Articles by Mahua Venkatesh

Despite directive, service charge still levied at many restaurants across India

Sources said that the Centre merely passed a guideline which has no legal validity.

Updated on Mar 19, 2017 02:00 PM IST

Hindustan Times, New Delhi | Mahua Venkatesh

Govt eyes over Rs 8,000 cr bonanza from black money tax in 2016-17

CBDT chief Sushil Chandra says the government has mopped up 21% higher tax returns

Updated on Apr 26, 2017 11:37 AM IST

Hindustan Times, New Delhi | Mahua Venkatesh and Raj Kumar Ray

GST: The long journey to roll out India’s biggest tax reform

The GST council approved the State GST and Union territories (UT-GST) Bills. The supporting GST laws will now be taken to the Cabinet and then to Parliament for approval.

Updated on Apr 20, 2017 11:31 AM IST

Hindustan Times, New Delhi | Mahua Venkatesh and Raj Kumar Ray

GST may roll out from July as Centre, states approve draft bills

The GST council approved two remaining pieces of supporting legislation that will enable states and Union territories to introduce the GST, billed as India’s biggest tax reforms.

Updated on Apr 26, 2017 11:38 AM IST

Hindustan Times, New Delhi | Raj Kumar Ray and Mahua Venkatesh

Govt may pump Rs 8000 crore into public sector banks

The government is looking to inject an additional Rs 8,000 crore into the cash-starved public sector banks likely by the end of this financial year.

Updated on Mar 11, 2017 12:23 AM IST

Hindustan Times, New Delhi | Mahua Venkatesh

Air India profit claim wrong, lost over Rs 6,000 crore in 3 years: CAG report

According to a CAG report , national carrier Air India understated understated losses to the tune of Rs 6,415 crore in three years from 2012.

Updated on Mar 11, 2017 07:37 AM IST

Hindustan Times, New Delhi | Mahua Venkatesh

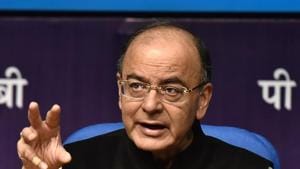

Jaitley, RBI officials draw up plans to deal with top defaulters

One of the alternatives that the government and RBI was considering for some time now was to set up of a “bad bank” to deal with the problem of non-performing loans.

Updated on Mar 10, 2017 08:34 PM IST

New Delhi | Mahua Venkatesh

Petrol pumps under I-T scanner for depositing more cash than sale

A senior official said the licences of the pump owners and cooking gas distributors could be cancelled if probes show discrepancies and illegal transactions of demonetised currency.

Updated on Mar 09, 2017 07:35 AM IST

New Delhi, Hindustan Times | Mahua Venkatesh

Demonetisation fallout: 2,400 bank branches report suspicious transactions in Nov-Dec

As many as 2,400 public sector bank branches, mostly in Uttar Pradesh, Madhya Pradesh, Rajasthan and West Bengal, reported suspicious high-value transactions after the demonetisation of Rs 1000 and 500 notes

Updated on Mar 16, 2017 07:18 AM IST

Hindustan Times, New Delhi | Mahua Venkatesh

Demonetisation will have positive impact on Indian economy, says World Bank CEO

Prime Minister Narendra Modi’s decision to ban high-value banknotes as part of efforts to stamp out corruption will have a profound and positive impact on India’s economy, World Bank CEO Kristalina Georgieva has said.

Updated on Mar 02, 2017 10:38 PM IST

Hindustan Times, New Delhi | Mahua Venkatesh and Raj Kumar Ray

Banks may hike ATM withdrawal charges; more step to curb cash in coming months

Banks may slash the number of free ATM withdrawals or hike the charges levied in the coming months in a move to discourage people from using cash. Currently, a customer has to pay Rs 20 per ATM withdrawal after five free transactions a month.

Updated on Mar 02, 2017 02:50 PM IST

Hindustan Times, New Delhi | Mahua Venkatesh

Gujarat, Bengal fraud-prone red zones for rampant insurance con jobs

Insurers have ticked several pockets in Gujarat, West Bengal, Bihar, Andhra Pradesh, Uttar Pradesh, and Odisha as fraud-prone with instances of misuse of insurance cover and fraudulent claims increasing exponentially in these areas.

Updated on Mar 02, 2017 07:22 AM IST

Hindustan Times, New Delhi | Mahua Venkatesh, New Delhi

HDFC, ICICI, Axis to charge you at least Rs 150 after 4 free transactions

Banks including HDFC Bank, ICICI Bank and Axis Bank on Wednesday began charging a minimum amount of Rs 150 per transaction for cash deposits and withdrawals beyond four free transactions in a month.

Updated on Mar 02, 2017 05:28 PM IST

New Delhi, Hindustan Times | Suchetana Ray and Mahua Venkatesh

Most ATMs in India use outdated tech, prone to fraud

Three of five ATMs in India use outdated technology and lack basic security features, making them prime targets for fake currency, banking experts say.

Updated on Feb 28, 2017 08:25 AM IST

To address cyber fraud, new bank manual to be in place by April 1

As the government pushes for an expanded digital economy, a new manual aiming to address frauds in cyber and online banking is set to be in place by April 1. The thrust will be on continuous tracking of sources of funds transferred online to rule out money laundering.

Updated on Feb 26, 2017 12:39 AM IST

Hindustan Times, New Delhi | Mahua Venkatesh

Small towners to pay less for health insurance than metro dwellers

The move is expected to increase health insurance cover in smaller towns, where people often avoid buying such products because they find the price too steep. Currently only 17% of India’s population has some form of health insurance.

