Articles by Beena Parmar

Rel Cap, SREI Infra, LIC Housing Finance likely to set up banks

Non-banking financial companies (NBFCs), including Reliance Capital, SREI Infrastructure Finance and LIC Housing Finance, are looking to explore their chances of starting a new bank after the Reserve Bank of India (RBI) came out with the draft rules for offering on-tap bank licences last week.

Updated on May 10, 2016 01:38 AM IST

Hindustan Times | Beena Parmar, Mumbai

Retail push prompts ICICI Bank, Axis, HDFC Bank to hire more

Even as bad loans continue to rise, a strong retail push has made India’s top three private banks hire more in 2015-16, compared to the previous fiscal, with HDFC Bank taking on its rolls almost two-third more people than ICICI Bank and Axis Bank. The hiring is largely at the branch level in frontline roles, including sales and relationship managers.

Updated on May 07, 2016 01:58 PM IST

Hindustan Times | Beena Parmar, Mumbai

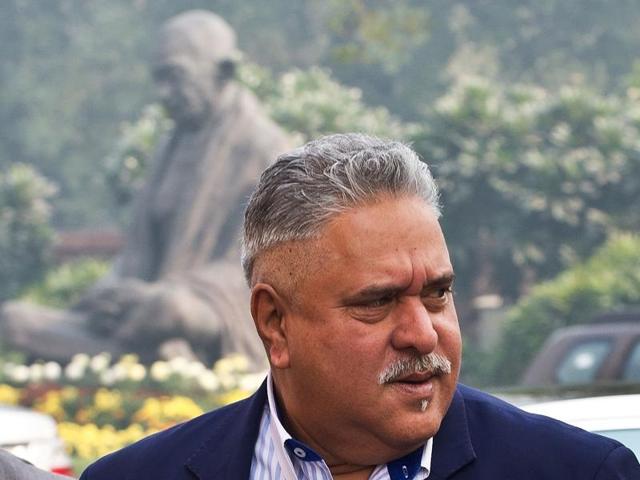

Banks may tweak auction prices of Mallya’s assets

With banks holding debt and interest of Rs 9,000 crore, and Mallya still in the UK, lenders are unwilling to relax their stand: they want to be paid, and will fight tooth and nail

Updated on May 03, 2016 02:33 AM IST

Hindustan Times | Beena Parmar, Mumbai

ICICI top officials forgo annual bonus after dismal Q4 performance

The move was proposed by the executive management to the bank’s board after the private lender witnessed its worst quarterly performance in a decade, with its net profit falling by 76% to Rs 702 crore due to a surge in bad loans.

Updated on May 01, 2016 01:32 PM IST

Hindustan Times | Beena Parmar, Mumbai

Rs 1lakh cr of debt, but no buyers in sight for stressed firms

Almost a year since the strategic debt restructuring (SDR) mechanism was formed to lessen stressed assets, banks are facing problems in getting buyers or reasonable valuation for the assets.

Updated on Apr 28, 2016 02:12 PM IST

Hindustan Times | Beena Parmar, Mumbai

Asked to provision for losses on Punjab foodgrain loans, India’s bankers say it should be a one-off

The central bank has asked lenders to set aside 7.5% of the outstanding amounts from their earnings in the March quarter, and another 7.5% in the June quarter, which could lead to total provisioning of up to Rs 3,000 crore to the account

Published on Apr 27, 2016 07:31 PM IST

Beena Parmar, Mumbai

Banks sound alarm on credit card spending

The surge of growth in retail loans, especially credit card loans, may lead to consumer debt levels similar to the pre-2008 crisis, according to State Bank of India (SBI), the country’s largest lender.

Updated on Apr 25, 2016 04:24 PM IST

Hindustan Times | Beena Parmar, Mumbai

Govt vs RBI governor: Raghuram Rajan could be right after all

Taking offence to criticisms comes easy for government officials, especially when the criticisms come from a head of institution, which has had love-hate relationship with the government. However, this time the officials may have to swallow back their offence after the “words” chosen by RBI governor Raghuram Rajan.

