Depositing cash? Declare and pay 50% tax on unaccounted money

The government is planning to amend the Income Tax Act and introduce provisions to tax and penalise those who deposit old notes into their bank accounts that they cannot account for.

The government is planning to amend the Income Tax Act and introduce provisions to tax and penalise those who deposit old notes into their bank accounts that they cannot account for.

If deposited amounts do not match with their declared income, they will have to pay 60% tax on the amount deposited, which may go up to as high as 90% including penalties. However, if they declare the money as unaccounted while depositing it in the bank, the tax would be 50%, sources in finance ministry, who did not wish to be named, told HT.

“The cabinet decision yesterday (Thursday) was a pre-cursor to a proposal to amend the tax laws in this session of Parliament,” said an official in the tax department of the finance ministry.

Half of the deposit (what remains after the tax is deducted) would have to remain locked-in for a period of four years in case it is declared as unaccounted, and five years in case the depositor does not declare so but the disparity is subsequently detected by the income tax department.

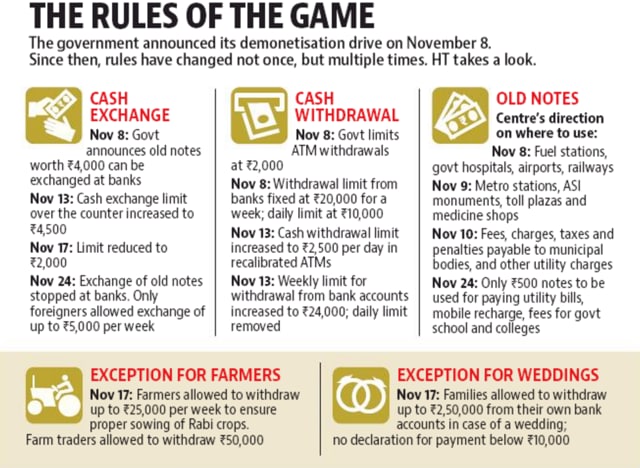

Read more: Demonetisation: How govt rules changed as chaos increased

Changes to the Income Tax Act have to be in the form of a money bill introduced in Lok Sabha and passed by it before being ratified by Rajya Sabha. Money bills, simply put, are those that involve imposition or abolition of taxes.

“Thursday’s Cabinet decision was taken with the view of moving a money bill in Parliament,” the source quoted above said.

“The stated purpose of demonetisation is a surgical strike on black money. This is part of the government’s on-going war against illegal money circulation in the economy,” revenue secretary Hasmukh Adhia had earlier told HT.

And in keeping with this purpose, the government had announced that authorities will keep an eye on bank deposits above Rs 2.5 lakh. Any mismatch between wealth and income would invite heavy taxes and penalty.

But the government had earlier stated that any mismatch would attract 30% tax and 200% penalty on the taxed amount; imprisonment was also not ruled out.

Sources in the income tax department explained that the lowering of the tax amount was to pre-empt litigation.

“Any income wealth mismatch could always be shown in the income tax return and for that 30% tax has to be paid. It is difficult for the tax authorities to ascertain the year when black money was generated and so the proposed 30% tax and 200% penalty on it can be litigated,” explained a source in the tax department.

“Amending the Income Tax Act was necessary to ensure that tax notices are not challenged in courts. And this tax will be applicable on all deposits from November 8, onwards,” said Girish Vanvari, national head of tax in KPMG.

For our full coverage on demonetisation and black money crackdown, click here