Updated on Feb 23, 2017 09:06 AM IST

Hindustan Times, New Delhi | Mahua Venkatesh

Fake ‘Children’s Bank of India’ Rs 2000 notes came from SBI Okhla currency chest: Sources

The union finance ministry has swung into action and has sought a report from the State Bank of India after one of its ATMs at South Delhi’s Sangam Vihar dispensed fake Rs 2000 notes earlier this month.

Updated on Feb 22, 2017 08:11 PM IST

Hindustan Times, New Delhi | Mahua Venkatesh

Graft cases in private banks to come under central vigilance commission lens

The CVC is the statutory body that investigates cases of graft under the Prevention of Corruption Act, 1988, but is authorised to probe cases involving central government departments, public sector companies and their workforce.

Updated on Feb 22, 2017 10:20 AM IST

New Delhi, Hindustan Times | Mahua Venkatesh

Tax evasion, undisclosed income to see a decline post demonetisation

Demonetisation appears to have provided the impetus for the expansion of the formal economy and has laid the groundwork for a corruption-free India by giving authorities an insight into the income of taxpayers and the source of their earnings.

Updated on Feb 16, 2017 10:05 AM IST

Hindustan Times, New Delhi | Mahua Venkatesh

Currency crunch remains 100 days post demonetisation with 30% ATMs running dry

ATMs across the country continued to battle cash crunch even 100 days after the demonetisation announcement with nearly 30% of the 2.2 lakh machines across India still running dry.

Updated on Feb 16, 2017 10:05 AM IST

Hindustan Times, New Delhi | Mahua Venkatesh

Jewellery demand picks up after note ban hiccup as e-transactions gain pace

After an initial surge in jewellery sale just after the government’s note ban announcement, the demand for gold and gems dropped by more than 60% in November and December 2016 in comparison to what it was during the same period in 2015.

Published on Feb 13, 2017 12:57 AM IST

Hindustan Times, New Delhi | Mahua Venkatesh

Nitish takes a U-turn on note ban, calls for greater opposition unity

The Janata Dal (United) president was the first non-BJP chief minister to support Prime Minister Narendra Modi’s shock announcement to recall 500- and 1,000-rupee notes last November. His stand fuelled speculation that he was warming up to the BJP, which was his ally in Bihar for about nine years since 2005.

Updated on Feb 11, 2017 01:42 AM IST

Hindustan Times, New Delhi | Srinand Jha and Mahua Venkatesh

Post-demonetisation, shell companies laundered at least Rs 3,900 crore

The government recalled 500 and 1000-rupee notes on November 8 in a move it said was aimed at sucking out illicit cash from the system. Since then, various financial crime investigating agencies are tracking movement of high volumes of cash.

Updated on Feb 10, 2017 11:16 PM IST

Hindustan Times, New Delhi | Mahua Venkatesh

Can’t act suo motu against US protectionism, says WTO

Amid apprehensions over US President Donald Trump’s new economic policies which many fear could lead to protectionism, the World Trade Organisation (WTO) said it cannot act on its own, but in case of a violation, a member could raise the issue.

Updated on Feb 10, 2017 05:52 PM IST

Hindustan Times, New Delhi | Mahua Venkatesh & Sanjeev Ahuja

‘Not consistent with Indian reality’: Govt, Oppn differ on state funding of polls

Finance minister Arun Jaitley on Thursday ruled out the possibility of state funding of polls, a suggestion floated by various political parties.

Updated on Mar 05, 2017 11:04 PM IST

Hindustan Times, New Delhi | Smriti Kak Ramachandran and Mahua Venkatesh

Non performing assets are legacy of UPA: Jaitley tells LS during budget session

Finance minister Arun Jaitley said the Reserve Bank of India (RBI) has not come out with an estimate of scrapped notes that came back into the system after November 8 as the process of computing those notes was still on. He further charged the previous UPA government with handing down the problem with non-performing assets.

Published on Feb 10, 2017 12:18 AM IST

HIndustan Times, New Delhi | Mahua Venkatesh

Jaitley defends demonetisation move, says excessive cash boosts parallel economy

Finance minister Arun Jaitley said demonetisation was just a part of the several initiatives taken by government to weed out black money.

Updated on Feb 09, 2017 06:14 PM IST

Hindustan Times, New Delhi | Mahua Venkatesh

Over 2-crore Jan Dhan accounts opened since Nov 8 demonetisation move

More than 2 crore zero balance savings bank accounts have been opened under the Pradhan Mantri Jan Dhan Yojana since the government announced its demonetisation move on November 8.

Updated on Feb 09, 2017 06:14 PM IST

Hindustan Times, New Delhi | Mahua Venkatesh

Demonetisation pain returns: One-fourth of ATMs across India running dry again

Even after three months of demonetization, the cash crunch continues. Many ATMs across the country are once again running dry after the Reserve Bank of India (RBI) increased the cash withdrawal limit for a single transaction to Rs 24,000

Updated on Feb 08, 2017 08:32 AM IST

Hindusatn Times, New Delhi | Mahua Venkatesh

More 100 and 500 rupee notes to be circulated as small change remains an issue

More 100- and 500-rupee banknotes are set to be pumped into the economy after the government shelved plans to reintroduce Rs 1,000 bills, which were scrapped during last November’s demonetisation drive.

Updated on Feb 06, 2017 08:50 AM IST

Hindustan Times, New Delhi | Mahua Venkatesh