Delhi

Why ATMs are running out of cash so fast

The country’s banks struggled through the day to cope up with serpentine queues with most ATMs going dry, no adequate replenishment and disgruntled customers, even as they extended their working hours and opened up many temporary cash counters.

Updated on Nov 12, 2016 12:59 AM IST

Hindustan Times | Mahua Venkatesh, New Delhi

Toll tax suspension, use of old notes for utility bills extended till Nov 14

The government has extended the use of Rs 500 and Rs 1000 notes for paying public utility bills by another 3 days.

Updated on Nov 11, 2016 09:38 PM IST

Suchetana Ray and Mahua Venkatesh, New Delhi

Banks won’t get nearly 30% of black money: SBI

Even though the Narendra Modi government has demonetised the currency notes of ₹500 and ₹1,000, about 25-30% of the black money may not be injected into the formal banking system.

Updated on Nov 11, 2016 01:36 PM IST

Hindustan Times | Mahua Venkatesh and Jyotindra Dubey, New Delhi

Chaos reigns at banks, ATMs as people rush to ditch worthless banknotes

Indians woke up on Thursday to chaos and confusion. It was easy to spot banks, ATMs and post offices in any town, big or small.

Updated on Nov 11, 2016 08:10 AM IST

Hindustan Times | Mahua Venkatesh and Beena Parmar, New Delhi/mumbai

Income tax ‘raids’ in Delhi, Mumbai, other cities on stashed demonetised notes

The Income Tax department on Thursday conducted multiple raids in Delhi, Mumbai and other cities in the wake of reports of alleged profiteering and subsequent tax evasion by traders by converting withdrawn currency notes in an illegal manner.

Updated on Nov 11, 2016 02:09 AM IST

Hindustan Times | Mahua Venkatesh, New Delhi

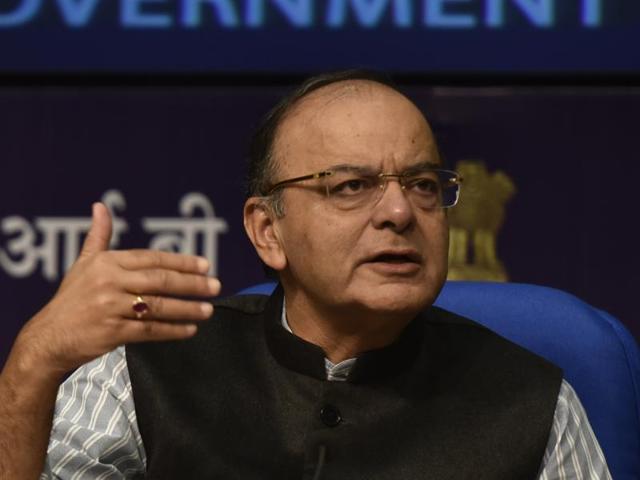

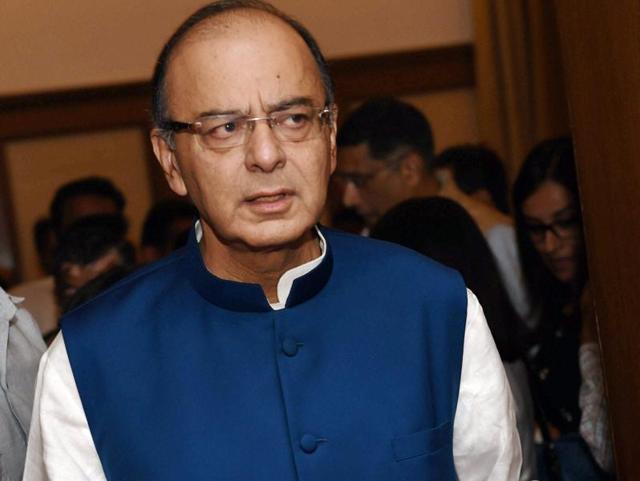

Demonetisation will benefit everyone in the long run: FM Jaitley

The sucking out of all currency notes of denomination Rs 500 and 1000 that formed 86% of all cash transactions could impact short-term consumption but will eventually benefit the country, finance minister Arun Jaitley said on Thursday.

