Traders, shopkeepers across the country anxious as GST deadline nears

With just two days left before the June 30 deadline, many are panicking.

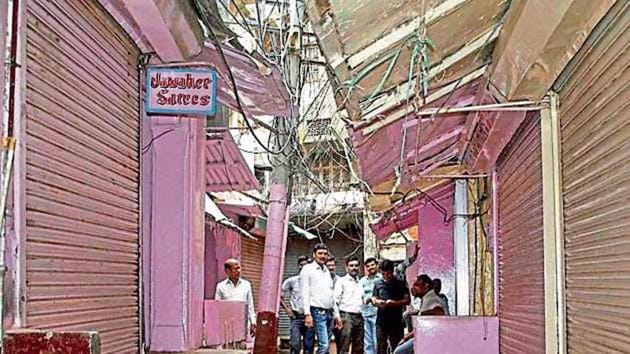

Deepak Mendiratta has spent decades trading in leather out of north Delhi’s sprawling Sadar Bazar but has never had a more harrowing week.

As president of the local trade body, he is helping wholesale leaders, shopkeepers and traders navigate the complex maze of rules as they migrate to the Goods and Services Tax (GST). And with just two days left before the June 30 deadline, many are panicking.

“90% of traders are complaining they don’t understand the tax structures… in GST, there is excessive confusion because there are three different slabs causing confusion,” he said, fearing the July 1 launch might disrupt the lives and businesses of the nearly 15,000 small traders in the thriving market.

Adding to the trouble are complaints of technical glitches in the GST registration process from some regions.

In smaller cities, the confusion has mounted manifold as the deadline nears.

“I have tried to understand GST around 10 times from friends and chartered accountants but still can’t. The process is very complicated,” says Imran Khan, a wholesaler of water purifiers in Jaipur.

Touted by the government as the biggest tax reform since Independence, the GST is meant to boost growth and scrap local taxes that add to overhead costs and stymie businesses.

But experts fear the lack of preparedness, the multiple rates — unlike other countries, India has chosen four slabs ranging from 5% to 28% — and the chaos that precedes the July 1 launch might cause near-term disruption and shave off the gains intended from the uniform tax regime.

“Clarity on GST laws and the multiple rate structure is required, especially for the trading community. But the immediate challenge for traders will be to upgrade their billing and accounting software,” said Priyajit Ghosh, partner, indirect tax in KPMG, India.

But officers handling the transition say the confusion is because taxpayers and accountants never took the GST deadline seriously. “There is never a good time to implement a reform such as GST. Stakeholders will always complain that they are never fully prepared,” said Amarjeet Chopra, former president of the Institute of Chartered Accountants of India.

On the ground though, small traders are feeling the pinch.

“Nobody from the commercial taxes department came to us and explained how GST differs from the present system,” Krishna Murthy, proprietor of Balaji Medicals and Generals, a retail druggist at Somajiguda near Hyderabad, told HT.

Murthy said he had heard of input tax credit through which business can reduce the taxes it has paid on inputs from the taxes it has to deposit on output — but hadn’t understood it. “We have engaged a tax consultant to calculate the input tax credit and claim the same. May be over a period of time, I will know about it,” he said.

Critics are worried about accountants exploiting taxpayers, given the GST’s complex structure.

The Chamber of Maharashtra Industries and Trade (CAMIT) said small traders are the worst affected. “We are not opposed to GST but there are so many problems and it is all cumbersome. We just want simplification of the procedure,” said Mohan Gurnani, chairman, CAMIT.

One of the worst affected is the textile industry — and manufacturers from across the country are coming together for a nationwide protest over rates. “We were promised that there will be no GST on cloth but the government backtracked,” said Raichand Binaykya, convener, Joint Action Committee, All Textile Traders Association.

(Inputs from Suchetana Ray and Abhinav Rajput in New Delhi, Srinivasa Rao Apparasu in Hyderabad, Sachin Saini in Jaipur, KV Lakshmana in Chennai, Vikram Gopal in Benglauru, and Naresh Kamath in Mumbai)