Tata-Mistry row: Will they be able to bury the hatchet?

The almost daily fight between Tata Sons and ousted chairman Cyrus Mistry, which bore different lessons for India Inc, was without doubt the biggest surprise of 2016.

It has been the most public of all corporate battles in India so far.

The almost daily fight between Tata Sons and ousted chairman Cyrus Mistry, which bore different lessons for India Inc, was without doubt the biggest surprise of 2016. That a leadership dispute could happen in one of India’s oldest business families was unthinkable before October 24; that it would sow seeds of doubt about corporate governance in the Tatas, was also beyond comprehension.

Some say it had been in the making since a year. But the Monday morning board meeting of Tata Sons on October 24 sparked the country’s biggest boardroom coup in India, when a vote was passed to remove chairman Mistry, citing the board’s loss of confidence. The loudest voice was from Tata Trusts, the philanthropic arm of the Tatas, who said that Mistry had deviated from the $103-billion group’s philosophy of ‘earning to give’.

The removal brought patriarch Ratan Tata back into the saddle, albeit for an interim period, till a successor was found, a job that was entrusted to a select panel, which has been given time till February end.

Mistry represents the single-largest shareholder of he Tata Group -- the Shapoorji Pallonji family with 18.5% equity stake. The Trusts are the principal shareholders with 66% ownership.

But Mistry refused to leave without a fight, and the dispute has only grown since then.

Read more: ‘Definite move’ to damage my personal reputation over last 2 months: Ratan Tata

In a letter to Tata Sons and the Trusts a day after his removal, which also reached media houses, Mistry alleged that the main reason for his ouster was because he had started cleaning up doubtful deals and breaking decades-long cosy clubs in the 150-year old conglomerate, raising governance issues, which threatened to turn the popular opinion about brand Tata, on its head.

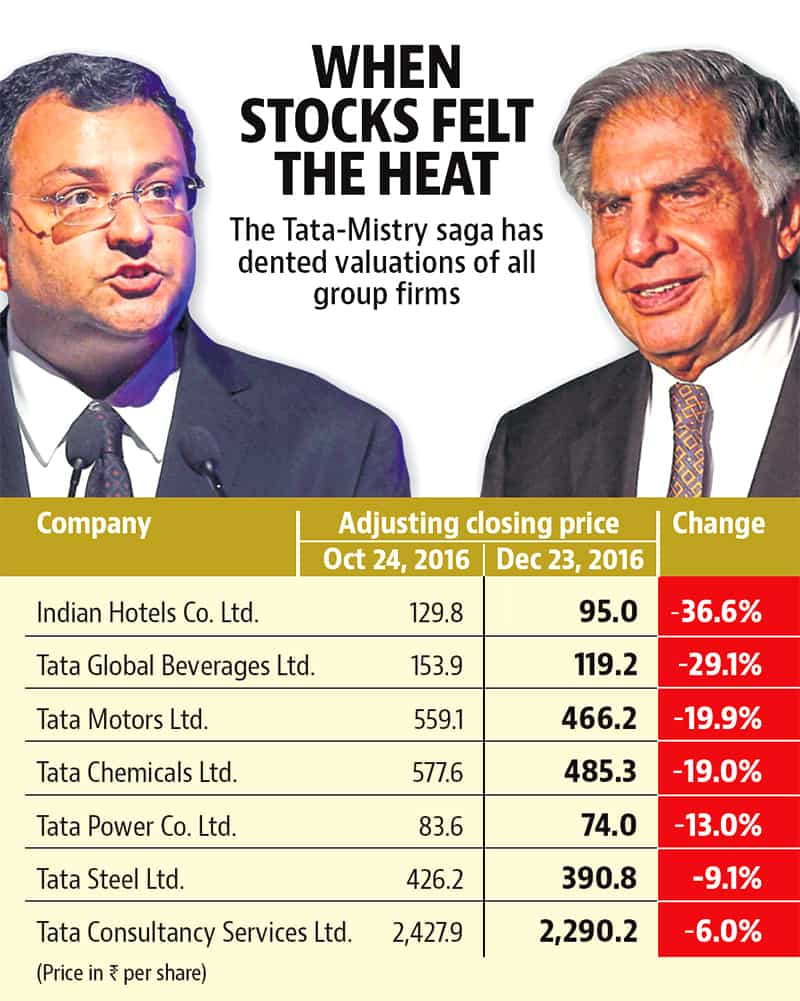

The Tatas were quick to swing into action. What followed has been a daily dose of charges and counter charges, which has unfortunately shaved off more than R1 lakh crore in shareholder wealth of Tata group companies.

But what added colour to the boardroom battle was the attack from industrialist and corporate samurai Nusli Wadia on November 12.

For years a Tata confidante, godson of much respected former Tata chairman JRD Tata, and a childhood friend of Ratan Tata, Wadia felt slighted after his position as independent director on boards of Tata Chemicals, Tata Steel and Tata Motors was suspected, following an endorsement of Mistry’s leadership by independent directors of a group company.

The Tatas, who had expected Mistry to step down from the boards of all group companies after his removal as Tata Sons chairman, were taken aback by Wadia’s support and proceeded to convene extraordinary general meetings (EGMs) to oust both Mistry and Wadia as directors.

This spurred Mistry to renew attacks, bringing out the group’s various business decisions that caused say, Tata Steel to face potential impairments of $10 billion, or that related to sustaining the Nano car project despite losses only because it was a personal favourite of Ratan Tata. The allegations also covered the “haemorrhaging” in telecom business and suspicious transactions in an aviation joint venture.

On December 19, ahead of key EGMs, Mistry sprang a surprise; he stepped down from all boards vowing to continue the fight in the courts, since it was getting destructive for other stakeholders. The next day an investment firm from his family, moved the National Company Law Tribunal, alleging oppression and mismanagement and undue control of the Trusts in the group’s businesses.

Wadia, on the other hand, mounted a parallel legal battle, filing criminal defamation complaints and making public board discussions on different projects.

The EGMs, however, voted out Wadia – resolutions on Mistry’s removal had become infructuous since he had already stepped down. The focus is now on the fight between Mistry and Tata Sons in the Tribunal and the courts.

The duel has, however, come at a wrong time for the Indian economy, which is battling a slow down due to demonetisation and the impact of foreign funds outflows. With foreign institutions adopting a strong stance on governance issues within the Tata Group - they are learnt to have led the no vote on the Mistry removal – it should prompt some corrective measures in the old, yet vital business, which makes both luxury cars and table salt.