After demonetisation and GST, it’s payback time for govt: Ludhiana industry, traders on budget

The traders felt that the BJP-led NDA government, in its last full budget of its five-year tenure, should announce business-friendly measures to win confidence of the community.

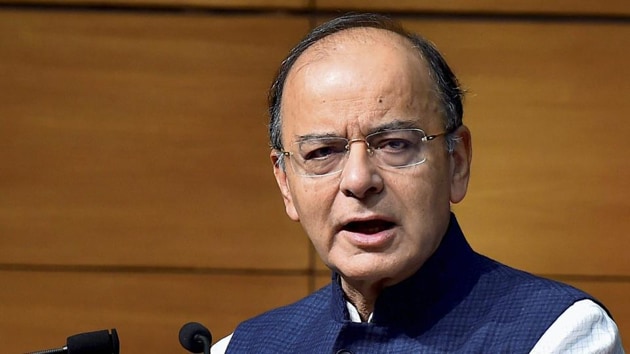

Ahead of the Union budget to be tabled on February 1, the business community in Ludhiana expects finance minister Arun Jaitley to ease the taxation policy. With the impact of demonetisation and GST still fresh in their memory, traders felt that the BJP-led NDA government, in its last full budget of its five-year tenure, should announce business-friendly measures to win confidence of the community.

“Anti-trader policies should be withdrawn and income tax relaxation should be given to those having income up to Rs 5 lakh per annum. But income tax is not the only concern,” said Sandeep Wadhwa of Ludhiana Apparel and Knitwear Manufacturers’ Association. “We are also concerned about how the government will relax GST. I am an office-bearer of the BJP, and urge the government to withdraw reverse-charge mode, which is more like arm-twisting,” he added.

Businessmen also added that their community has cooperated and “bore all the brunt” of GST and demonetisation for which the government should now “pay back” by incentivising exports and exempting them from income tax. “The government has collected enough revenue due to GST and it is time that it should consider relaxing GST which is still confusing,” said another trader who engages in hosiery and fabric manufacturing, but refused to be named for fear of being singled out for any action.

Traders’ associations have also demanded cut in social security schemes and allocating more funds to develop infrastructure to boost generate employment. “We urge the Union finance minister to announce special incentives for women who become entrepreneurs and also ensure that pollution control devices are tax-free. The government should also look into ways of simplifying GST,” said Badish Jindal, president of Federation of Punjab Small Industries’ Associations.

For steel price regulator

The association of fastener manufacturers and other units raised the issue of regulating steel prices “to end the cartel and monopoly” of major plants. Earlier this month, a group of associations had also held a protest against frequent rise in price of raw steel .

Urging the finance minister to announce a price regulatory commission, Upkar Singh Ahuja of Chamber of Industrial & Commercial Undertakings (CICU) said steel export is increasing but the export of steel-made product is not increasing due to uneven rise of prices in the last couple of months. Also, he added, “Investment limit of a medium enterprise should be increased to Rs 20 crore, while that of a small enterprise should be increased to Rs 10 crore. The government should also cap the income tax for traders at 20%.”

‘Subsidise modernisation’

The members of Federation of Indian Export organisations said the Union government should encourage those business units which plan to adopt modern techniques and also provide subsidies. “We are facing tough competition from foreign companies. The government should devise a plan to counter this and provide subsidies to encourage modernisation,” said SC Ralhan, one of the members. He also urged the government to come up with a special package for exporters.