Little-known small stocks surge in broad-based rally

The bull run in the markets due to strong foreign inflows and expectations of a more stable and investor-friendly government at the Centre is boosting not only large caps but smaller companies as well.

The bull run in the markets due to strong foreign inflows and expectations of a more stable and investor-friendly government at the Centre is boosting not only large caps but smaller companies as well.

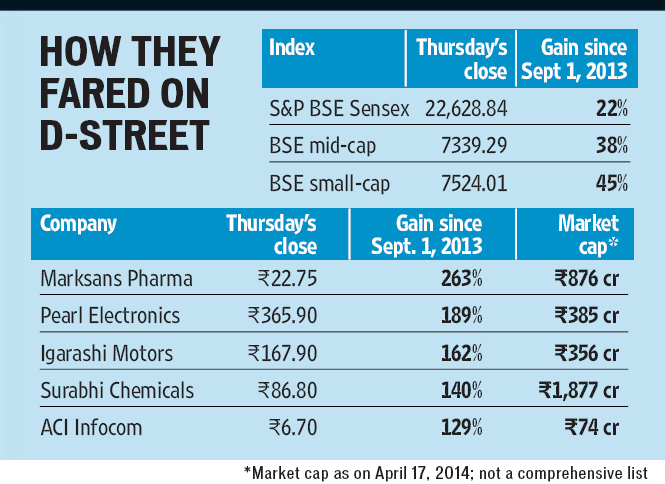

Since September 2013, while the index has gained 22%, the mid-cap and small-cap index have significantly outperformed it, gaining 38% and 45%, respectively. (see graphic)

According to an analysis of returns of more than 900 firms in 2013-14 by IIFL Institutional Equities, the small and mid-cap stocks outperformed their large-cap peers due to “spectacular returns” generated by several smaller companies last year.

“Despite lack of buying interest from both foreign and domestic institutional investors, smaller companies have surged over the past year. The only possible explanation for the resurgence is increased interest from non-institutional investors, said Abhijit Akella of IIFL.

Interest in smaller firms is catching up with the market rallying significantly, said Rikesh Parikh, vice-president, equities at Motilal Oswal. “Typically what happens is that large-caps are first to move up in a market rally. That is then followed by the mid-caps and small-caps.”

However, while the returns may be higher, the risks of investing in these stocks are also relatively high, especially if it is a little-known company. Analysts say investors should do a proper study before putting money in these stocks as the fag-end of a rally is when they begin to rise.

“If you don’t do your homework, you should refrain from investing in these stocks,” said Parikh, indicating that small investors should be cautious.