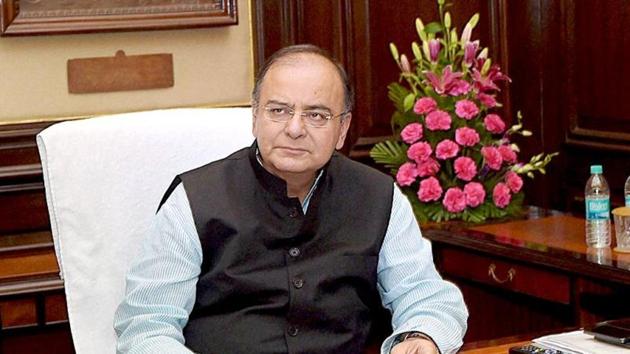

Arun Jaitley says government will meet fiscal targets, not eyeing RBI funds

Finance minister Arun Jaitley expressed confidence that the government will meet its fiscal deficit target for the year to March 31 without dipping into the central bank’s reserves, which he said could be used for recapitalising state-run banks or for public welfare.

Finance minister Arun Jaitley expressed confidence that the government will meet its fiscal deficit target for the year to March 31 without dipping into the central bank’s reserves, which he said could be used for recapitalising state-run banks or for public welfare.

“It [part of the Reserve Bank of India’s reserves] could be used for recapitalising the public sector banks, it could be used for the poor of the country. The government does not use it for its own salaries. My government has the best fiscal record. Even this year, we will maintain the fiscal deficit and I don’t need that kind of money for maintaining fiscal deficit,” Jaitley said at an Aaj Tak news channel event. For the current year, the government has set a fiscal deficit target of 3.3% of gross domestic product.

Former chief economic adviser in the finance ministry Arvind Subramanian has argued in his latest book that the Centre and the Reserve Bank of India should strike a “grand bargain”.

Under this bargain,the government should allow reforms of public sector banks, including majority private-sector participation in them, while the central bank should deploy its surplus capital to help recapitalise state-run banks.

On the recent spate of farm loan waivers, Jaitley said states can do so if they have the capacity while remaining mindful of their mandated fiscal deficit ceiling of 3% of state GDP. “At a time the current account deficit is rising because of high oil prices, the last thing that can happen to India from a big picture point of view is also a rise in its (combined) fiscal deficit. Its impact will be that there will be investment outflow and the rupee’s parity will be disturbed,” he said.

Jaitley defended the government’s move to strongly raise the issue of liquidity crunch faced by non-bank financial institutions with RBI. “The government will be failing in its duty if it does not use all instruments at its command to inform the central bank that this is a real problem that pinches you and it will be completely incorrect for anybody to suggest that government flagging this issue is infringement of [RBI’s] autonomy. We are not taking over the function [of the RBI],” he said.

Jaitley, however, maintained the government did not expect RBI governor Urjit Patel to resign. “The two board meetings of the RBI were very cordial. Decisions were taken on three-four matters. There were many matters on which he [Patel] advised not to take decisions. There was consensus on the economic capital framework that it cannot be discussed in the board and should be left to an expert committee, and we discussed names of many eminent persons, an announcement of which will be made soon,” he said.

The government has since appointed former economic affairs secretary Shaktikanta Das as the RBI governor. Das has signalled the possibility of an amicable resolution of all pending issues with the government through discussions.

Jaitley said the government wants a new committee to review how much capital RBI needs as this is the nation’s money. “Most central banks have 8% of their assets as reserves while conservative central banks have 13-14%. In 2013, the Malegaon committee said you have ~1.13 lakh crore [trillion] and you give it to government. Nobody talked about raiding the reserves of the RBI then. Today, it is believed that RBI has 28% of its assets as reserves,” he said.

Subramanian, in his book, has argued that RBI has set for itself a risk tolerance that is “ultra, ultra conservative, almost bordering on paranoia”.

“Whereas other central banks want to cushion against events with 1% probability of occurring, the RBI wants to cushion against events that can occur with .001% probability,” he wrote.