Lord Ganesha and the science of insuring pandals

The Ganesh puja season is seen as an annual opportunity for general insurance companies to rake in business.

Sunday brought the news that one of the Ganesh puja pandals in Mumbai has been insured for all of Rs 300 crore. Considering that the overall size of pandal insurance for the Ganapati season is in the range of Rs 700-1,000 crore, this figure stood apart, even for a country known for its financial eccentricities around festivals and weddings.

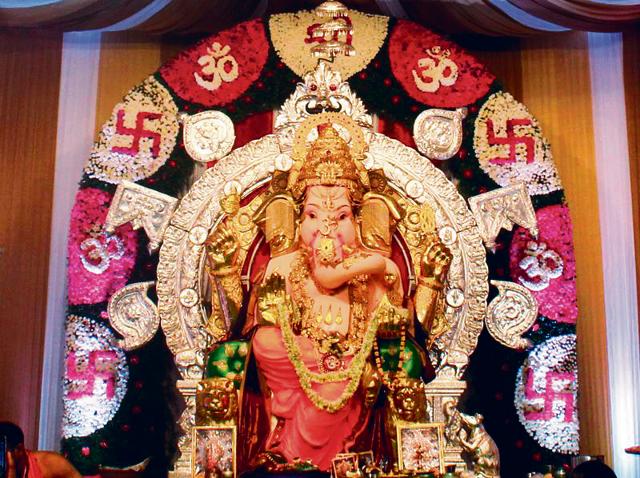

The huge cover, said one official at the GSB Seva Mandal at King’s Circle, which made the Rs 300 crore insurance, is because the idol is adorned with 68 kg of gold and over 300 kg of silver. The pandal has even raised a silver stage for the deity. More jewellery and donations are expected to pour in during the 10-day festival, necessitating in the high insurance, he said.

The Ganesh puja season is an annual opportunity for general insurance companies to rake in business. Mumbai’s most popular pandal, Lalbaugcharaja, has this year insured its pandal for Rs 51 crore. It has also insured all smaller pandals throughout the financial capital of India, a practice it started 3 years ago.

The pandal insurance cover extends from the festival kick-off till the immersion of the idol. Typically, it covers gold and silver ornaments, the sets, the visarjan procession, and personal accident covers for volunteers and devotees. The cover also pays for any damage to pandals, settings and electrical work, risks arising out of any stampede, poisoning of food and “prasad” etc.

The business is typically serviced by the four public sector general insurance companies -- National Insurance Company, New India Assurance, Oriental Insurance Company and United India Insurance Company.

“Mostly pandals for all festivals — Ganesh, Durga Puja and even Diwali besides others—are serviced by the public sector insurers. The risk is skewed and mostly the private sector players do not get involved,” explained a senior official in a large private sector general insurance company.

The premium, which has to be paid up-front, could vary from Rs 10 lakh to Rs 20 lakh for a Rs 100-crore cover. Due to the fierce competition, companies’ negotiations with pandal organisers are highly secretive. Usually there are privacy clauses in the insurance contracts so that the terms are not ‘leaked’ to rival insurers.

“The festival season is a good time for us as it helps the public sector companies to garner a lot of premium,” said an executive of a public sector insurance company. It would not be surprising if private insurers enter the pandal fray soon.