Property tax due: Chandigarh MC shoots off notices to 30,000 defaulters

Failure to clear property tax dues in two weeks to result in penalty; multiple defaults may lead to confiscation of property

With a week to go before the fiscal year ends, the Chandigarh municipal corporation has launched a crackdown on property tax defaulters in the city.

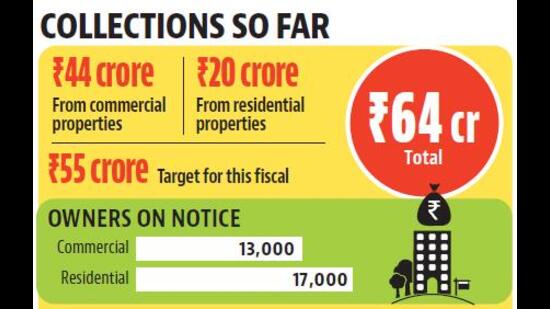

As many as 30,000 notices have been issued to the violators, who have been given two weeks to clear their dues.

Around 17,000 owners of residential properties predominantly make up the list of defaulters, while 13,000 commercial property owners are also yet to pay their dues.

In case the property tax is not paid within the deadline, MC will impose penalty, while in case of multiple defaults despite repeated notices, the civic body has the power to confiscate the property and recover the dues from its sale, as provided under the Punjab Municipal Corporation Act, 1976, extended to Chandigarh.

As many as 1.16 lakh property owners are liable to pay property tax in the city. Among them 85,000 own residential units and 30,000 commercial buildings.

Owners of structures on area less than 500 square feet are exempted. Also, no tax is levied on residential properties of up to 300 square yards owned by serving and former defence personnel, widows and disabled persons.

The fund-starved Chandigarh MC heavily depends on the property tax for its revenue. As per its budget estimates for 2021-22, ₹40 crore were expected from property tax and another ₹15 crore through arrears, penalties and interest from past years.

“Around 30,000 residents have still not paid tax this year. So, we have issued them notices to pay up within two weeks. We are also sending reminders to payees, who still owe MC arrears for past years,” said Rupesh Kumar, additional commissioner, MC.

With a large number of residents clearing their arrears, MC’s collections have reached ₹64 crore so far. This includes ₹44 crore from commercial properties and ₹20 crore from residential buildings.

“The collections include dues for the current fiscal, and arrears and penalties from previous years. These are expected to rise to ₹75 crore as more residents clear their dues before the end of the current fiscal,” said Kumar.

On improvement in its property tax collections, Kumar said, “The entire process has been computerised. Arrears are also added to the bills and regular notices are sent to the payees. We have also become stringent in dealing with the defaulters. All this has spurred increase in compliance.”

The Punjab Municipal Corporation Act, 1976, allows MC recovery of property tax through distraint and sale of the defaulter’s movable property; attachment and sale of the property; attachment of rent due in respect of the property; or by suit.

Recently, MC had also served eviction notices on Panjab University over non-payment of property tax dues that have piled up to over ₹21 crore. Earlier, it had issued notices to the UT administration, via its engineering department, for defaulting on tax worth ₹45 crore. The administration has started paying the dues and is expected to completely pay up by the end of this month.

New bill cycle from April 1

MC will also start issuing property tax notifications for the 2022-23 fiscal from April 1. Arrears from the previous fiscal will be added in the fresh bills.

In the new bill cycle, the residential property owners will get a rebate of 20% and commercial property owners 10% if payment is made by May 31. Thereafter, there will be a penalty of 25%, with 12% interest on the tax dues.

MC is also planning to expand its taxpayer base. “We will add 18,000 new property tax payers in the new fiscal. They were located in various colonies of the city through a survey conducted in February this year,” said Kumar.