Updated on Nov 10, 2016 04:37 PM IST

Hindustan Times | Mahua Venkatesh, New Delhi

More relief: Rs 500, Rs 1000 notes can be used for paying utility bills, tax

Old Rs 500, 1000 notes to be accepted for payment of fees, charges, taxes, penalty to central and state governments, including municipalities and local bodies.

Updated on Nov 11, 2016 01:28 AM IST

Hindustan Times | Mahua Venkatesh and Suchetana Ray, New Delhi

Govt looks at intervention when high-currency notes spike: Adhia

Massive crackdowns become a necessity when circulation of high-currency denominations increase alarmingly, the government said on Wednesday.

Updated on Nov 11, 2016 12:01 AM IST

Hindustan Times | Suchetana Ray and Mahua Venkatesh, New Delhi

What will you do with your old Rs 500 and Rs 1000 notes?

In a surprise move the government today declared that ₹500 and ₹1000 notes will be illegal from Tuesday midnight. Here’s what you can do with your ₹500 and ₹1000 notes:

Updated on Nov 11, 2016 12:00 AM IST

Hindustan Times | Suchetana Ray and Mahua Venkatesh, New Delhi

War on black money will bring down inflation, expect a rate cut: Experts

Inflation in the coming months will come down significantly with the Narendra Modi government clamping down on the circulation of black money. This will not only give the much needed relief to the common man as expectations for a lower interest rate regime is set.

Updated on Nov 10, 2016 08:34 AM IST

Hindustan Times | Mahua Venkatesh, New Delhi

Tackling black money: Modi govt’s two-year report card

Tuesday’s strike on black money will make every other step so far look like loose change, but the Narendra Modi government has run a sustained campaign against it since coming to power in May 2014.

Updated on Nov 10, 2016 08:32 AM IST

Hindustan Times | Mahua Venkatesh, New Delhi

Respiratory problems? Your health insurance may cost you 10-25% more

With air pollution in the capital going up to unprecedented levels this year after Diwali, your health insurance costs may go up by 10-25% if you are suffering from asthma or other respiratory problems.

Published on Nov 09, 2016 01:00 AM IST

Hindustan Times | Mahua Venkatesh, New Delhi

Classification of goods under GST, the new flash point say experts

The government may be rejoicing after getting the GST (Goods and Services Tax) council to agree to the rates and slabs for the new tax, but experts and insiders point out that the biggest hurdle is yet to be crossed: choosing the goods that will fall into these slabs. It has been decided that a committee of finance secretaries of all states will work on this, but this could become a flash point in the run-up to the implementation of this new indirect tax.

Updated on Nov 08, 2016 11:10 AM IST

Hindustan Times | Suchetana Ray and Mahua Venkatesh, New Delhi

GST Council sets rates, four main tax slabs ranging from 5% to 28%

The Centre and state governments approved of four main tax slabs ranging from 5% to 28% under a proposed Goods and Services Tax (GST), authorities said on Thursday.

Updated on Nov 04, 2016 01:07 AM IST

Mahua Venkatesh and Suchetana Ray, New Delhi

All decisions on GST to be taken by consensus among states: Meghwal

The government has decided to resolve all GST-related issues by consensus even as it sticks to its April 1 2017 deadline, minister of state for finance and corporate affairs Arjun Ram Meghwal told HT on Wednesday. While there are several issues to be ironed out before the indirect tax reform is implemented, the finance ministry is not adamant about any particular proposal, he added.

Updated on Nov 03, 2016 11:00 AM IST

Hindustan Times | Suchetana Ray and Mahua Venkatesh, New Delhi

Govt set to tweak social security schemes to make them more appealing to masses

The government, which is looking to push the social security schemes under the Jan Suraksha umbrella, could bring in changes in these programmes to make them more saleable.

