15th Finance Commission: Design principles & fiscal transfers

The study has been authored by Shohini Sengupta, Assistant Professor of Research, Jindal School of Banking & Finance. The study has been published under under a non-commercial content agreement.

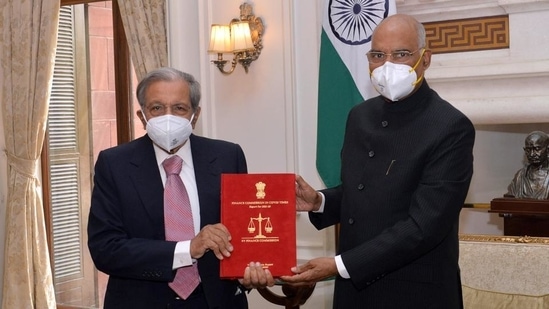

The Report of the 15th Finance Commission (FC), 2021-2026 that released earlier this year is an important fiscal policy that was released in the exceptional context of Covid-19 in India. The Report, in its own words, seeks to achieve “responsible, efficient, equitable, and inclusive growth for India, amid an unparalleled global and domestic macroeconomic backdrop”. It provides for, amongst other things, a fiscal and economic analysis for the next five years, recommendations on resource mobilisation including administrative/operational changes and tax policy changes; recommendations on maintaining cooperative federalism between the Union and states, empowerment of local governments, and performance based incentives and grants.

The Report assumes great significance because of the key role that the Finance Commission as a Constitutional body in India has always played, by recommending measures for the effective distribution of revenue in the country, reduction of fiscal imbalances between the Union Government and the states, and generally promoting economic efficiency of tax collection and subnational spending of public goods and services. These recommendations, although not strictly binding, have conventionally been treated so, and affect fiscal policy making in the country to a great extent.

In its latest Report, the Commission has elaborated about Intergovernmental Fiscal Relations: Lessons from International Experience’, and ‘Trends in Inter-Governmental Transfers’ in great detail. To this extent, for getting expert views on particular subject matters, the FC had commissioned certain study reports. Our study, one of those commissioned and submitted to the FC, titled ‘Examination of the legal basis for conditional transfers to states and issues relating to performance-based incentives for states’ was a detailed examination of the legal basis for conditional fiscal transfers from the Union to state governments in India, and issues relating to performance-based incentives for states. Our study also developed a framework for the design of such transfers based on best practices from around the world.

The Study looked at both inter-governmental transfers and conditional transfers, and their legality, design, and reform. For context, intergovernmental transfers are concerned with distribution of taxes and funds from the Union government to the state governments to ensure basic services for citizens, while correcting for any imbalances or fiscal asymmetries, between different levels of government, or amongst governments operating at the same level; while also accounting for inter-jurisdictional spillovers, or spillovers of externalities from one area to another. Conditional transfers are the transfers of funds that are tied to certain conditions being met by the recipient government. These are undertaken with a view to influence sub-central policy preferences, and can take many forms, including ‘specific purpose transfers’, or ‘performance linked transfers’.

In addition to the legal analysis of such inter-governmental and conditional transfers, the Study documented both what past FCs had recommended, capturing crucial information on the different grants given, and the conditions attached, along with incorporating the recommendations of the Sarkaria and Punchhi Commissions for more efficacious implementation of centrally-sponsored schemes.

This was supplemented by an examination of over 30 countries to help design a framework for inter-governmental transfers based on international best practices. The framework consisted of key design principles to guide fiscal transfers. The design principles consolidated learnings on who should design the transfers, encouraging greater collaboration and local government autonomy in the design of grants and their conditions; and enabling legislation or bilateral agreements to affect such transfers. Such bilateral agreements, if executed between the Union and the states, could help govern the design and implementation of the conditional transfer, also provide for processes to address the grievances of states, and adequately safeguard the rights of both the Union and the relevant state.

Additionally, the principles recommended the use of select conditions with a view to incentivise performance and minimise discretion, including the use of minimum conditions, and standardised reporting and accounting standards. It was recommended that the Union Government have a results-based, accountable transfer system. This was to be supplemented by establishing institutional arrangements for monitoring and evaluation of states/local governments; and the use of administrators, or an intergovernmental forum for monitoring and grievance redressal.

An important learning of the study was that achieving compliance was largely a function of transfer design - setting the right conditions, performance targets and incentives, and therefore the use of an intergovernmental forum as a means to conduct negotiations and discussions during times of conflict between the Union and the states was recommended. This can only happen by establishing due process of law and a

robust appeal systems, and with due representation from both the Union Government and the states in the forum.

Several of these recommendations were incorporated in the FC’s final report, even though there are several challenges before they can be effectively implemented. Given that there have been growing challenges with building fiscal sustainability in India, juxtaposed with the pressures of a global pandemic, it is all the more important to strengthen co-operative federalism in India, and ensure that Centre-state relations are transparent, accountable, and hold true to the Constitutional spirit. It is hoped that the study, and the design framework created for this purpose brings us closer to that goal.

Full study can be accessed by clicking here

(The study has been authored by Shohini Sengupta, Assistant Professor of Research, Jindal School of Banking & Finance. The study has been published under under a non-commercial content agreement.)

All Access.

One Subscription.

Get 360° coverage—from daily headlines

to 100 year archives.

HT App & Website