Number theory: Understanding the state of the Indian economy

The Union government released important economic data including GDP numbers, fiscal figures, and core sector index. What do these numbers tell us?

The Union government released important economic data on May 31, including GDP numbers for the quarter ending March 2023, provisional fiscal numbers for the central government for 2022-23, and the index of eight core sector industries for April 2023. What do these numbers tell us about the state of the economy? Here are four charts which provide a summary of the key takeaways.

There seems to be a consumption-investment divergence in GDP data

The 6.1% headline GDP growth print for the quarter ending March 2023 has surpassed analyst and the government’s estimates by a long distance. However, an expenditure-side analysis of the numbers shows that two key drivers of growth, consumption and investment, seem to be headed in different directions. While private final consumption expenditure (PFCE) growth slowed down significantly over the course of 2022-23, gross fixed capital formation (GFCF) continues to show robust momentum. Part of the GFCF momentum is on account of a government’s push towards capex as its total capital spending increased by 24% between 2021-22 and 2022-23. While GDP numbers do not give a private-public classification of capex numbers, a look at a capacity utilisation survey conducted by RBI shows that utilisation levels have been rising, which would necessitate at least some pick up in private investment activity. But urban consumer sentiment, as captured in the RBI’s Consumer Confidence Surveys continues to be in the red.

2022-23 saw an inflation-driven windfall gain on the fiscal front

Provisional fiscal numbers for 2022-23 released by CGA shows that the government has been able to meet its fiscal deficit target for the year. At 6.4%, the gross fiscal deficit as a share of GDP is in line with the Revised Estimates presented in the 2023-23 Budget. To be sure, this prudent fiscal management is more a result of a massive windfall on account of inflation. Nominal GDP growth in 2022-23 is 16.1%, which is five percentage points higher than what the 2022-23 Budget assumed it to be. With inflation coming down significantly, the nominal growth component of GDP is expected to be much lower in 2023-24 than what it was in 2022-23. The 2023-24 Budget has projected a nominal GDP growth of 10.5%.

Will manufacturing revive itself?

With a growth of just 1.3%, manufacturing is the most underwhelming component of Gross Value Added (GVA) in the annual numbers for 2022-23. Manufacturing sector GVA actually saw a contraction in the quarters ending September 2022 and December 2022. While the March 2023 quarter manufacturing numbers show an improvement in growth, there is an element of favourable base effect at play as the March 2022 quarter manufacturing growth was just 0.6%. It is important to underline that manufacturing GVA numbers do not seem to be displaying the momentum seen in Purchasing Managers’ Index (PMI) manufacturing data which showed a very high degree of business expansion throughout 2022-23.

Will better than expected growth numbers harden monetary policy stance?

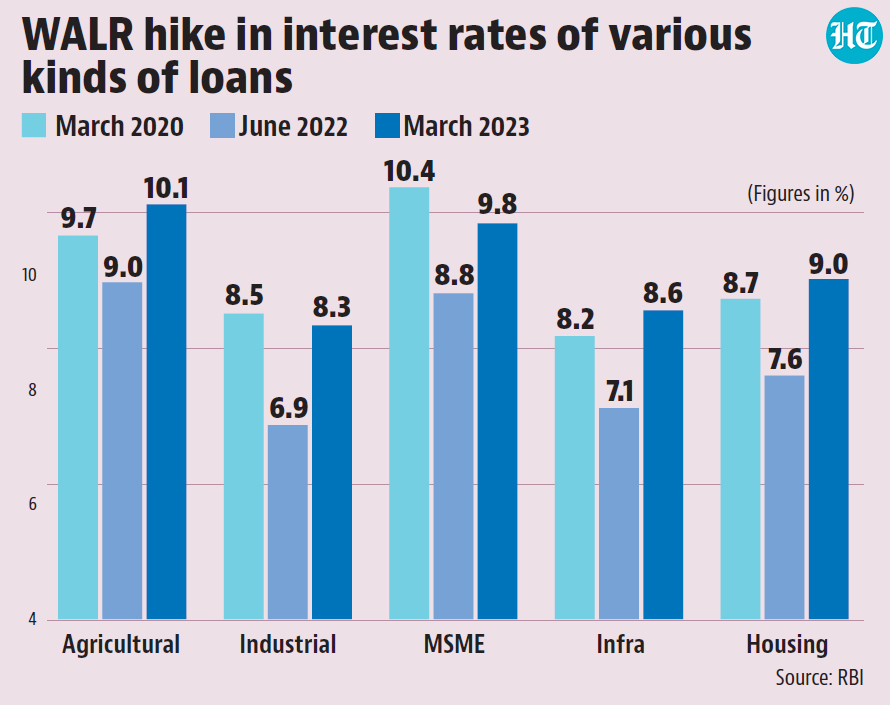

This is the only question worth asking in the run-up to the next meeting of the RBI’s Monetary Policy Committee (MPC) which will begin on June 6. MPC has administered a cumulative hike of 2.5 percentage points between May 2022 and February 2023. The MPC decision to keep rates unchanged in its April meeting was vindicated when Consumer Price Index (CPI) growth in April came at 4.7%, the lowest in 18 months. To be sure, RBI’s rate hikes have led to a significant increase in lending rates across the spectrum and this is bound to generate headwinds for growth. It remains to be seen whether a better-than-expected GDP growth number will turn MPC’s sentiment in the hawkish direction. To be sure, as things stand, most analysts do not expect MPC to cut rates in its June meeting.

All Access.

One Subscription.

Get 360° coverage—from daily headlines

to 100 year archives.

HT App & Website