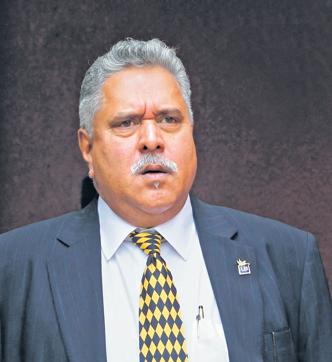

Six months on, banks groping in the dark for Vijay Mallya

Six months on, there is no end in sight for authorities struggling to bring liquor baron Vijay Mallya to book after the industrialist fled to London in March, invoking suitable laws and crimping India’s efforts to bring him back.

Six months on, there is no end in sight for authorities struggling to bring liquor baron Vijay Mallya to book after the industrialist fled to London in March, invoking suitable laws and crimping India’s efforts to bring him back.

The latest is an admission by the home ministry, which has reportedly said that a treaty with the UK — the India-UK Mutual Legal Assistance Treaty signed in 1995 — cannot facilitate the arrest of Mallya, a demand raised by the Enforcement Directorate and a 17-member lenders’ consortium. Mallya and his company Kingfisher Airlines had defaulted on around Rs 7,000 crore worth of loans and disregarded court summons to appear in cases related to the loan defaults.

“The home ministry has not said anything to us as of now. But we are in the process of approaching the ministry. There are a lot of processes that need to tied up before we approach them,” one ED official said.

The directorate, which probes irregularities related to foreign exchange violations, is working to file a prosecution case against Mallya and get a trial against him in the PMLA (Prevention of Money Laundering Act) Special Court. “We are seeking evidence against him, asking foreign jurisdictions, including the UK and other places… not everything is in our hands,” said the official quoted above.

The agency is also in process of a third attachment of assets of Mallya, which are largely in the form of equity shares worth over Rs 1,000 crore.

For banks, who have so far failed to recover anything even after putting on auction a sprawling office complex and trademarks of Kingfisher Airlines, the process has been fraught with non-cooperation. “Bankers are still waiting for access to the promoter and in enforcing conversion of loan to equity and the follow-through process of change of debt into equity,” said one person familiar with the development. “Enforcement decisions are not strong enough and the promoter (Mallya) needs to co-operate. The lenders need to take control with the help of legal authorities.”

Efforts by the lenders consortium led by State Bank of India to recover dues have so far yielded around Rs 1,200 crore since the first default in November last year.

The consortium has failed to even get suitors to multiple auctions of the Kingfisher House and Kingfisher Airlines’ brands, including logos, trademarks and his personal luxurious aircraft.

Banks have been fighting more than 20 legal disputes with 500 hearings in various courts and legal agencies, including the Supreme Court of India and the Central Bureau of Investigation.