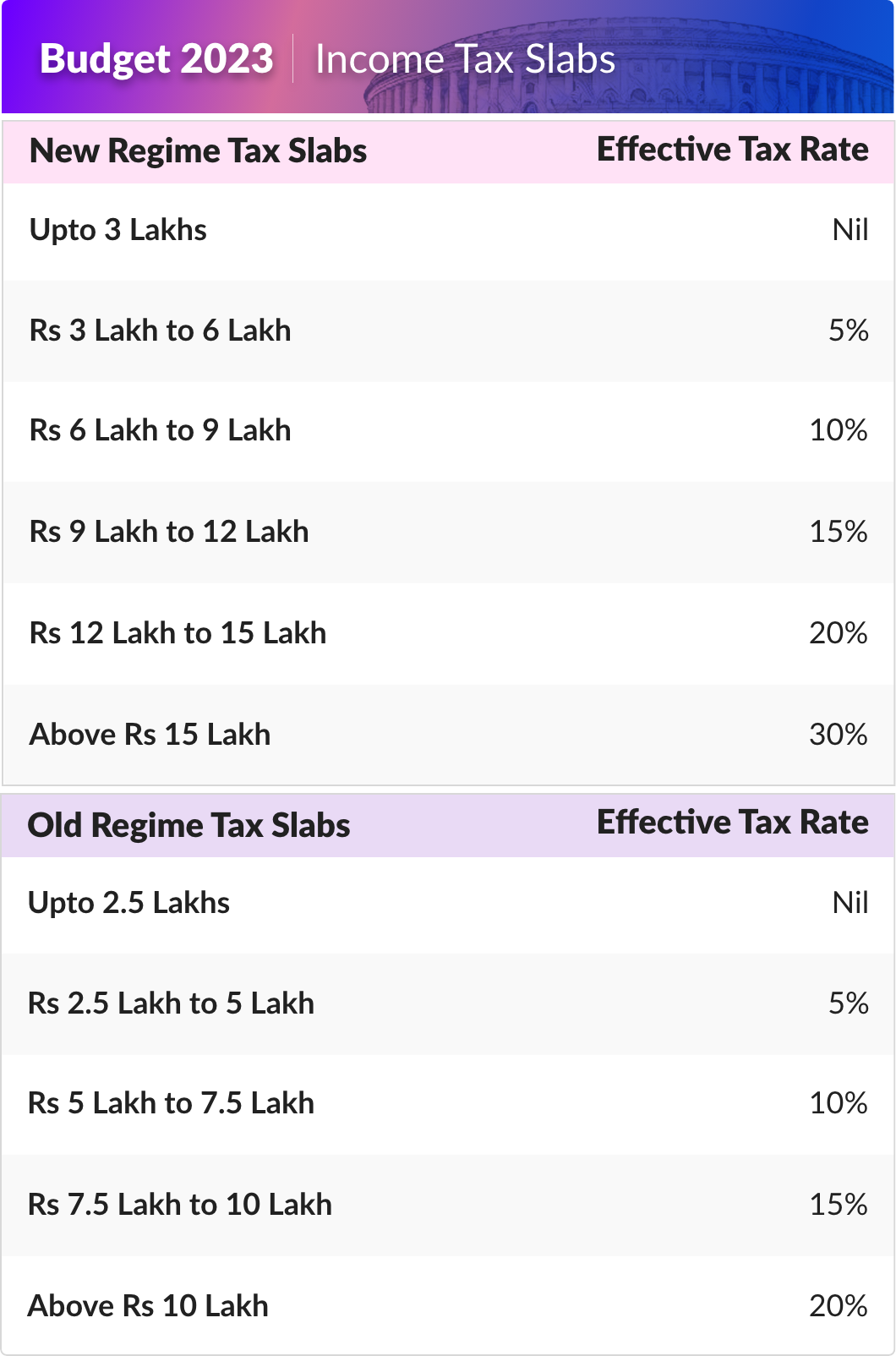

Budget 2023: How are old and new income tax slabs different from each other

From the upcoming budget 2023, taxpayers are expecting the current tax slab with basic exemption limit of ₹2.5 lakh income to be increased to ₹5 lakh.

The income tax slabs were last changed in 2014, when the personal tax exemption limit was revised, too. While the 2020 budget introduced an optional new income tax regime, which found few takers, the 2022 budget did not offer any respite for salaried professionals. The salaried class always expects income tax rebate every fiscal year. From the upcoming budget 2023, taxpayers are expecting the current tax slab with basic exemption limit of ₹2.5 lakh income to be increased to ₹5 lakh, in lieu of rising inflation and cost of living.

New tax slabs

1) Annual income of ₹2.5 lakh exempted from taxes

2) 5% tax on annual income between ₹2.5 lakh to ₹5 lakh

3) 10% tax on personal income between ₹5 lakh and ₹7.5 lakh

4) 15% tax on income of ₹7.5 lakh to ₹10 lakh

Income above ₹10 lakh is categorised into three:

1. 20% tax on personal income between ₹10 lakh and ₹12.5 lakh

2. 25% tax on ₹12.5 lakh to ₹15 lakh annual income

3. Annual income above ₹15 lakh will be taxed at a rate of 30%

Old tax slabs

1) Up to ₹2.5 lakh income is exempt from taxation

2) Income between ₹2.5 to ₹5 lakh taxed at the rate of 5%

3) 15% taxation on personal income between ₹5 lakh and ₹7.5 lakh

4) An income of ₹7.5 lakh to ₹10 lakh attracts taxation of 20%

5) 30% tax on personal income exceeding ₹10 lakh

A uniform tax structure for capital gains, incentives for personal loan borrowers and rise in tax exemption limit for home buyers are some of the expectations of the salaried class from finance minister Nirmala Sitharaman for the upcoming budget.