Diversified they fall: When corporates move beyond core competence

How corporate groups wrote the script of their own downfall by moving beyond their core competence

Back in 2005, when Kingfisher Airlines started, the uncharitable called it a planeload of surrogate advertising. Not entirely without justification.

Vijay Mallya’s United Breweries, which owned the airline, also owned Kingfisher beer, which, like all alcoholic drinks, was not allowed to advertise. Now, while others had to make do with promoting their soda, or music, Kingfisher had its name floating in the sky in bright red.

But the business of aviation turned out to be much farther from liquor than soda, or music. In seven years, Kingfisher Airlines was grounded, buried under a mountain of debt so big it hobbled the mother ship. This is no coincidence. An HT analysis shows that companies identified as “stressed” were barely doing a good job of managing their original business. As the diversification took a toll on their efficiency, their ability to pay interest and repay loans withered away

The UB group folks did well with the lifestyle aspects of the airline. Its crew had the most attractive attire. The planes were plush. Every passenger got a goody bag of earphones and other knick-knacks. The nuts and bolts of aviation were too far from the cork and screw of liquor. “I can’t tell you how much I got shouted at the day I told him we needed a professional,” says a person associated with Mallya at that time.

Contrast that with the story of another airline, IndiGo, which started a year after Kingfisher. Its mother company, Interglobe, and co-promoter Rahul Bhatia were already in travel and hospitality. The other co-founder, Rakesh Gangwal, had an enviable record as an aviation professional culminating in his becoming the CEO of US Airways.

Shunning Kingfisher’s ways, IndiGo focused on keeping its costs low (costs, not fares) and established new benchmarks in efficiency and fleet management. Flush with profits, it recently floated a successful public offer, the highlight of a bleak stock market.

Mallya’s empire, on the other hand, has slipped out of his grasp. But his is not the only group to stumble on the path of diversification. The list of Indian companies with the highest debt stockpiles is replete with ‘companies’ that became ‘groups’, which grew laterally rather than vertically, in new businesses rather than in the ones they knew well.

The Burden of Mounting Debts

Stock markets around the world know the perils of diversification. They have a term called conglomerate tax – groups in multiple businesses typically get lower valuations. The reverse, too, is true. Look no further than Eicher Motors. Its share price surged after it sold the tractor unit and scaled up the core of niche motorcycles and commercial vehicles.

“It affects your profitability and ability to meet debt servicing requirements when you go in for diversification into unrelated areas. The vulnerability increases if you are venturing into new areas with more borrowed funds,” says Ashish Gupta of Credit Suisse. The research firm was one of the first to flag the issue of “stressed” business groups — an euphemism for choking on their debt — in the country.

Read | Banks put heat on ‘loan defaulting’ men of steel

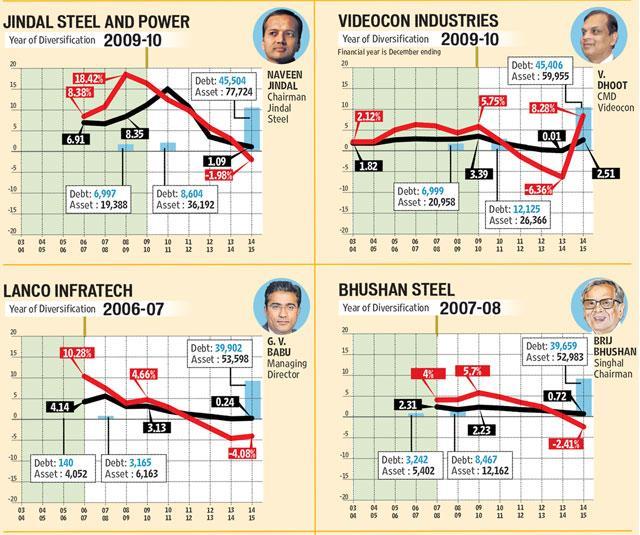

HT analysed 10 companies from the top 20 business groups Credit Suisse identified as stressed. The cornerstones of the analysis are return on assets (RoA) and interest cover. RoA, earnings divided by assets, is a measure of how well the management utilises what it has — how many rupees of earnings, or profits, it squeezes out of every rupee of asset it controls.

Interest cover (IC) is the ratio of loan-related expenses, also called debt servicing, to the total earning, or gross profit. If the loan and interest payment a company has to make is Rs 100, and it earns the same amount in gross profit, the IC is 1 (100 divided by 100). If the gross profit is Rs 00, the IC is 2 (200 divided by 100). So, a higher IC means more money in the company’s hands to pay interest and repay loans.