Updated on Apr 22, 2016 09:30 AM IST

Beena Parmar, Mumbai

There should be no ambiguity in passing on rate cuts: SBI’s Sriram

State Bank of India, India’s largest lender, will see improved cash recoveries from bad loans this quarter. In an interview to HT, SBI managing director B Sriram said the bank will pass on lower interest costs faster due to better implementation of the MCLR methodology. The government-owned bank will also hire about 10,000-15,000 each year.

Updated on Apr 21, 2016 01:27 AM IST

Hindustan TImes | Beena Parmar

Strike effect? IDBI suspends, transfers 75 officers

IDBI Bank has transferred and suspended nearly 75 employees after the large strike that was called in March to protest the privatization of the state-owned bank.

Updated on Apr 15, 2016 12:10 PM IST

Hindustan Times | Beena Parmar, Mumbai

Yes Bank borrows $50 mn for women loan-seekers

Yes Bank will borrow $50 million via long-term bonds issued to International Finance Corporation (IFC) for ‘gender financing’ that will support women borrowers

Published on Apr 04, 2016 07:23 PM IST

Hindustan Times | Beena Parmar, Mumbai

RBI policy review: Raghuram Rajan expected to cut interest rates

Reserve Bank of India (RBI) governor Raghuram Rajan is expected to lower key interest rates by at least 0.25 percentage points in the central bank’s first bi-monthly monetary policy review for 2016-17.

Updated on Apr 04, 2016 12:08 AM IST

Hindustan Times | Beena Parmar, Mumbai

Bankers unhappy with Mallya’s ‘sweetener’ deal of Rs 4,000 cr

Lenders can also attach Mallya’s personal assets since he has given a personal guarantee on the loans. However, since a large number of assets are abroad, it would be difficult to attach them, bankers said.

Updated on Apr 01, 2016 08:33 AM IST

Hindustan Times | Beena Parmar, Mumbai

Banks announce cuts in lending rates, EMIs may fall

State Bank of India (SBI), HDFC Bank, Punjab National Bank, Bank of Baroda and Canara Bank announced cuts in lending rates on Thursday.

Updated on Apr 01, 2016 12:06 AM IST

Hindustan Times | Beena Parmar, Mumbai

The banker who swears only by ties, not neckties

This might make Thomas Jefferson chuckle in his grave with joy and disbelief. The third President of the United States liked to say that banks were more dangerous than standing armies, and that they swindled futurity. For the founder of India’s newest bank, however, the inspiration is poor women.

Updated on Mar 28, 2016 03:28 PM IST

Hindustan Times | Beena Parmar, Mumbai

Weddings are my biggest business and I love it: Manish Malhotra

Manish Malhotra is one of the leading fashion designers of India. He has designed and styled many successful actors. On the sidelines of the Mint Luxury Conference, Manish sat down for a chat with HT.

Updated on Mar 26, 2016 09:09 AM IST

Hindustan Times | Beena Parmar

Luxury sector depends on India’s ability to grow at 9-10%: Niti Aayog CEO

Department of Industrial Policy and Promotion secretary Amitabh Kant believes that the luxury sector has the potential to grow nine-fold to $180 billion (`12 lakh crore) by 2025. Kant how India’s reform measures can make that happen. Excerpts from an interview:

Published on Mar 26, 2016 08:55 AM IST

Hindustan Times | Beena Parmar, Mumbai

Donna Karan looks at domestic designers to dress up India

Global fashion designer Donna Karan is exploring opportunities to expand in the jewellery segment in India, and work with local fashion designers and artisans to expand her brand ‘Urban Zen

Updated on Mar 26, 2016 08:07 AM IST

Hindustan Times | Beena Parmar

SBI may revalue Mallya’s Kingfisher House in Mumbai to attract bidders

The actual value of Kingfisher House, the former headquarters of the defunct Kingfisher Airlines, was pegged at a little more than Rs 50 crore — about a third of the reserve price that SBI Caps had fixed at Thursday’s auction.

