iPhone 16e must worry Qualcomm, Mira Murati’s startup and Jio’s new smart TV OS

Murati left OpenAI late last year amidst an exodus from the AI company that had its own turbulence to deal with.

This is definitely history repeating itself. As I write this on Wednesday (IST), Qualcomm may be feeling what Intel did in the November of 2020 when Apple released the M1 chip. The new Apple iPhone 16e, a truly compact iPhone in a while (iPhone SE was in 2022 and the iPhone 13 mini in 2021), crucially begins an era of Apple’s own cellular modem. The C1 modem replaces Qualcomm’s chips in the iPhone 16e. Considering the iPhone refresh cycle usually is much simpler, we could find Qualcomm’s hardware gone once the next generation iPhones come around later this year.

If we go back to the release of the M1 with the MacBook Air and then the MacBook Pro series in late 2020, it took just about a years’ time for the elaborate Mac and iPad portfolios make switched to Apple silicon — and that was much lesser than Apple’s initial estimates in terms of timeline. Intel lost the Mac business for good, and thats one of the reasons for its current struggles. The M-series chips, then and now, continue to set performance benchmarks including performance per watt, which Intel, AMD and Qualcomm try to match. The reason is, Apple believes the experiences they are trying to deliver, require purpose-built tech. Bob Borchers, VP of Worldwide Product Marketing at Apple pointed out to HT in an interview earlier, that “you can turbocharge experiences when you have amazing purpose-built technologies that you can bring together,” and that other chipmakers “need to think about kind of the lowest common denominator.”

RECOGNISE

- She’s back! I had pointed out a while ago that many more chapters in Mira Murati’s legacy remain to be written. Murati left OpenAI late last year amidst an exodus from the AI company that had its own turbulence to deal with. Her new Thinking Machines Lab startup is coming into public view. They’ve made the intent clear — “to make AI systems more widely understood, customisable and generally capable.” The start-up’s initial guidance seems to be saying all the right things, of collective efforts, human-AI collaboration, model intelligence as a cornerstone and prioritising understanding of frontier AI systems. This will be one to keep an eye on, as well as Ilya Sutskever’s Safe Superintelligence Inc. Their intentions go deeper than just flexing muscles with a (shallow, not enough substance but a lot of noise?) new AI model.

- Speaking of which, Elon Musk’s xAI made a lot of noise on X yesterday to unveil the Grok-3 chatbot with advanced reasoning capabilities. Tall claims of course, including that this model performs better than OpenAI’s GPT-4o, Google’s Gemini, and DeepSeek’s V3 models as far as early tests go. The reason to pitch advanced reasoning, is that it’s supposed to showcase the AI’s ability to answer complex questions by subdividing them into smaller questions or tasks. Grok-3, for those who are willing to pay Elon Musk a monthly subscription, is available in the Grok app as part of the X Premium Plus subscription (that’s now ₹34,380 per year after a price increase), or a SuperGrok plan which is only available within the Grok app (and I couldn’t care enough to download that).

PURCHASE

There are a few questions that need answering. Quite which phones are Indians buying? How they’re selecting them? And to that point, where does that leave some other brands? I ask because they floated back into active memory, the trigger being International Data Corporation’s (IDC) latest Worldwide Quarterly Mobile Phone Tracker numbers with specific references to India. The silver lining is, overall smartphone shipments grew 4% in calendar year 2024, compared with the year prior. It may not look like a big number in terms of percentages, but 151 million units is no mean feat. Mind you, the momentum in the first half of the year which made way to a sluggish second half, averaged things out respectably. Does that sluggishness give way to optimism in the first half of 2025? Particularly with almost the flagships now lined up (Xiaomi’s will be too, next month)?

In terms of the big winners, Apple’s iPhone shipments grew 34.6% to give it a market share of 8.2%. Oppo grew 21% to jump a few places up in the charts (they’re now third in the market share pecking order), while Vivo (13.9% growth; 16.6% share) took the top step from Samsung (a negative 19.9% annual trajectory; dips share to 13.2%). But amidst all this searching for a bright spark in these dull (or perhaps not) times, a big worry stares back at us. At for those of us willing to look. OnePlus dropped 32.6% share year-on-year. What ails OnePlus?

Worrying times…

I’ll be honest, little was I expecting to have to tackle this question, and any answer equally requires you to persist past perplexity of this situation first. Utilising the method of elimination, we can safely say their mid-range Android phones aren’t the problem. The OnePlus Nord series (and that’s a wide portfolio to choose from) more often than not sets an experience benchmark — no mean feat, considering how competitive that space is with Xiaomi, Vivo and Samsung figuring prominently. Neither were last year’s OnePlus 12 or OnePlus 12R flagships, and neither are the current generation OnePlus 13 and OnePlus 13R phones. In the past couple of years, OnePlus have not dropped the ball with timeliness software updates, their potential to delivery ratio has been quite good, and the Hasselblad camera partnership has kept them very much in the flagship smartphone photography conversation. So, what gives?

