Now TCS votes out Mistry, but shareholders are not amused

It was a day of known expectations. But the extraordinary general meeting (EGM) of Tata Consultancy Services (TCS) on Tuesday at the YB Chavan auditorium in Mumbai, ironically a favoured venue for serious theatre and sombre political meetings, saw much excitement.

It was a day of known expectations. But the extraordinary general meeting (EGM) of Tata Consultancy Services (TCS) on Tuesday at the YB Chavan auditorium in Mumbai, ironically a favoured venue for serious theatre and sombre political meetings, saw much excitement.

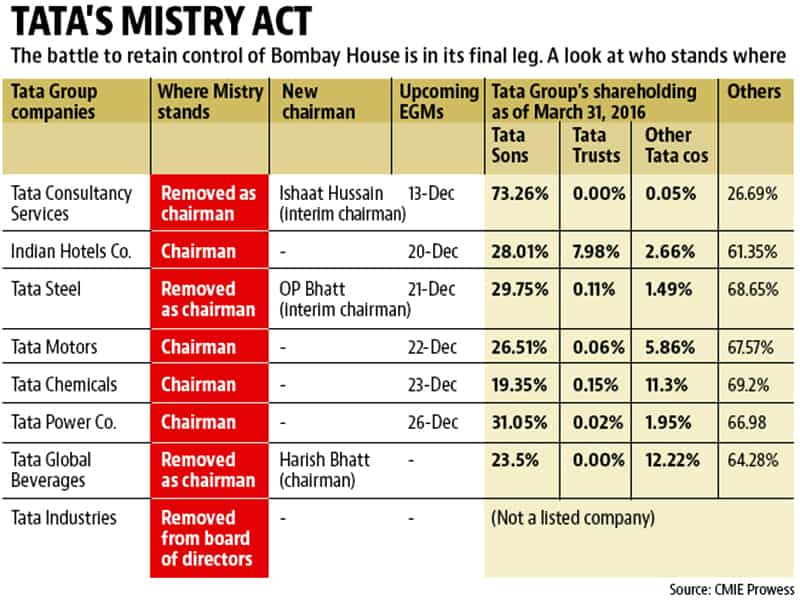

It was the first EGM of a listed entity under the Tata Group, which had been convened to vote out former group chairman Cyrus Mistry as director. While the votes were still being counted at the time of going to press, with 73.33% shareholding in TCS, the Tatas were sure to win this round too; on December 12, Tata Sons was able to vote out Mistry as director of unlisted Tata Industries. That, too, was a foregone conclusion since Tata Industries is wholly owned by the Tatas.

Mistry chose to skip the TCS EGM, preferring to have his letter read out. “The fight is a matter of principle rather than facing the foregone outcome. The very future of TCS hinges on good governance and ethical practices. In the past several weeks, we have seen good governance being thrown to the wind in every sense of the term, replaced by whims, fancies and personal agenda. We have witnessed an unmatched erosion of ethical values and the very foundation of the institution being put to grave risk by the conduct of a few,” Mistry‘s letter said. His fight was to save the soul of the Tata Group, he added.

But what triggered the excitement was whether the EGM could see any dissent, which though would have little influence on the result, could spark changes in governance, issues that Mistry had raised. About 17% of the public shareholding in the software firm is with foreign institutional investors (FIIs).

“Even if half of that cluster votes against the resolution, it would send a signal that foreign investors want a change in current governance,” said Shriram Subramanian, founder of shareholder advisory InGovern. While for Indian investors, it is a question of the Tata brand, for global investors, it would be more professional reasons, he added.

Global advisory ISS had earlier recommended voting against the resolution.

Read more: Cyrus Mistry voted out as director of Tata Consultancy Services

Most shareholders, pensioners and retired clerks agree that the dispute at Bombay House should have been avoided. “It is like two elephants fighting and the grass (shareholders) getting crumpled. Shareholder value is eroded,” said Aloysius Mascarenhas, a shareholder.

Vinod Dadlani, another shareholder, was unhappy at the manner in which Mistry was sacked. “Even if I sack my driver, I will give him reasons. They haven’t given any specific reason.”

In reply to such queries, Aman Mehta, independent director on TCS board, who presided over the EGM on Tuesday, said: “Independent directors met separately and reviewed this issue. It was clear that the dispute can have a materially negative effect. The real issue here is of trust and confidence of the promoter group with its nominated chairman. It goes far beyond any consideration of performance, competence or even personalities. Once the trust is lost, it is appropriate for the nominated chairman to resign in the best interest of the company. Looking into the interests of all stakeholders, the most appropriate thing is we cut it where it is and get on with the normal operating business.”