Updated on Mar 19, 2016 12:20 AM IST

Hindustan Times | Nachiket Kelkar and Beena Parmar, New Delhi

Bad loans at private lenders grow faster than PSU banks

It’s not only public sector banks (PSBs) that are fighting the bad-loan monster.

Updated on Mar 17, 2016 11:35 PM IST

Hindustan Times | Beena Parmar, Mumbai

Did lenders flout rules while pledging the KFA brand for loans?

The move to pledge the Kingfisher Airlines brand with IDBI Bank to raise around Rs 900 crore has raised questions since this is not a common method for lenders to extend loans, as intangible assets do not offer a clear estimate of future cash flows.

Updated on Mar 08, 2016 11:19 PM IST

Hindustan Times | Beena Parmar and Ramsurya Mamidenna, Mumbai

SBI wants Vijay Mallya arrested, passport impounded

The banks are apparently trying to force the former Kingfisher Airlines chairman to the negotiating table. But will the move yield the desired results?

Updated on Mar 04, 2016 08:50 AM IST

Hindustan Times | Beena Parmar, Mumbai

After Jaitley’s fiscal discipline plan, eyes on RBI interest rate cut

Repo is the rate at which banks borrow from the RBI. A cut in repo rate can lead to banks reducing their lending rates benefitting the borrowers. In his budget speech on Monday, Jaitley had said that the government will adhere to its fiscal deficit target of 3.5% for 2016-17.

Updated on Mar 02, 2016 01:50 AM IST

Hindustan Times | Beena Parmar, Mumbai

Now, engineers find a new recruiter in private sector banks

Engineers are in great demand in banks if the current trend in recruitment in large private lenders is anything to go by.

Updated on Feb 19, 2016 01:44 AM IST

Hindustan Times | Beena Parmar, Mumbai

PNB declares Vijay Mallya’s UB Holdings willful defaulter

Company is estimated to have given a corporate guarantee that amounted to Rs 800 crore-Rs 1000 crore.

Published on Feb 16, 2016 02:11 PM IST

Hindustan Times | Beena Parmar, Mumbai

Power to see Rs 68 lakh-crore investment flow in 15 years

The government will soon announce a new policy on coal swapping and is targeting a total investment of $1 trillion (Rs 68.07 lakh crore) in the power sector by 2030, including in coal renewables.

Updated on Feb 16, 2016 01:43 AM IST

Hindustan Times | Beena Parmar, Mumbai

Reforms on the way to help bleeding banks, says Jaitley

The government could likely bring in big-ticket reforms in banking soon, and may announce specific measures to address the problems faced by the industry, which has been reeling under bad loans.

Updated on Feb 17, 2016 08:01 AM IST

Nachiket Kelkar and Beena Parmar, Mumbai

RBI may hold key rates to check price pressures

Reserve Bank of India (RBI) governor Raghuram Rajan is likely to maintain a status quo on key interest or repo rate at the monetary policy review on Tuesday.

Updated on Feb 01, 2016 11:26 PM IST

Hindustan Times | Beena Parmar, Mumbai

HDFC Bank to offer personal loans, credit cards at ATMs

If you are an HDFC Bank account holder in need of a loan or a credit card, all you need to do is walk over to your nearest HDFC Bank ATM.

Updated on Feb 01, 2016 01:15 AM IST

Hindustan Times | Beena Parmar, Mumbai

Axis Bank stock tumbles 7% in 2016 as bad loans pinch

While a fall in banking stocks has been widely expected due to rising bad loans, the quantum of fall in Axis Bank was unprecedented as it has been seen as a private bank with improved management and healthy NPA levels.

Published on Jan 27, 2016 11:49 PM IST

Hindustan Times | Beena Parmar, Mumbai