Budget 2017: Price of smartphones to go up, govt imposes additional duty on PCBs

As a part of the Union Budget 2017, the government has proposed to levy a special additional duty (SAD) of 2% on a smartphone component which consists of nearly 20-30% of smartphone manufacturing costs.

The price of smartphones is likely to go up as the government proposes to levy a special additional duty of 2% on a component that accounts for nearly 30% of a phone’s manufacturing cost.

That means handset manufacturers, domestic or foreign, will have to pay the extra duty if they import printed circuit boards (PCB) used in mobile phones.

The decision, announced on Wednesday in the budget for the 2017-18 fiscal, put paid to hopes of a drop in handset prices in alignment with the government’s push for a digital economy that encourages use of smartphone for just about everything — including buying goods and services through e-wallets.

- Cigarettes, pan masala, cigar, cheroots, bidis, chewing tobacco

- LED lamp components

- Cashew nuts (roasted and salted)

- Aluminum ores and concentrates

- Polymer coated MS tapes used in manufacturing of optical fibres

- Silver coins and medallions

- Printed circuit board used in making mobile phones

- Booking railway tickets online

- RO membrane elements for household usage

- LNG

- Solar tempered glass used in solar panels

- Fuel cell-based power generating systems

- Wind operated energy generator

- Vegetable tanning extracts used in making leather products

- Point of Sale (PoS) machines card and fingerprint readers

- Group insurance for Defence services

Naveen Aggarwal, partner (tax) at KPMG, said the additional duty will be passed on to the consumer as India “doesn’t have the capacity to manufacture PCBs from scratch”.

Industry experts believe the move could persuade domestic handset manufacturers to shift from assembling smartphones in country with imported parts to fulltime manufacturing.

But Aggarwal warned that India may lose the manufacturing war to countries such as Vietnam and Indonesia in the process.

Read: Budget 2017: Jaitley boosts electronic manufacturing by boosting MSIPS, EDF

In last year’s budget the government levied a 2% special duty on populated printed circuit boards used in mobile phones, laptops and personal computers.

The proposal triggered outrage in the industry, which said the ecosystem for local manufacturing of these components was not ready in India. Consequently, the duty was rolled back in May 2016.

Some analysts feel latest decision could prove counter-intuitive to finance minister Arun Jaitley’s announcement of increasing allocation of modified special incentive package scheme (MSIPS) and electronic development fund (EDF) to Rs 745 crore.

Aimed at promoting electronic manufacturing, MSIPS provides capital subsidy of 20% in special economic zones (SEZs) and 25% in non-SEZs, in the form of reimbursement of excise for capital equipment. For high-capital investment projects, it provides for reimbursement of central taxes and duties.

EDF was created to develop the electronics system design and manufacturing (ESDM) sector to achieve “net zero imports” by 2020.

Read: Budget 2017: Nearly 1,50,000 gram panchayats to get high-speed Internet by the end of FY18

It is more like a “fund of funds” to participate in professionally managed “daughter funds”, which in turn will provide risk capital to companies developing new technologies in the area of electronics, nano-electronics and information technology (IT). The EDF helps attract venture funds, angel funds and seed funds towards R&D and innovation in specified areas.

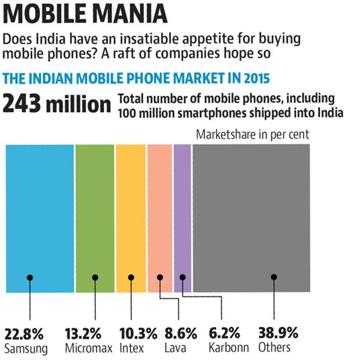

Parv Sharma, research associate at Counterpoint Research, said India might be the fastest growing smartphone market in the world, but the government’s latest move might not be effective since the country doesn’t have “fabrication units” to produce components.

The industry was expecting the government to pass the phased manufacturing plan, which included expansion of differential duty structure to include five more components, to make the transition easier for handset makers.

“But imposing a SAD on PCB which can’t be made here is definitely counter-intuitive. This means that the announcement of extra allocation under MSIPS and EDF may not help after all,” a top industry leader said.

Read: Budget 2017: Jaitley says BHIM app now has 125 lakh downloads

The government has applied a differential duty structure to attract foreign handset and component makers to start actual manufacturing in India. Under the structure, if a manufacturer assembles phones locally, then it just pays a 1% duty, instead of the 12.5% on a phone that is imported.

There is also a duty differential on battery, adapter and headsets. If a handset maker purchases all these from domestic companies, it pays only 2%, instead of 12.5% when imported.