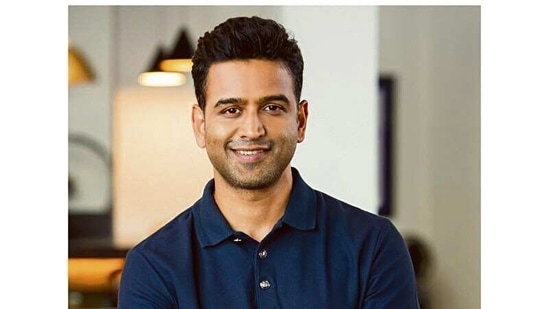

Zerodha's Nithin Kamath wants Nirmala Sitharaman to check this anomaly out: 'On one side Sebi is working on...'

The Zerodha co-founder urged Nirmala Sitharaman and the finance ministry to look into the discrepancy.

Zerodha co-founder Nithin Kamath pointed out an anomaly in cryptocurrency transactions which he recently spotted in an ad about a cryptocurrency F&O exchange. Nithin Kamath said the 1% TDS rule is not applicable to crypto F&O but for regular crypto transactions, 1% of the transaction amount is deducted as TDS. The Zerodha co-founder urged Nirmala Sitharaman and the finance ministry to look into this discrepancy.

Read more: Union Budget 2024: Longest and shortest budget speeches presented in Parliament

He wrote in a post on X (formerly Twitter), “On one side, SEBI is working on restricting F&O, but on the other side, this crypto F&O ad is on the front page of ET. By the way, all these platforms have taken the stance that the 1% TDS rule doesn't apply to crypto F&O. For regular crypto transactions, 1% of the transaction is deducted as TDS.”

Read more: Vishal Mega Mart weighing confidential filing of IPO papers: Report

Earlier Nithin Kamath had recently commented on Sebi's new transparent pricing circular which he said could significantly impact brokers, traders and investors.

He said, “This circular has a significant impact on brokers, traders, and investor. The difference between what the brokers charge the customer and what the exchange charges the broker at the end of the month is a rebate, which goes to brokers."

Read more: Mahindra & Mahindra records sharpest intraday fall in 28 months, plunges over 7%

“Such rebates are common across the major markets in the world. These rebates account for about 10% of our revenues and anywhere between 10-50% of other brokers across the industry. With the new circular, this revenue stream goes away,” he explained.