Take Lanco, an infrastructure group. As it started a diversification drive in 2006-07, its debt rose from Rs 140 crore to Rs 3,165 crore the next year. It still had a healthy RoA of 10.28 % and IC of 4.14. But the two figures ran out of breath as the debt rose to Rs 40,000 crore by 2015, bringing “stress” into the company. It no longer had the ability to service its debt.

From Expressway to Runway

It’s the same story elsewhere. Someone who was good at making expressways wanted to make runways by getting airport contracts, someone else who was good at pipelines wanted to be in defence, a liquor baron wanted to fly high.

The lenders were, to use underworld lingo, desperate for a piece of the action. They were eager to extend loans. That started the cycle that spiralled out of control once demand turned out to be much less than anticipated, and managements failed to manage the ensuing crisis.

“Companies across the world have grown by diversifying. But Indian corporate houses did not go in for diversification because they needed it. The system helped them get bank loans easily and they were tempted by the thought of growing overnight, before attaining the competence to handle big money,” says Prithvi Haldea, chairman of Praxis Consulting & Information Services, which is into data analytics.

The Trap of Easy Loans

In 2006, Hyderabad-based GVK group won the contract to rebuild and manage the Mumbai airport. The same year it completed construction of the Gautami power project, which was yet to start producing power. Its most successful project till then was the Jaipur-Kishanganj Expressway.

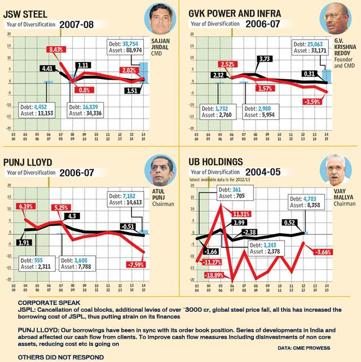

In 2006-07, GVK’s RoA was 2.52%. It began to slip as the debt rose from Rs 796 crore to Rs 1,732 crore. That did not deter the group from venturing into more areas. It entered oil and gas exploration, setting up of special economic zones, and development of a coal block in Jharkhand. Almost inevitably, its profitability decreased, as did its ability to repay loans.

From its inception in 1996 to 2005, GMR was in the power sector. Then it won the contract to build and operate the Hyderabad airport in 2005, and the Delhi airport a year later. It also got into constructing highways.

In parallel, GMR’s RoA and IC began to decline . It today sits on a debt stockpile of Rs 50,120 crore and IC of negative 4.36. It’s one of the most stressed groups.

Neither GMR nor GVK had anything to do with building and running airports until the opportunity presented itself. But it was probably too much to resist, what with easy loans knocking on the doors. Similarly, liquor baron Mallya had nothing more to do with airlines than flying their best seats and enjoying their best lounges. But once into aviation, he did not mind being compared with Richard Branson of Virgin group, which is into aviation and financial services.

Mallya’s new ponytail in the Kingfisher Airlines years, not to mention his flamboyance, said he supported the comparison with Branson. He did not stop at the airline. He bought a cricket team (another surrogate advertising vehicle, as it bore the name of another liquor brand), and bought a Formula One team.

The Mallya associate cited at the beginning of this story says: “He would say he is a different breed. But the truth is he aspired to be Branson and in that mad rush he has met with a fatal accident.” An Ernest and Young forensic team, appointed by the consortium of lenders to Mallya, said in its report he diverted 13 million pounds to Formula One from the loan taken by the airline.

Branson remains one of the world’s best known businessmen with $5.2 billion in net worth. He tries his hands at new things, such as space travel. But he also shows the prudence to sell businesses. In fact, he sold Virgin Records in 1992 even though reports say it made him run down London’s Ladbroke Grove crying.

Branson still has his long hair and wispy beard. Mallya wears short hair and no beard these days.

Corporate speak

JSPL: Cancellation of coal blocks, additional levies of over Rs 3000 cr, global steel price fall, all this has increased the borrowing cost of JSPL, thus putting strain on its finances

Punj Lloyd: Our borrowings have been in sync with its order book position.Series of developments in India and abroad affected our cash flow from clients. To improve cash flow measures including disinvestments of non core assets, reducing cost etc is going on

GMR: The mix of various assets in various sectors provided opportunity to have stable revenues and cash flows (from power and Annuity highways) and also capture upsides from growth of economy (from Airport and Toll Highway business). Hence, it is incorrect to state that GMR’s debt burden has been because of diversification. GMR’s debt level has peaked out by March 15 and going forward, it should be gradually reducing