Number Theory: The rise and rise of India’s income tax collections

.

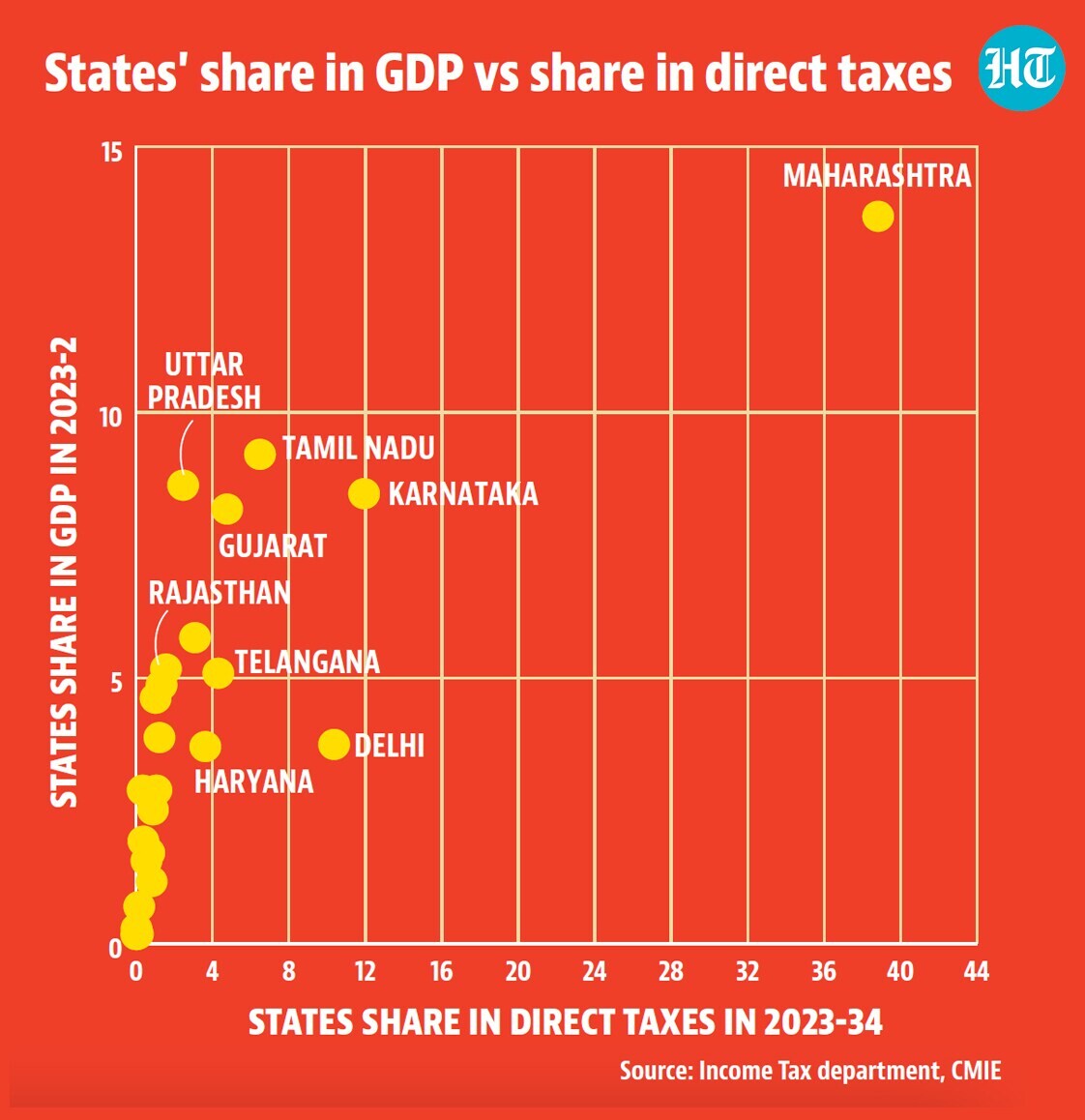

Much of the euphoria around the 2025-26 budget has to do with income tax. The government has , through a rebate and a redefinition of slabs , forgone revenue of ₹1 lakh crore, giving a huge boost to consumer sentiment. Despite this, it has not had to sacrifice its fiscal consolidation plan for the next fiscal year. Everything else (and there is quite a bit, including a continued emphasis on cap-ex), in the Budget is pretty much the same as last year. Here are four charts which tell us the income tax story in some detail.

The rise and rise of India’s income tax collections

-

-

-

How long can the rally in income tax collections continue?Going forward this will be an important determinant of India’s fiscal prowess and also a derived reflection of growth in better paying jobs. After all, people only pay taxes when they earn higher salaries. There are two ways to look at this question. One is the fact that India still has a young workforce compared to many advanced economies and therefore a bigger pool of potential taxpayers. Another way to look at this question is to look at the importance of income taxes in more advanced economies. According to data from Organisation for Economic Cooperation and Development (OECD), share of personal income tax (taxes on income, profits and capital gains of individuals) in GDP peaked at 9.3% in 1990. This number has since fallen to 8.2% by 2022. With income tax collections at around 4% of GDP, India is very far from reaching this threshold in terms of income tax share in GDP. However, it is worth underlining that most people still have low-paying jobs in India unlike in OECD countries. In other words, the prospect of future growth in income tax collections is critically linked to our ability to generate more and better-paying jobs for the young workers entering the labour market.Click Here

How long can the rally in income tax collections continue?Going forward this will be an important determinant of India’s fiscal prowess and also a derived reflection of growth in better paying jobs. After all, people only pay taxes when they earn higher salaries. There are two ways to look at this question. One is the fact that India still has a young workforce compared to many advanced economies and therefore a bigger pool of potential taxpayers. Another way to look at this question is to look at the importance of income taxes in more advanced economies. According to data from Organisation for Economic Cooperation and Development (OECD), share of personal income tax (taxes on income, profits and capital gains of individuals) in GDP peaked at 9.3% in 1990. This number has since fallen to 8.2% by 2022. With income tax collections at around 4% of GDP, India is very far from reaching this threshold in terms of income tax share in GDP. However, it is worth underlining that most people still have low-paying jobs in India unlike in OECD countries. In other words, the prospect of future growth in income tax collections is critically linked to our ability to generate more and better-paying jobs for the young workers entering the labour market.Click Here

Unlock a world of Benefits with HT! From insightful newsletters to real-time news alerts and a personalized news feed – it's all here, just a click away! -Login Now!

Unlock a world of Benefits with HT! From insightful newsletters to real-time news alerts and a personalized news feed – it's all here, just a click away! -Login Now!

SHARE

Copy