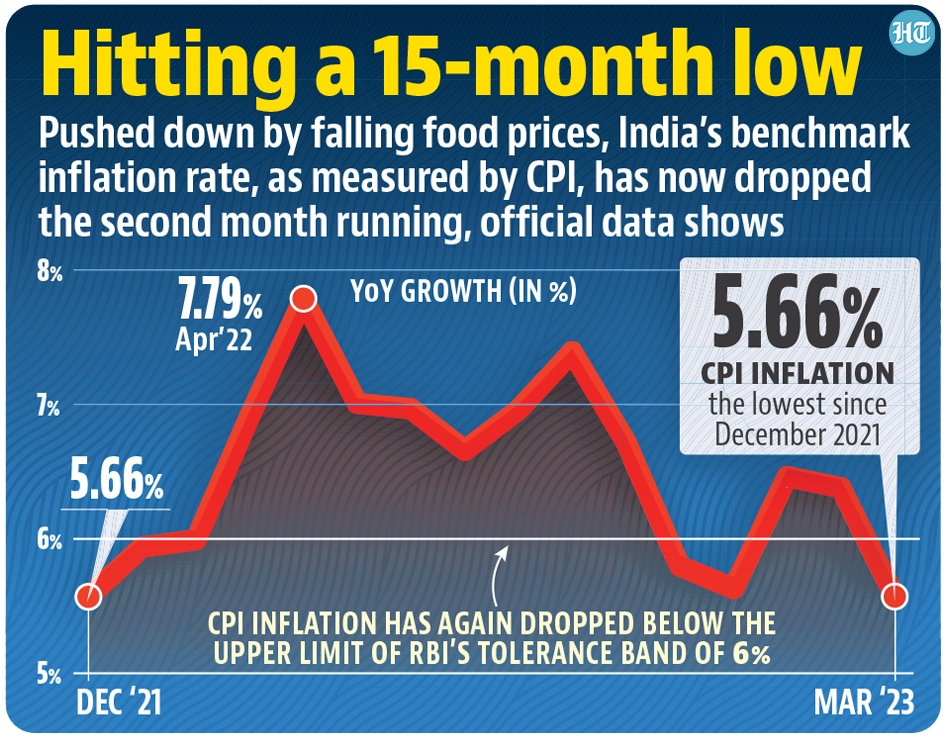

Inflation eases below tolerance band of 6%

Headline inflation has once again come within the Reserve Bank of India’s tolerance band of 2-6% after two months, and is the lowest since November 2021

Retail inflation as measured by the Consumer Price Index (CPI) eased to 5.66%, the lowest in 15 months, on the back of a cooling in food and fuel prices, although the continued spiral in prices of cereals and milk should worry policy makers.

Headline inflation has once again come within the Reserve Bank of India’s tolerance band of 2-6% after two months, and is the lowest since November 2021. Significantly, sticky core inflation – it measures the non-food non-fuel component of the CPI basket -- has come below the 6% mark after seven months.

The number comes after RBI’s monetary policy committee, earlier this month, held the policy rate after taking it up by 2.5 percentage points since last May.

While these numbers will bring a lot of relief to both the government and the RBI – at 6.65%, retail inflation in 2022-23 is the highest since 2013-14 – the moderation in inflation is partly the result of a favourable base effect. March 2022 was the first month after the beginning of the war in Europe, which inflicted an inflationary shock the global economy. Inflation numbers from March 2023 onwards will be moderated by the high base last year. To give some context, retail inflation was 7% or higher for four consecutive months beginning March 2022. Still, on a sequential basis, inflation increased by 0.2% between February and March 2023. While this is same as February, a slightly longer-term view shows moderation in sequential inflation as well.

If the projections by RBI’s Monetary Policy Committee (MPC) are to be believed, inflation numbers should fall further going forward. MPC has projected an inflation of 5.1% for the quarter ending June and 5.2% for the fiscal year 2023-24. The latest inflation numbers will also provide some post-facto justification for MPC’s decision to not hike interest rates for the seventh consecutive time in its April meeting, although many experts believe that monetary policy is now being driven by financial stability than price concerns. To be sure, barring an upward shock to inflation, RBI is likely to keep interest rates unchanged in its June meeting, despite its pause-not-pivot qualification of the April decision.

“The lower than 6% print today and the expectation of a below 5% print in April suggest a pause in the next MPC meeting is likely. MPC surprised markets last week by keeping repo ( policy) rates unchanged, citing uncertainty and the need to evaluate the impact of rate hikes effected in the previous fiscal FY23. While the RBI governor stated that this was a “pause, not a pivot”, we think the bar for another rate hike is high. We expect MPC to remain on hold for the rest of the fiscal year and do not anticipate rate cuts in the near term”, Rahul Bajoria, MD & Head of EM Asia (ex-China) Economics, Barclays said in a note.

A disaggregated analysis of CPI numbers shows that the moderation in inflation numbers is broad-based with sub-category wise inflation falling for every major group except a marginal increase in housing between February and March 2023. To be sure, food and beverages (6.26% to 5.11%) and fuel and light (9.9% to 8.91%) show the biggest fall between February and March. While the former has a weight of 46% in the CPI basket, the latter accounts for 6.8%. Within food, vegetables and edible oil show a significant disinflation with prices contracting by 8.5% and 7.9% on an annual basis. On the other hand, cereal (15.3%) and milk (9.3%) prices continue to rise at a high rate. Within cereals, wheat inflation has fallen to 19.9% from its February reading of 25.4% but rice prices increased at 11.5%, rising for the second consecutive month. The production outlook for both rice and wheat, India’s most important cereals, remains uncertain, the former due to debate about the performance of the monsoon and the latter because of the damage from unseasonal rains.

In another set of statistics, factory output data also released on Wednesday showed that the Index of Industrial Production grew at 5.6% on an annual basis in February 2023. To be sure, the growth is on a low base given the 1.2% growth in IIP in February 2022. “That the industrial recovery is still uneven can be gauged form the fact that the level of industrial output in intermediate and consumer durables is still lower than the pre COVID period (February 2020) and the overall industrial output is only 3.4% higher in February 2020”, Sunil Sinha, Principal Economist, India Ratings and Research said in a note.