Haryana : Domestic consumers shell out more as foodgrain exports continue to surge

As per traders, basmati rates have reached an all-time high of ₹120 to ₹170 per kg (depending upon the quality and variety) from ₹90 to ₹140 three months ago, due to increasing exports amid falling production. The rates of parmal (non-basmati) rice have also witnessed an increase, going from ₹30 to ₹40 per kg three months ago to above ₹45 per kg now.

Domestic consumers are on the receiving end as the rates of foodgrains, including basmati and non-basmati rice, besides wheat flour, have shot up due to the growing exports.

As per traders, basmati rates have reached an all-time high of ₹120 to ₹170 per kg (depending upon the quality and variety) from ₹90 to ₹140 three months ago, due to increasing exports amid falling production.

The rates of parmal (non-basmati) rice have also witnessed an increase, going from ₹30 to ₹40 per kg three months ago to above ₹45 per kg now.

The rate of wheat flour is hovering between ₹38 and ₹40 per kg as compared to ₹30 earlier.

Wheat grain is also fetching a whopping ₹2,800 per quintal, against the minimum support price (MSP) of ₹2,125, in the domestic market despite a ban on exports. The government had banned wheat exports in May last year in view of a dip in production. While in 2020-21, the country had produced 109.59 million tonnes of wheat, in the subsequent year (2021-22), it had produced 106.84 million tonnes.

Bunty Garg, a rice-trader from Taraori of Karnal, said, “The prices of basmati and non-basmati rice are rising with every passing month. Even the rates of common basmati rice have shot up to ₹110 per kg from ₹85 two months ago.”

Rice exporters from Karnal say the global surge in demand for basmati is driving the surge in domestic rates.

Former vice-president of All-India Rice Exporters’ Association Vijay Setia said, “With around 13% increase in basmati exports and more than 5% increase in non-basmati rice exports in the international market, the prices of both varieties have witnessed a surge in the domestic market. Though basmati consumers are not affected much, the increase in prices of non-basmati which is called common man’s rice is worrisome.”

India’s exports see a rise

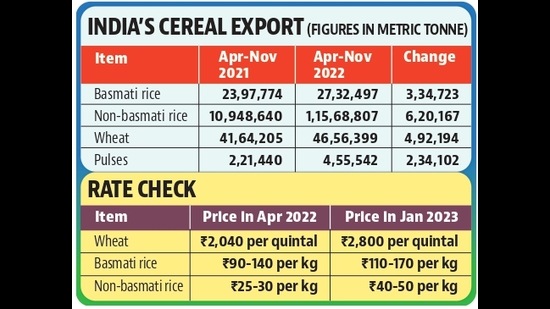

The latest comparative statement of Agricultural and Processed Food Products Export Development Authority (APEDA) reveals that India’s cereal export between April and November 2022 reached ₹72,626 crore as compared to ₹57,658 crore for the corresponding period in 2021.

The figures revealed that 27.32 lakh tonne of basmati was shipped between April and November against 23.97 lakh tonne in the corresponding period last year and the price of Basmati touched 1,051 USD ( ₹85,971) per tonne in November 2022 against 860 USD ( ₹70,348) per tonne in November in the last financial year.

The government had even imposed 20% duty on rice exports during this period but the basmati export increased.

Wheat export reached to ₹11,727 crore from ₹8,658 crore. Despite poor production last rabi harvesting season, India had exported 4.92 lakh MT wheat more than the previous year as the figures reveal that India’s wheat export from April to November this year was 46.56 lakh MT against 41.64 lakh MT of the last year.

The biggest reason behind the surge in the wheat export is surge in the prices in the international market -- it increased to 324 USD ( ₹26,503) in November this year from 280 USD ( ₹22,904) last year. “We are selling wheat flour at ₹35 per kg and maize flour at ₹40 a kg. This is the highest ever it has gone in recent memory and there is a strong possibility that the prices will increase further,” said Pawan Kumar, a trader of Ladwa of Kurukshetra.

Agriculture economist and food expert Devinder Sharma said increased export is leading to increase in prices of wheat flour and rice. “Though basmati consumers can afford this increase in prices, the main concern is the increase in prices of parmal rice which is consumed by the common man. As of now, the government has enough stock of rice. But the increase in wheat flour rates is worrisome. Even the Food Corporation of India has offered to sell wheat in open market to bring down the prices but there is need of more steps deal with the problem and protect the consumers.”