Why sentiment fails to keep up with GDP data

The current government has performed worse in terms of agricultural growth than UPA-II, but it has done better in both industry and services

When the Central Statistical Office (CSO) released back-series data for the 2011-12 GDP series until 2004-05, one key metric stood out. Economic growth under the Narendra Modi government has been better than under the previous two Congress-led United Progressive Alliance (UPA) governments. This means the current government’s term has been the best ever in terms of growth in the Indian economy. With months to go before the next elections, this should be good news for the Bharatiya Janata Party (BJP). This achievement, however, does not seem to be translating into positive perception about the economy, as is evident in Consumer Confidence Surveys conducted by the Reserve Bank of India (RBI).

What explains the current mismatch between economic performance and sentiment? The rural anger against the government can be attributed to the terms of trade crisis in agriculture. This author pointed out on January 15, 2019 that farm-gate prices have entered a slump which has not been seen in two decades. But the RBI survey is conducted in 13 major cities, not rural areas. Deterioration in terms of trade against farming should have led to an improvement in economic conditions in urban areas (because, it means low food prices and inflation). Why has this not happened?

An HT analysis shows that the key to this puzzle might lie in a sector-wise break-up of economic growth. In two key non-agricultural sectors, growth under the current government has been less than what the UPA-II achieved. These are precisely the sectors where the share of employment rose significantly in the post-reform period. So, even if one were to take the new GDP back-series numbers on face value – they have been criticised by a lot of independent economists – the fruits of high growth under the present government have not gone to employment intensive sectors. Given this backdrop, it is not surprising why consumer sentiment has gone down.

The compound annual growth rate (CAGR) of Gross Value Added (GVA) under the present government (2014-15 to 2018-19) is 7.2%, higher than the 7% and 6.2% under the UPA-I and UPA-II governments. Yet, economic sentiment on three key indicators - general economic situation, employment and income - has fallen significantly in comparison to what it was when this government assumed office. Chart 1 shows net sentiment on these three indicators till November 2018, the latest period for which data is available.

Net sentiment is calculated by subtracting the share of respondents who reported a worsening of situation from those who reported an improvement. As can be seen, the perception vis-à-vis employment seems to be particularly bad.

A sector-wise break-up of growth performance under the three governments for which latest back-series data is available, offers an insight into this conundrum. The current government has performed worse in terms of agricultural growth than UPA-II, but it has done better in both industry and services. However, there are two subsectors; construction and trade, hotel, transport, storage and communication where the CAGR of GVA under the present government is less than what it was under UPA-II.

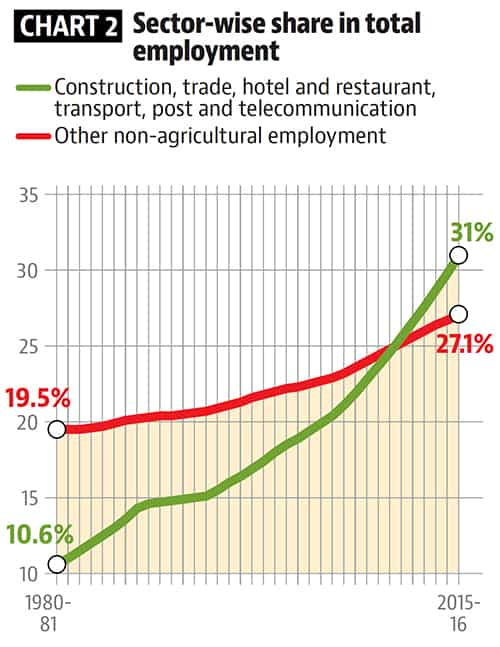

These two sectors had a share of around 27% in total GVA in 2018-19, which is half of the share of rest of the non-agricultural economy. But, they have a disproportionately high share in employment. Statistics from the KLEM (Capital with a K, Labour, Energy, Material) database released by RBI show that share of these two sectors in non-farm employment has been increasing at a fast rate and had overtaken the employment share of all other non-agricultural sectors.

To be sure, KLEM figures are available only till 2015-16, but it is unlikely that the trend would show a radical change in the subsequent period. Reading the employment share and sector-wise growth numbers shows that the most employment intensive sectors outside agriculture have actually seen a poorer growth performance under the present government. This also means that majority of the non-agricultural workforce has experienced a lower income growth, contrary to what the headline GVA numbers would want us to believe. Given this context, the fall in economic sentiment is not counter-intuitive.

The break-up of responses about the general economic situation conveys another trend which could have political implications. Share of respondents who think that the economic situation has neither improved nor worsened has been declining in the recent period. This decline in share of fence sitters has been accompanied by the rise in number of naysayers. This too might not be good news for the BJP.