GST Council sets rates, four main tax slabs ranging from 5% to 28%

The Centre and state governments approved of four main tax slabs ranging from 5% to 28% under a proposed Goods and Services Tax (GST), authorities said on Thursday.

The all-powerful GST Council on Thursday agreed to give a little more relief to the poor and a little more grief to the rich in the goods and services tax (GST) slated to take effect on April 1 next year.

The council did not give in to the demands that the number of rates be reduced, since the ideal GST has just one rate. The number of rates remains four, though the lowest comes down from the earlier proposal of 6% to 5%, and the highest goes up from 26% to 28%. The two standard rates – which will apply to the bulk of the items -- are 12% and 18%.

There will be no tax on essential items such as food – this is likely to beat down inflation, which has afflicted food items in particular. The lowest rate of 5% is on items of common use and the highest for luxury goods that now attract a total tax – value-added tax and excise – of 30 to 31%.

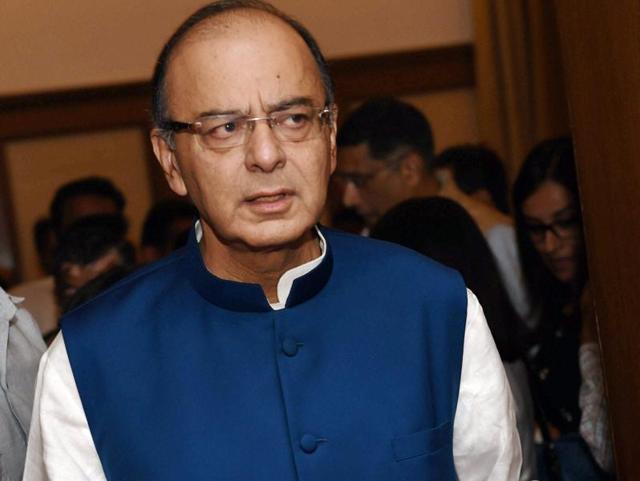

“I hope the indirect tax outgo for the common man will be marginally lower under the GST,” finance minister Arun Jaitley said in a media briefing after the first day of the GST Council’s sixth meeting in New Delhi.

“The zero-tax rate will apply to half of the items in the CPI (consumer price index) basket, including food grain used by the common man.” The council will meet again on Friday.

Read: HT Explains: All you should know about Goods and Services Tax

The outgo will be more for those who buy luxury cars, aerated drinks, and cigarettes and other tobacco products. Dubbed “demerit goods”, these will be taxed at 28% and attract a cess that may take the total to 40% or more, though there is no confirmation yet of how much the cess will be.

The cess, Jaitley said, will not be an additional burden on the taxpayers because the total of 28% and cess will not exceed the total of the existing levies.

The collections from this cess will create a pool that will compensate states for loss of revenue as they shift from the earlier structure to GST, which will subsume levies such as excise, service tax, and VAT. That loss in revenue is expected to be Rs 50,000 crore in the first year alone. This cess will lapse after five years.

Read: Here is why GST may increase your phone bill but reduce eating out costs

The structure agreed only applies to goods. The next step is to classify the goods under each rate and decide on the rates for services.

Revenue secretary Hasmukh Adhia said most services might come under the 18% rate. “We are very hopeful that the central GST and Integrated GST legislation will be presented in Parliament in the winter session,” he said.

There were some sceptical voices. The Confederation of Indian Industry, an association of companies, said the GST law does not clarify if the administration for assessment and audits will be done by the central government or states. Dual administration, said CII president Naushad Forbes, will put an additional burden on companies.

Bipin Sapra, tax head at consultancy and audit firm EY, said the multiple rates will create issues of classification of goods and services, and throw up disputes. “But, at the same time, the effort is to keep the prices of many commodities under control,” said Sapra.