Published on Nov 01, 2016 10:55 AM IST

Hindustan Times | Mahua Venkatesh, New Delhi

DND toll: Halting a running project may not yield the desired results

Halting a running project may not yield the desired results and knee-jerk reactions are no solution. N

Updated on Oct 28, 2016 11:41 PM IST

Hindustan Times | Mahua Venkatesh, New Delhi

Centre may expedite measures to improve biz climate

The impact of GST, expected to be rolled out on April 1, 2017, may not show up in next year’s ranking.

Published on Oct 27, 2016 11:01 AM IST

Hindustan Times | Mahua Venkatesh, New Delhi

Public banks not to hire pvt execs for top posts

The government, which hired executives from the private sector to take charge of Canara Bank and Bank of Baroda last year, has decided not to pursue the policy for now.

Updated on Oct 26, 2016 11:59 AM IST

Hindustan times | Mahua Venkatesh

Bank mitras role under lens in Jan Dhan push

While the government said that the number of zero balance accounts reduced drastically, news reports in September suggested that R1 was deposited in several accounts to show that these were operational and active.

Published on Oct 25, 2016 12:14 PM IST

Hindustan Times | Mahua Venkatesh, New Delhi

RBI set to come out with new norms on debit cards

With over 3.2 million debit cards compromised in India’s largest banking security breach and most customers not paying heed to bank advisories asking them to change their passwords and PINs, the Reserve Bank of India (RBI) is likely to issue new directives in this matter.

Updated on Oct 22, 2016 01:47 PM IST

Hindustan Times | Mahua Venkatesh, New Delhi

Govt seeks report on debit card security breach, promises swift action

The government has sought a report on the debit card data compromise issue, finance minister Arun Jaitley said on Friday, adding that the idea was to contain any damage caused by the feared breach.

Updated on Oct 22, 2016 12:18 AM IST

Mahua Venkatesh and Suchetana Ray, New Delhi

FinMin in damage-control mode on debit cards security breach

As reports of data breaches at the country’s leading banks surfaced on Thursday leading to fears that million of credit card information have been compromised, the finance ministry quickly sprung into action and asked all public sector lenders to take steps to ensure it does not turn into a full-blown crisis.

Published on Oct 21, 2016 11:11 AM IST

Hindustan Times | Mahua Venkatesh, New Delhi

ATM virus attack: Dos and don’ts for debit card holders

With debit card users in the country coming under threat with leakage of financial data and the State Bank of India blocking thousands of cards, most banks in the country may mandate you to either change your plastic or immediately change your password. The Reserve Bank of India, along with other investigating agencies and issuers are looking into the issue. However, most lenders say there is no reason to panic but here are a few do’s and don’t’s for you:

Updated on Oct 20, 2016 01:53 PM IST

Hindustan Times | Mahua Venkatesh, New Delhi

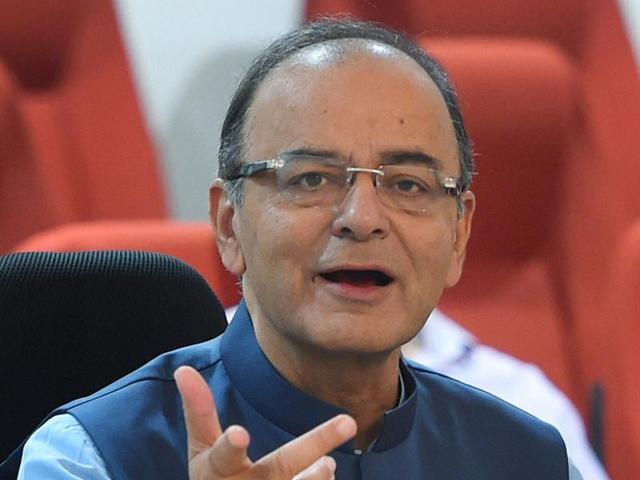

Centre, states fail to agree on GST rollout, decision on tax rate next month

GST Council cuts meeting short by a day, to convene again on November 3 and 4; consensus in sight, says finance minister Arun Jaitley

Updated on Oct 20, 2016 12:19 AM IST

Hindustan Times | Suchetana Ray and Mahua Venkatesh, New Delhi