RBI Monetary Policy highlights: From unchanged repo rate to reduced economic growth forecast

RBI Monetary Policy: The committee forecasted economic growth at 9.5 per cent for the current fiscal from the previous 10.5 per cent.

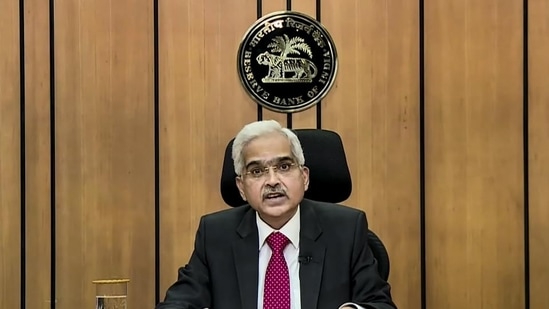

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) on Friday announced it will maintain the status quo on its key rates. RBI governor Shaktikanta Das said that it was decided to keep the repo rate and the reverse repo rate unchanged at 4 per cent and 3.35 per cent respectively to mitigate the impact of Covid-19 on the economy.

"Enduring lesson from Covid-19 experience in the Indian context has been the deployment of unconventional monetary policy measures that distribute liquidity among all stakeholders," Das said.

Also read: Sensex, Nifty trade flat ahead of RBI’s monetary policy announcement

Das said that the policy committee has decided to maintain the accommodative stance to continue as long as necessary to revive and sustain growth and ensure that inflation remains within the target.

Here are the key highlights of the MPC announcement:

1. Besides, unchanged repo rate and reverse repo rate, the MPC decided to keep the bank rates the same too at 4.25 per cent.

2. The economic growth forecast was cut to 9.5 per cent for the current fiscal from the previous 10.5 per cent, announced Das. Das said 18.5 per cent real GDP growth is expected in the first quarter, 7.9 per cent in the second quarter, 7.2 per cent in the third quarter and 6.6 per cent in the fourth quarter of 2021-22.

3. RBI's MPC has projected the consumer price inflation (CPI) at 5.1 per cent during 2021-22. RBI governor Das announced 5.2 per cent CPI in the first quarter, 5.2 per cent in the second quarter, 4.7 per cent in the third quarter and 5.3 per cent in the fourth quarter.

4. Das especially commended the resilience of the farm economy, however, the dent in urban demand and spread of infection in rural India poses risks to the normalisation of the economy, he said. A normal monsoon, resilience of agriculture and farm economy, adoption of Covid-compatible business models and gathering momentum of global recovery can help revive the domestic economy when the second wave of coronavirus disease abates, the governor said.

5. The governor said it has been observed that the mobility indicators declined but were seen above the levels of last year. The impact on economic activities due to the second wave of the virus is expected to be relatively contained in comparison to that of the first wave, with restrictions on mobility being nuanced and regionalised.

Also read | Banks shouldn’t cite 2018 crypto note: RBI

6. Further on the assessment of growth and inflation, the MPC observed that India's exports in March, April and May 2021 have been on an upswing. "Conducive external conditions are forming for a durable recovery beyond pre-pandemic levels, targeted policy support for exports is need of the hour," Das said.

7. The governor of the central bank said that the focus of RBI is turning from systemic liquidity to equitable distribution. He also added that the vaccine policy of the country is expected to gather steam in the coming months and should help normalise economic activities.

8. RBI took several steps to inject liquidity in the economy as it conducted regular Open Market Operations (OMO) to the tune of ₹36,545 crore till May 31, Das said. This was in addition to ₹60,000 crore under the G-SAP 1.0.

9. Das also highlighted that the country's foreign exchange reserves touched $598.2 billion as of May 28. The forex reserves are at a striking distance of reaching $600 billion.

10. Policy measures decided by the MPC panel to boost economic recovery include opening ₹15,000 crore window till March 2022. Banks can provide fresh lending support to restaurants, adventure and heritage, aviation ancillary, private bus operators, rental car service providers among others in the hospitality industry that suffered significant damage from the pandemic.

11. To ensure further support to the medium, small, micro enterprises (MSMEs), RBI has lent ₹50,000 crore support to all Indian financial institutions. Of this, ₹15,000 crore support is provided to the Small Industries Development Bank of India (SIDBI) for aid to the MSMEs.