Could it be the green line issue social media platforms were rife with conversation of this issue noting its unwanted presence in new and not so new OnePlus phones alike. The company did take corrective action to replace those screens, but the perception damage was done, paired with the ambiguity about why this really happened. Secondly, and this is perhaps less plausible, is possible weakening of OnePlus’ strongest links in the chain. The Nord CE phones — the Nord CE2 Lite and the Nord CE3 Lite, over the years. While I do not have exact numbers, could it be that the Nord CE4 didn’t sell as well? No company is perfect with service, and no phone maker is perfect with their product portfolio. There are always gaps, often magnified with subjectivity and perceptions. It’ll be interesting to see how OnePlus responds to this in the next two quarters, which will effectively define its sales trajectory for 2025.

VISION

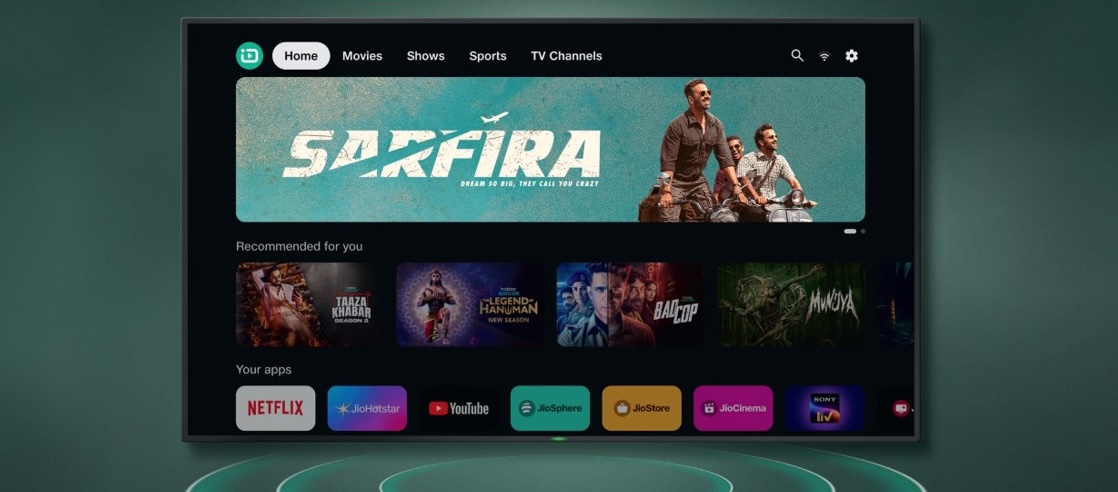

Google TV, Android TV, Tizen OS, Web OS, are finally getting some genuine made in India competition. Reliance Jio has built a smart TV operating system, called JioTele OS. The day you read this, TVs running JioTele OS will go on sale, and the early adopters include Kodak, Thomson, JVC and BPL. More brands will join the party through 2025, Reliance Jio confirms to us. There are no details yet on the minimum specs required to run JioTele OS on smart televisions, but my belief is, it’ll be more flexible and less resource intensive than the likes of Google TV and Android TV (those two are notorious for sluggish performance if TVs skimp on memory or processor power). That will allow Jio and adopting TV makers to further reduce prices of TVs, which should be a handy move to sell more in tier II and tier III towns. More affordable 4K TVs? That is the vision, let’s see how it pans out.

The company is still pitching this as a premium, content rich smart TV platform. There is of course conversation around AI. It’ll be key to delivering content recommendations, which it’ll pull from a series of preloaded steaming apps as well as more that must be downloadable from an application store (those details are scarce at this time). “Opens access to a vast library of TV Channels, cloud Games, your favourite OTT apps and seamlessly switching between TV Channels, Content — all with a single remote,” the company details. From the first glimpse that Reliance Jio have shared, JioTele OS does have a mix of familiar visual elements that do resemble what we’ve seen with Xiaomi’s Patchwall and Google’s Android TV.

In my opinion, affordability will be key to a renewed push for high definition and 4K smart TVs to more and more households in India. I have little doubt that Jio, along with the TV partners they choose, will deliver on the affordability aspect. Availability will be interesting to gauge in a couple of months, because if the partner TV brands prioritise online channels, they may realise there’s still an apprehensive demographic in India that’d like to buy a TV in a store, after seeing it in action hung securely on a wall of screens. Simple details, matter a lot.