Articles by Beena Parmar

SBI recalls 600,000 debit cards as questions linger about after-effects

Following reports of security breaches, top banks, including SBI, ICICI Bank, HDFC Bank, have initiated actions to address the issue at the earliest.

Published on Oct 21, 2016 11:20 AM IST

Hindustan Times | Beena Parmar, Mumbai

3.2 million debit cards under threat... and counting

Some 3.2 million debit cards issued by India’s biggest banks such as SBI, HDFC and others could be exposed to a malware-induced security breach, but the actual damage may be much more than that.

Updated on Oct 21, 2016 11:12 AM IST

Hindustan Times | Suchetana Ray and Beena Parmar, New Delhi/mumbai

This is how an ATM virus compromised 3.2 million debit cards in India

A virus or malware infection at Hitachi Payments Services led to over 32 lakh debit cards in India being compromised. Hitachi is one of the companies that operate ATMs in India. As a precautionary measure, State Bank of India and its subsidiaries have blocked 6.25 lakh cards while over 32 lakh cards including those of ICICI Bank, HDFC Bank, Axis Bank and Yes Bank are reported to have been infected.

Updated on Oct 20, 2016 04:09 PM IST

Hindustan Times | Beena Parmar, Mumbai

SBI blocks 6.25 lakh debit cards after ‘suspicious’ transactions spike

The State Bank of India, the country’s largest bank, and its subsidiary banks blocked about 6.25 lakh debit cards of their customers after “suspicious” transactions spiked at third-party ATM machines.

Updated on Oct 18, 2016 11:18 PM IST

Hindustan Times | Beena Parmar and Ramesh Babu, Mumbai/thiruvananthapuram

Banks eye ₹70K cr reduction in debt from top three deals

The recent flurry among corporate houses to sell off assets to reduce their debt has given banks, which are reeling under a huge pile of bad loans, reason to smile.

Updated on Oct 18, 2016 01:38 PM IST

Hindustan Times | Beena Parmar, Mumbai

Deal to help banks clean up books, but Essar has many debts to pay

The Essar Group will use the proceeds of the Essar Oil stake sale to halve its overall debt to about ₹44,000 crore, bringing relief to its leading creditors SBI and ICICI Bank.

Updated on Oct 17, 2016 12:56 PM IST

Hindustan Times | Suchetana Ray, Beena Parmar and Ramsurya Mamidenna, Mumbai/delhi

How bankers drove the deal, to clean up their loan books

The Essar Group will use the proceeds of the $12.9-billion (Rs 86,400 crore) sale of Essar Oil to halve its overall debt to about Rs 42,000 crore, bringing relief to leading bankers SBI and ICICI which have lent heavily in the past

Updated on Oct 16, 2016 10:31 PM IST

Hindustan Times | Suchetana Ray, Beena Parmar and Ramsurya Mamidenna, Mumbai/delhi

More property loans turn bad as NBFCs up lending

Facing stiff competition from banks, leading non-banking finance companies (NBFCs) are disregarding risk mitigation practices while lending money. This has led to a rise in bad loans against property (LAP).

Updated on Oct 13, 2016 10:39 AM IST

Hindustan Times | Beena Parmar, Mumbai

Relief in sight for debt-laden banks?

Banks struggling under a mountain of loans gone bad, could soon get a breather as RBI is looking at a proposal to classify a part of the sticky debt as standard loan rather than as non-performing asset.

Updated on Oct 08, 2016 01:09 PM IST

Hindustan Times | Beena Parmar, Mumbai

Loan EMIs may not fall as banks struggle with bad loans

Your loan EMIs may see a slow or no reduction as banks struggle with high deposit costs and bad loans.

Published on Oct 05, 2016 03:47 PM IST

Hindustan Times | Beena Parmar, Mumbai

Why Patel moved policy announcement to late afternoon

Predecessor Raghuram Rajan had stuck to the morning schedule, but Patel has brought it in line with global norms, and kept the interaction with media short and to the point

Updated on Oct 04, 2016 11:41 PM IST

Hindustan Times | Beena Parmar, Mumbai

All eyes on MPC in Patel’s first RBI policy: Here’s all you need to know

The upcoming monetary policy review on Tuesday has two firsts. It will be Urjit Patel’s first as governor of the Reserve Bank of India. It will also be the first interest rate review by the recently constituted monetary policy committee (MPC), which will function on lines followed by developed nations that ropes in more experts from varied backgrounds.

Updated on Oct 03, 2016 04:08 PM IST

Hindustan Times | Beena Parmar, Mumbai

Govt bank heads need longer tenures: RBI

The Reserve Bank of India is of the opinion that heads of public sector banks (PSBs) should have a minimum term of five years, as such time would be needed to build strong leadership in the sector which is currently grappling with bad loans and has to address issues related to profitability and market share.

