Mallya hurt the system, made entire business class a suspect: Jaitley

Now the next step is recapitalising banks, and empowering them more for recovery, says Jaitley

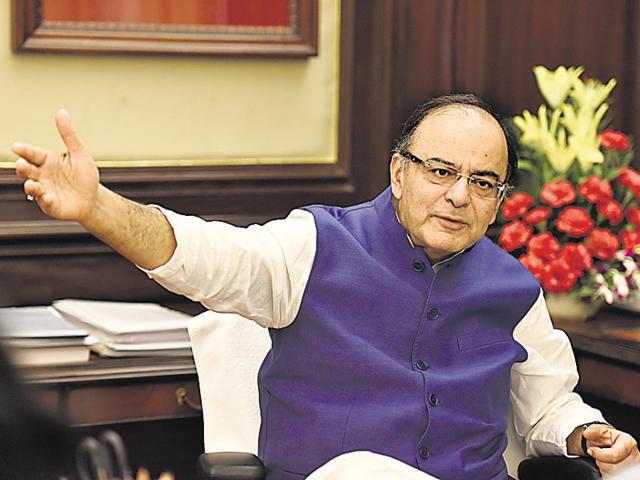

As Arun Jaitley completes two years as finance minister, he has many achievements to show. But new challenges have emerged. And Vijay Mallya hasn’t helped. Excerpts from an interview:

There seems to be much appreciation of your work.

A lot of the performance of the economy depends on the environment. The global economy is facing a lot of challenges. Every time I walk out of an International Monetary Fund, World Bank, or G20 meeting, I wonder how long this phase is going to last. Nobody seems to have a clue. We also have some domestic factors. Two bad monsoons, stress in some sectors that resulted in bad balance sheets and affected banks, etc. We had two positives: low oil prices and a clear mandate in the Lok Sabha. Third, the Prime Minister is decisive. We knew which policy direction to take. In the depressing global scenario, public investment and foreign investment became the driving force.

What about domestic investment, by Indian companies?

It is there in some sectors, such as, telecom, automobiles, startups, information technology. But a number of domestic companies are badly stressed. Domestic companies are good when the going is good; when the going is challenging, they want public investment to lead the way and create the environment. In ease of doing business, unless the states reform, we will come to a dead end. The central government has taken all the steps it could, there is a lot the states have to do.

How do you bring the states on board?

The states which come on board will get investment. Secondly, we have to provide them with an enabling framework.

Such as?

Quick permissions, early permissions, deemed permissions. There are countries where you don’t need a sanction plan, only a completion plan. We have changed the Arbitration Act, made commercial courts, bankruptcy law. Now two are left: resolution of disputes in public contracts, and dealing with bankruptcy of financial firms. These are in the drafting stage.

Read | Tailender Congress can’t lead national alliance: Jaitley

What about the GST?

My preference is to do it with consensus, and I hope the Congress party sees it. But there are new challenges. Strengthening the banks is a major challenge.

Speaking of which, how about Vijay Mallya?

He has hurt the system. A bona fide debtor who goes to a bank for finance is a good thing. People must take money from banks, create jobs, and pay taxes — that’s how the economy moves on. He has made that entire class a suspect. How much he has hurt his own class of businesses...

Has he done that by not paying or running away?

That entire episode... I won’t comment more than that. The next is recapitalisation, consolidation, empowering the banks more for recovery. And we have to resolve the stress in certain sectors that began under the UPA.

You have always said banks should lend more, but the Mallya episode has put them on the back foot.

Yes, they are on the back foot, therefore they need to be supported to the fullest. I will support them. I think the banks should have the freedom and confidence to enter into transactions which are based purely on commercial considerations. The debtor-creditor relationship has to be settled on commercial considerations. And banks should have a comfort level in doing that. We will fully support them.

Read | Will not lose anything more in battle with Mallya: Banks

One of your boldest measures was EPFO reforms, on which you have had to retrace your steps.

India is a significantly uninsured and non-pensioned society. Therefore we lack social security. As you evolve from a developing economy to a more developed one, avenues of social security have to be opened up. We have used volumes to reduce insurance premiums through Jan Dhan. But outside the government, there is no pension. Our intention was to follow the model of social security. You invest in savings when you earn, and live on those saving as pension after you retire. In EPFO, it was misunderstood. We had to yield, but we kept the benefit we gave to pension schemes.

Will you revisit it?

The EPFO will remain as it is: spend and enjoy. Those who want to lead a secure old age, for them NPS is the preferred option.

Will that make it more difficult to tackle the small savings rates issue?

High interest rates make an economy sluggish. Deposit and lending rates have to move in tandem. We have to make products available on which you get higher returns. You can’t compel a society or economy to have high interest rates because you want a higher deposit rate. That will make buying houses and cars uneconomical.

What about job creation?

It is not in isolation. If the economy grows faster, more jobs are created. We have to look at the textile sector, real estate. These will have a long-term impact on jobs.

Read | Will use every option to bring Vijay Mallya back: Jaitley