Note ban helped formalise economy but hit small businesses

Demonetisation generated tailwinds for formalisation of the economy. Income declared in income tax returns, as a share of India’s total Gross Value Added, increased significantly in 2016-17. But it also generated headwinds for small business incomes.

Demonetisation generated tailwinds for formalisation of the economy. Income declared in income tax returns (ITRs), as a share of India’s total Gross Value Added (GVA), increased significantly in 2016-17. But it also generated headwinds for small business incomes.

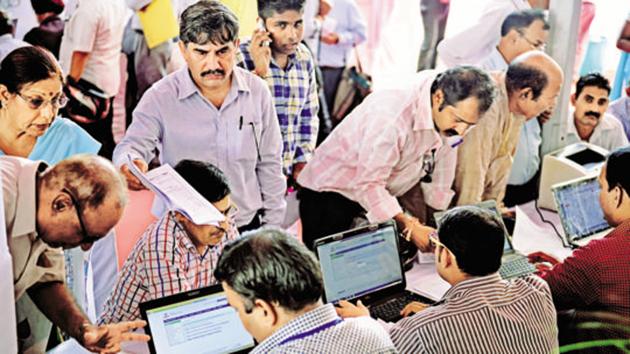

Growth in the number of tax returns and income shown in ITRs in the up to ₹5 lakh annual non-salary income category suffered a big deceleration. These findings are based on an HT analysis of detailed income tax data for Assessment Year (AY) 2017-18 released on 22 October. AY 2017-18 captures income in fiscal year 2016-17.

To be sure, at least two factors should suggest caution in using these statistics to make grand conclusions about demonetisation’s impact on income tax collections. 2016-17 also saw a voluntary disclosure scheme to declare unaccounted incomes, which is likely to have given a one-time fillip to tax collections. And, one should wait for a longer period to check whether the change in tax patterns due to demonetisation is sustained or not.

If there is one statistic which captures India’s income tax collection challenge, it is the low share of income declared in ITRs as a share of India’s overall economic product. The income tax department gives data on total income declared in ITRs from 2012-13 onwards.

This value was just 23% of India’s total GVA in that year. This is not to say that the figure should be 100%. A lot of people with lower incomes need not even file returns. Agricultural incomes are outside the income tax net in the country. And a lot of economic activity attracts taxes other than income tax. The figure was almost stagnant between 2012-13 and 2014-15.

But it increased at a much faster pace in 2015-16 and 2016-17, increasing by more than 8 percentage points in these two years. This suggests that the economy has been undergoing a formalisation process under the present government. This means that more and more firms/individuals are moving from the non-tax economy to the tax net. While the process seems to have started before demonetisation, the economic disruption due to demonetisation did not slow it down.

The statistics released on October 22 also give details about the number of ITR filings and income shown in ITRs by income categories and different type of taxpayers. HT has used this information to create two broad categories of salary and non-salary income.

The slab of ₹5 lakh or less per annum has been taken as the lowest income category. These statistics also give us an interesting idea about income inequality (on declared income) in the Indian economy. For example, only 2% of the total ITRs filed in 2016-17 declared an income of ₹25 lakh or more. But these ITRs accounted for more than 45% of the total declared incomes.

The income inequality pattern has a stark difference among the salaried and non-salaried income class. 80% of the total income reported in the former in 2016-17 was from the up to ₹25 lakh category, while this share was just 39% for non-salaried income. Interestingly, the share of salaried and non-salaried categories was almost similar in the up to ₹5 lakh category. This suggests that there exists a problem of the missing middle — earnings are either too less or too much — among India’s non-salary income earners.

Coming back to demonetisation, a look at annual growth in total income reported in each category can tell us about whether or not there was a class-difference in the policy’s impact. There is merit in examining salaried and non-salaried incomes separately, as 2106-17 was also the year of implementation of seventh pay commission recommendations. Also, it is relatively difficult to conceal incomes among the salaried.

The up to ₹5 lakh non-salary income group category stands out in the data due to the sharp deceleration in growth of total income filed in ITRs. This is in keeping with anecdotal evidence that small businesses might have taken a hit during demonetisation. Interestingly, non-salaried income between ₹5-50 lakh shows a big increase in the demonetisation year. This might be a result of unscrupulous businesses declaring their unaccounted cash to some extent. One will have to wait for data for a few more years to see whether this trend continues or whether it was just a one-off attempt to get rid of unaccounted cash.