Technology-aided structural reforms can bring transparency in political funding

The government should start integrating our political systems into the Digital India and Cashless India programmes

The Centre has given several hints that the next big wave of financial reforms after the Goods and Services Tax (GST) roll out would be in the area of political funding. Though its plan has been received well --- the Association for Democratic Reforms data shows that 70% of Rs 11,300 crore of political party funding over an 11-year period came from anonymous sources --- the government’s efforts on this to date hasn’t been enough.

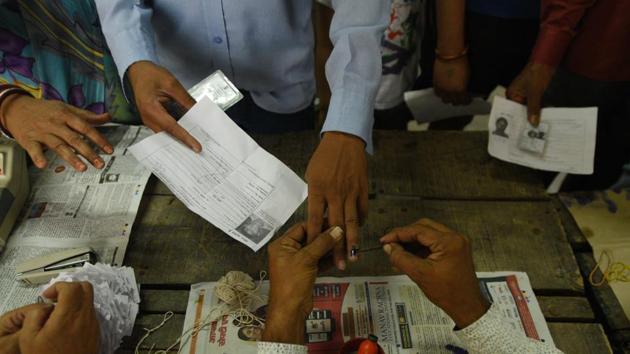

However, the finance Bill had seen a few progressive changes, such as the reduction of the ceiling of all cash donations towards political parties from Rs 20,000 to Rs 2,000, and a proposal for the creation of electoral bonds. The reduction in the limit of cash donations to Rs 2,000 sharply decreases the ceiling to 1/10th, but the absence of a cap in the total number of such payments that could be collected, and the lack of any requirement to collect donor details create the same loopholes as before.

The same bill also had a few eyebrow raising amendments, including fresh provisions that allowed companies to donate any amount to a political party, without disclosing the name of the party in the company records, and the removal of an earlier restriction that prevented companies from donating more than 7.5% of its average net profit in the three immediate preceding fiscal years to a political party – steps that effectively made corporate funding of political parties more opaque.

The government decision to give Income Tax exemptions to political parties when they deposited the old Rs 500 and Rs 1,000 notes in their bank accounts during the demonetization exercise, provided that the donations taken were under Rs 20,000 per individual, and were “well documented”, also did not give the impression of a step in a direction towards increased transparency.

Even though the bonds give donors anonymity while they make digital political contributions, they do not offer tax exemptions. There remains an alternative route to make donations along with tax-breaks, through electoral trusts, entities that can collect funds without disclosing source of funding, and distribute them to political parties.

The government should start integrating our political systems into the Digital India and Cashless India programmes. The donors could be incentivised to make digital donations through tax rebates and cash transaction surcharges. Legacy entities and provisions that aid transactional opacity should be simultaneously eased out. As India’s digital economy matures further and exhaustive databases are created, funding information filed by the parties could be cross-checked real-time with the spending history of individual and corporate donors.

The Centre, which prides itself on making structural changes such as demonetisation and the GST rollout, would have to make deep-rooted technology-aided reforms to bring in political funding transparency.

Anil K Antony is a technology and social entrepreneur, and executive director of Cyber India

The views expressed are personal