Updated on Sep 28, 2016 02:11 PM IST

Hindustan Times | Beena Parmar, Mumbai

RBI guv Urjit Patel keen to shed ‘hawkish’ tag

Former Reserve Bank of India governor Raghuram Rajan was widely perceived to be a “hawk” when it came to monetary policy matters. His successor Urjit Patel, however, does not want to inherit the tag.

Updated on Sep 27, 2016 10:27 AM IST

Hindustan Times | Beena Parmar, Mumbai

Rupee to stay volatile, all eyes on US Fed, BoJ monetary policies

Published on Sep 21, 2016 12:02 PM IST

Rupee to stay volatile, all eyes on US Fed, BoJ monetary policies

The rupee is set to remain volatile for a few months, primarily due to external factors such as the monetary policy reviews by the US and Japan. But the currency will be spared sharp falls and is likely to trade in the 67-68 per dollar range.

Updated on Sep 21, 2016 11:10 AM IST

Hindustan Times | Beena Parmar, Mumbai

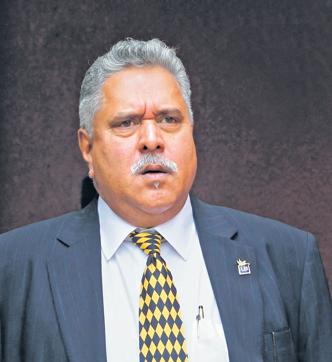

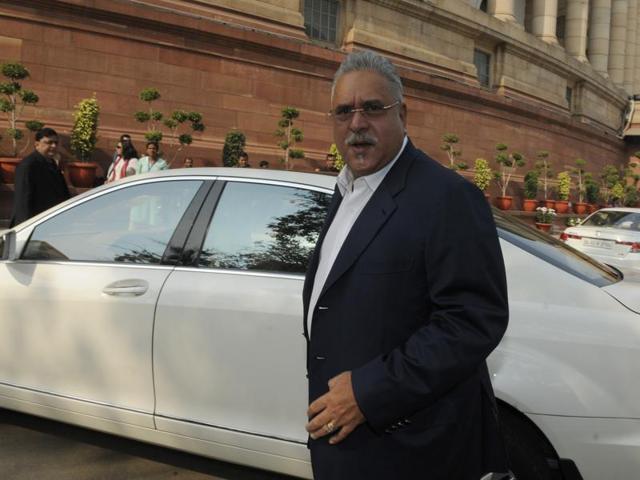

Want to own Kingfisher villa?Get ready to shell out Rs 85 crore or more

Vijay Mallya’s grand Kingfisher Villa in Goa, home to his many flashy parties in the past, will be auctioned by lenders on October 19, to recover part of the dues that the industrialist owes to various banks.

Updated on Sep 13, 2016 05:57 PM IST

Hindustan Times | Beena Parmar, Mumbai

Six months on, banks groping in the dark for Vijay Mallya

Six months on, there is no end in sight for authorities struggling to bring liquor baron Vijay Mallya to book after the industrialist fled to London in March, invoking suitable laws and crimping India’s efforts to bring him back.

Updated on Sep 13, 2016 10:56 AM IST

Hindustan Times | Beena Parmar, Mumbai

‘You see the same companies defaulting on loans in 1990s and 2000s. We have not learned’

Veteran banker Uday Kotak seems to have taken to history. Kotak Mahindra Bank chief’s hour-long chat with HT was peppered with historical incidents. He spoke about the group’s 31-year track record: on how the firm studiously didn’t make trades that were too good to be true, on the importance of being prepared for the worst-case scenario on oil prices, and how Indian firms would soon see more institutional ownership as bad loans are tackled.

Updated on Sep 12, 2016 11:50 AM IST

Hindustan Times | Beena Parmar and Ramsurya Mamidenna, Mumbai

ICICI Bank’s 200 robots process a million transactions a day

Bank claims it has enabled employees to focus more on value-added and customer-related functions

Updated on Sep 09, 2016 01:20 AM IST

Hindustan Times | Beena Parmar, Mumbai

Don’t have the UPI app? You can still transact through Trupay

Published on Sep 07, 2016 10:36 AM IST

Goodbye Raghuram Rajan, welcome Urjit Patel

Urjit Patel became the 24th Governor of the Reserve Bank of India as he took charge after Raghuram Rajan’s term ended on September 4.

Updated on Sep 06, 2016 01:34 AM IST

Hindustan Times | Beena Parmar, Mumbai

ED attaches Vijay Mallya’s assets worth Rs 6,630 crore

India’s financial crime investigating agency on Saturday took possession of assets worth more than Rs 6,500 crore of liquor baron Vijay Mallya, the second such action against the flamboyant businessman once known as a “king of good times”.

Updated on Sep 03, 2016 07:18 PM IST

Hindustan Times | Beena Parmar, Mumbai

Bank of Maharashtra is hiring: 1300 vacancies

As the banking sector struggles with bad loans, state-owned Bank of Maharashtra has said it will hire 1300 people, signalling its projection of growth of business.

Updated on Aug 30, 2016 04:57 PM IST

Hindustan Times | Beena Parmar, Mumbai