From filing under wrong category to not paying at all, tax defaulters aplenty in Ludhiana

As per officials, Ludhiana MC got a survey of properties done through Punjab Remote Sensing Centre in 2013-14. The survey findings are being used for verification.

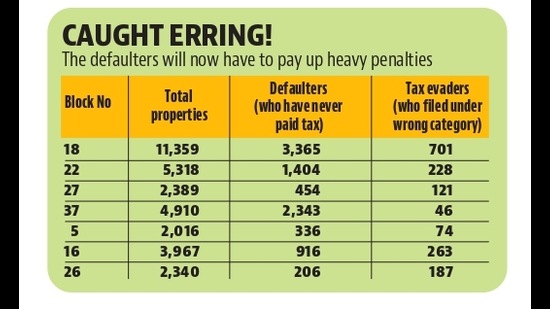

With the municipal corporation (MC) commencing verification of property tax returns, at least 9,024 owners who have never paid tax have been identified in the city. So far, the civic body has completed verification for seven out of 37 blocks in the city. Besides, 1,620 property owners have also been caught evading tax by filing under the wrong category.

As per officials, MC got a survey of properties done through Punjab Remote Sensing Centre (PRSC) in 2013-14. The survey findings are being used for verification.

In all, 32,299 properties were cross-checked in seven blocks, out of which 9,024 property owners were found to have never paid the tax since it was imposed in 2013-14. As many as 1,620 owners filed tax under wrong category so as to pay less. For instance, some owners were found filing tax on commercial buildings under residential category as the charge for the latter is lower.

As per officials, residents who failed to pay tax in the past will have to pay a 20% penalty and 18% annual interest on the pending tax. Owners who evaded tax by filing it under the wrong category or by mentioning less area in property tax return, will have to pay a 100% penalty on tax evaded.

MC additional commissioner Rishipal Singh said, “We are cross-checking the tax returns to catch violators. A report on this is being shared with the property tax wing of MC. The cross-checking of properties in other blocks of the city will also be completed soon.”

90,000 defaulters in city

Sources in the MC said that there are around 90,000 property owners who have never paid the property tax since 2013-14. As per the PRSC data, there are 4.35 lakh properties in the city, but only 3.45 lakh owners filed the tax in 2013-14 and the remaining have failed to pay the tax till now. Further around 1.2 lakh property owners have defaulted since 2013-14, which means they paid tax for a few years and then failed to pay for the remaining years.

During the drive, the civic body also found that property tax returns filed by residents are also decreasing every year, but no concrete action is being taken against the violators.

Despite facing a financial crisis and failing to achieve the annual recovery target, the MC has failed to act against the defaulters. MC recovered around ₹92 crore against the annual target of ₹110 crore for the financial year (2021-22).