As govt’s cashless payment tool battles faults, e-wallets gain

Digital wallet companies, including Paytm, MobiKwik, Freecharge and Itzcash, have seen multifold growth in their transaction volumes as they cashed in on the acute shortage of physical currency, following the government’s demonetisation drive.

Digital wallet companies, including Paytm, MobiKwik, Freecharge and Itzcash, have seen multifold growth in their transaction volumes as they cashed in on the acute shortage of physical currency, following the government’s demonetisation drive.

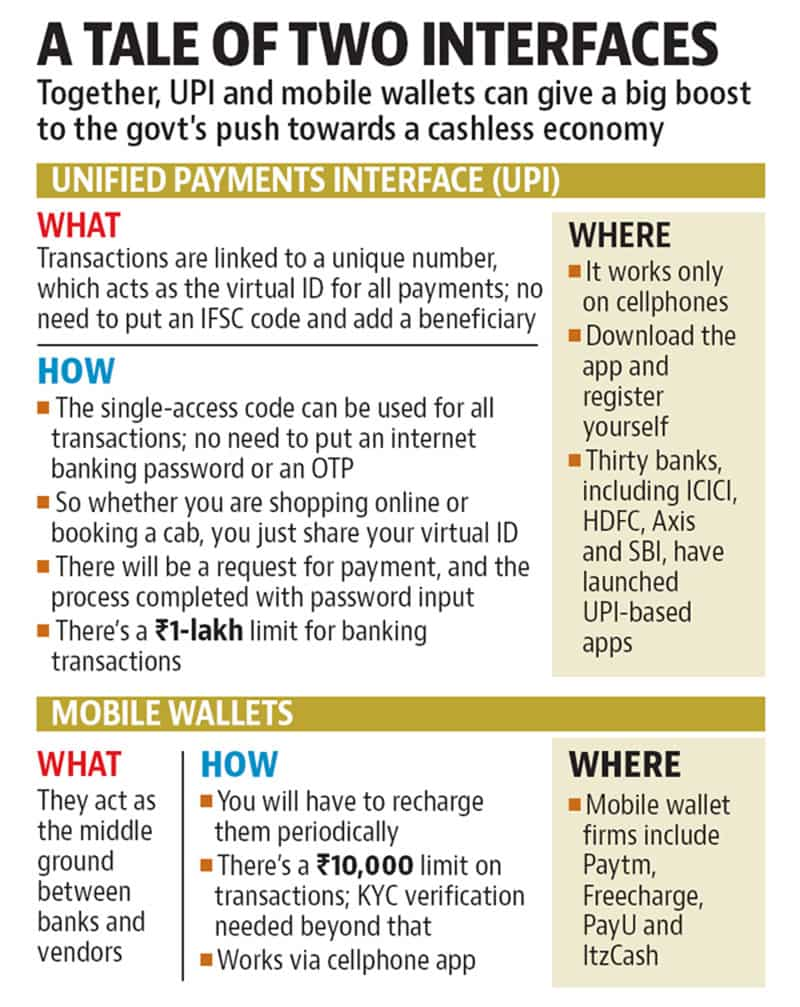

But part of this rise was also due to the bungling seen at Unified Payments Interface, or UPI, the government’s answer to the private sector’s fast-growing mobile payment apps. With high charges and lower integration with merchants, UPI has been a non-starter even three months after its launch.

Touted as former RBI governor Raghuram Rajan’s brainchild, the UPI, piloted in April and launched in August, was meant to address India’s small payment problems by making payments as simple as sending an SMS.

The National Payments Corporation of India (NPCI), an umbrella organisation of all retail payments, designed the interface as a 24x7 payment app, where the user can link multiple bank accounts with a single virtual ID and transfer money to other banks and third-party merchants.

But implementation did not match planning.

“Most digital wallet firms have waived off merchant fees to come on board. However UPI still charges around 1.5%. The side also needs more integration with larger number of merchants,” said a senior State Bank of India official who was involved in its setting up.

Nimbler private companies, meanwhile, cashed in on demonetisation.

While banks saw a 300% to 400% rise in debit card transactions, e-wallet market leader Paytm hit a record 5 million transactions and added 40,000 merchants daily after November 8. Rival MobiKwik’s transaction volumes rose 7,500%, and a lighter version of the app saw 20 lakh downloads in just two days of its launch.

The integration of banks with UPI is also another hurdle. SBI, HDFC Bank and Axis Bank are now planning to integrate their mobile applications and get UPI under it, rather than having a separate application just for UPI.

“UPI is more inter-operable than mobile wallets. I think there are less functions under the UPI and also less fanfare. Merchants are slowly coming on board. We plan to integrate our mail mobile app with UPI next month,” said Rajiv Anand, executive director at Axis Bank.

“SBI and HDFC Bank came on board only about a week ago, while six largely south-based public sector banks are yet to come. Banks are still preparing to educate themselves on UPI, and hence more training and education is required,” said Ap Hota, managing director and CEO, NPCI.

At present, NPCI has 30 banks. Indian Bank, Indian Overseas Bank, Syndicate Bank, Corporation Bank, Dena Bank and Punjab and Sind Bank are the only PSBs yet to integrate with UPI.

Hota said they have not yet finalised on taking up the finance ministry’s suggestion to upgrade UPI by developing a single platform for all banks, compared to the existing system of individual platforms.